Homeowners And Auto Insurance Quotes – The first thing you want to do when looking to insure your home is to find the best premium rates. Best of all, Before choosing the insurance company you prefer, they will ask for several quotes. We will also prepare you with the information you need to get a quote for home insurance. Why do insurance companies ask all these questions? First, every home is different, and homeowner’s insurance needs vary from property to property. When an insurance broker or agent gives you a form with questions to fill out. They are looking for details that can help you decide on a reasonable premium for the amount of insurance you need. Your answers will help potential insurance companies assess your risks and liabilities and give you a fair quote.

Specific questions about homeowners vary from company to company. Typically, Insurance companies will use your name, date of birth They’ll want to collect basic information about you, including your social security number and previous address. If applicable, you must provide the date of birth of your spouse or partner. Includes some information required for insurance.

Homeowners And Auto Insurance Quotes

Features such as a swimming pool or trampoline involve additional responsibilities on your part, such as drowning accidents. This exposure increases your premium and your insurance company must include it in their homeowner’s insurance quote.

How To Save On Homeowners Insurance

Home control system; Security devices and fire or smoke detectors can make your home safer and lower your premiums.

You can be sued for dog bites, so your insurance company should be aware of this risk. – What is your injury history? If you have not previously filed a homeowner’s claim. The insurance company will view you as a low-risk customer and adjust your interest rate accordingly.

Changes or upgrades to your home that are damaged in a covered event, such as a fire or natural disaster, will affect the cost of replacement or repair. for example, Replacing a modern slate roof will cost more than replacing traditional shingles. Your insurance company must be aware of any developments that occur after taking out your policy.

Don’t just give answers. It is your right to know what your homeowner’s policy will cover and what is excluded. Remember to ask the insurance agent or broker plenty of questions to fully understand your policy.

Insurance Quotes For Home, Auto, & Life

In addition, Review your homeowner’s policy documents carefully. If you understand exactly what protection your insurance provides. You can save money or even prevent serious problems in the future. The above is some of the information required for home insurance premiums.

You still need to speak to a representative in person or over the phone to get more answers or more information about your coverage needs. To learn more about obtaining homeowner’s insurance, Contact the experts at CF&P Insurance Brokers today at (925) 956-7700.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean elementum consectetur est at consectetur. I dolor nisi, mollis quis interdum vel, convallis ut nisi. Curabitur porttitor ipsum and facilisis vestibulum; turpis urna lobortis justo, og ultrices massa ligula ac lorem. Maecenas quis nibh sed mauris imperdiet pharetra sodales vitae lacus. Integer dapibus ligula velit, out placed velit sagittis sat amet. Fusce vulputate euismod nibh nec dictum. Nam id ullamcorper lorem. Insurance is an important part of modern life. By paying for insurance; You are taking steps to manage your risk. For example, driving a car increases the risk of accidents. Similarly, Owning a home can result in damage to your residence or even a lawsuit by someone injured on your property. When you pay for insurance, you give the company a small lump sum of money to help cover significant expenses. The insurance company pays even if you don’t make a claim, and you know they’ll (usually) cover more of your costs if you need it.

There are many different types of insurance, so it’s important to shop around. Getting insurance quotes from multiple companies is a great way to save money. Some types of insurance are required by law, such as motorist insurance, and some types of insurance are optional, such as life insurance. At the same time, Landlords or loan companies may require renter’s insurance and homeowner’s insurance, although not required by law.

Sample Home Insurance Quotes. Quotesgram

The insurance offer is based on the policy you are looking for and the information you provide. That’s your reference.

A change in your information, such as a discovery or low credit score. However, An insurance quote is an estimate of the premium or monthly rate you will pay for your policy.

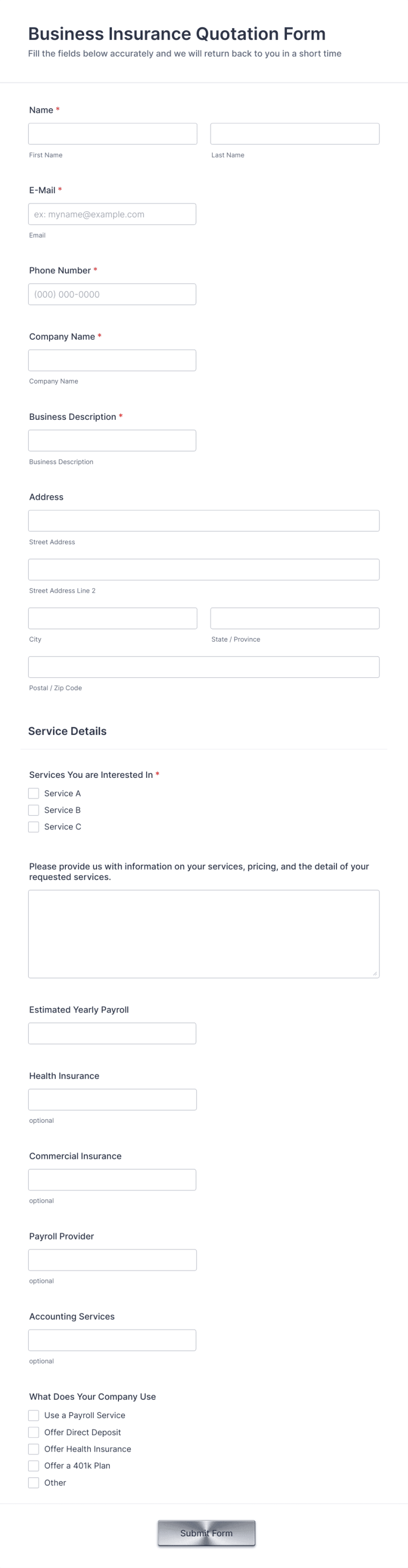

An insurance quote form is a form that insurance companies use to gather the information they reasonably need about your quote.

. Different companies use slightly different forms, but each company should provide potential customers with information about their rates and coverage. Organization on offer

Insurance Quote Form Template

Template, A business can quickly reuse the form to offer individualized insurance quotes by entering specific information for that person or group without having to create each one from scratch. These templates save time and man-hours and help streamline the process of providing information to hundreds or thousands.

There are many types of insurance. Some types of insurance are industry-specific, such as small business insurance or specialized policies for specific situations, such as travel or rental car insurance. usually Insurance companies are responsible; personal property; It offers many options such as other people’s property. Below is a brief list of the types of insurance most people need.

Car insurance is compulsory in most places if you own and drive a car. Car insurance quotes cover six basic types of cars, including the following:

Tip: Each state has different requirements for drivers. Always check the lowest insurance rates in your area before looking for coverage.

Car Insurance Texas • Get A Quote Near You By Lemonade

Disability insurance covers your needs if you are permanently disabled. There are different types of coverage and they can be designed to cover an individual or an entire group of people, but they can save your life if you’re injured and can’t get back on your feet quickly.

Pro tip: You can’t use disability insurance to file a claim for a pre-existing condition, but having a disability doesn’t prevent you from getting disability insurance to cover future problems.

Homeowners insurance is optional, but we can tell you that it’s a smart idea because homeowners will eventually need to make repairs. Here are some types of coverage you may need:

Tip: There is also insurance for vacant property, such as where you build a home or hunting and camping land.

Homeowners Insurance Guide: A Beginner’s Overview

Health insurance is a complex system that only covers medical needs agreed upon by each company. You have a deductible for doctor visits and hospital visits. There is also a deductible that you must pay out of pocket before the insurance company covers the rest of the bill.

Pro tip: Employers often offer insurance, but that doesn’t mean it’s the best deal. Do your research to find out who offers you the best coverage and rates.

Long-term care refers to adults who need regular or daily assistance. By the time you turn 65, you have a 70% chance of needing long-term care. The longer you wait to purchase this type of insurance, The premiums will be higher because the company’s potential payout increases significantly year after year.

Tip: Get long-term care insurance between the ages of 50 and 60.

Auto And Homeowners Insurance

Life insurance covers your death, so your family and loved ones don’t have to pay out of pocket. There are only two types of life insurance. How they work is explained below.

Pro tip: Get life insurance in your 20s to get the best possible rates. At this age, You have very little risk to the company and will save you money by locking in a reasonable interest rate for the next 20-50 years.

It provides relief to renters that they can replace their belongings and have a place to live if the lease is damaged. Here are the most common types of rental insurance.

Pro tip: Get renters insurance if your landlord doesn’t require it or if you live in a low-risk area. Every building has weathering and maintenance issues. Knowing you’ll have a roof over your head and anything can significantly reduce stress and anxiety, you can replace your possessions.

Best Auto Insurance In Colorado Springs, Colorado Your Guide To Affordable Rates In 2024

All insurance policies have limitations. Your policy can only pay up to a predetermined limit. In addition, You will pay an additional amount out of pocket. For additional car damage, such as a few hundred dollars or very large; It could be as small as someone suing you for hundreds or millions of dollars over your liability.

American Family Insurance (https://www.amfam.com/resources/articles/understanding-insurance/what-is-umbrella-insurance) explains it well: “Umbrella coverage provides financial protection that exceeds the personal liability limits of others and you . … Consider umbrella insurance.

Homeowners and auto insurance bundle, auto and homeowners insurance ratings, homeowners and auto insurance, cheap auto and homeowners insurance, best auto and homeowners insurance, auto and homeowners insurance companies, auto homeowners insurance quotes, best homeowners and auto insurance companies, homeowners and auto insurance bundle quotes, combined auto and homeowners insurance quotes, auto and homeowners insurance quotes online, auto and homeowners insurance quotes