Travis County Property Tax Map – Now that all of the Travis County hearing results have been made public, O’Connor is examining the state’s most recent assessment.

Travis County property owners could save $502 million in property taxes by 2023, according to county estimates.

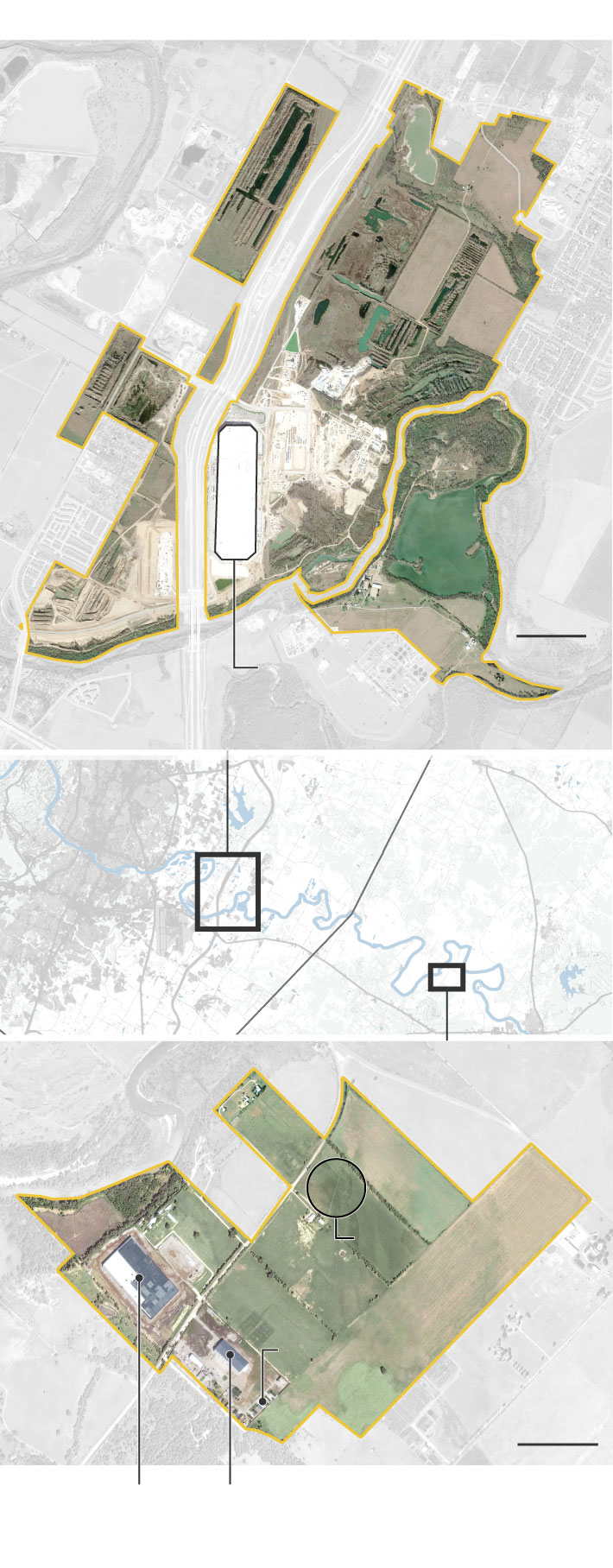

Travis County Property Tax Map

The fair market value of the company’s real estate is determined annually by the Travis Central Appraisal District. Property owners can dispute the data every year, whether the value has gone up or down. O’Connor compiled this information using preliminary and recent tax data provided by the Travis Central Appraisal District.

The Alarm Has Sounded: A Descriptive Study Of Performance Measures Of Fire Department Esds In Travis County

Before the latest tax rate is determined, O’Connor estimates that Travis County’s tax appeal will save $248 million in property taxes by 2023, based on an analysis of property tax trends data. . In 2021.

Homeowners will save $181 million in property taxes by 2023. That’s an increase of $119 million over the originally projected residential property tax savings based on data released in July 2023. According to updated data from the Travis Central Appraisal District, 76,382 homes underwent renovations and lost value. By 2023, it has declined due to tax conflicts. With a tax rate of 2.7%, the average property tax abatement is now $88,201. Each home will reduce property taxes by an average of $2,381. Household discount does not apply.

Homeowners avoided paying $69 million in property taxes this year. First, 42.1 billion US dollars. $39.5 billion in final objections to the 2023 tax. This resulted in a tax assessment of 2.7%, resulting in $2.5 billion in tax reductions and ultimate tax savings for Travis County homeowners. In September 2023, Travis condo owners saw a 6.1% decrease in their assessed value based on the results of the hearing. As a result, the 970 residential hearings will see an average property tax reduction of $72,010 in the 2023 tax year.

A total of 6,394 accounts were cleared in 2023 for accounts belonging to real estate and other commercial property categories. At the end of 2023, the current value is $2.76 billion, a $1.95 million decrease from the initial amount of $4.72 billion. For the current fiscal year, the landlord/other tax rate of 2.7% is expected to generate $52.8 million in tax savings. Including the adjusted tax rate, this comes to $8,271 per tax parcel. Land/Other Real Estate provides the highest rate of tax abatement (41.5%) for commercial real estate tax savings in Travis County.

Hundreds Of Lake Austin Homes Never Paid City Taxes, But That May Change

According to the latest results for 2023, the estimated value of hotels that complained fell from $4.8 billion to $4.3 billion. Based on a tax rate of 2.7%, this represents a tax savings of $12.6 million and a total assessed value reduction of $468 million. The study included 177 hotel properties that experienced a drop in value as a result of the cancellations, and by 2023, the hotel property accounts for $71,398 in property tax savings. September 2023 Hotel Property Tax Reduction Final Rate. 9.7%. .

In Travis County, office buildings ranked second in terms of property tax savings in September 2023. A total of 3,377 office buildings saved a total of 123 million US dollars. Lowering the original cost estimate from $30 billion to $25.5 billion resulted in a significant tax cut of $4.5 billion. At a tax rate of 2.7%, the final 2023 estate tax bill is $36,516 per account. In September 2023, due to the successful resolution of various issues, the office property value decreased by 15.2%.

The initial estimate was reduced from $157 billion to $138 billion, an average decline of 11.81%. The total property tax savings through September 2023, including residential and commercial properties, is $5,548. Travis County’s 2023 property tax order was successful, reducing property taxes for 90,550 property owners.

The following updates have been made to the apartments that are slated to receive the maximum tax credit in 2023.

Proposed Property Tax Rates Available Online For Travis County Property Owners

Bowen Apartments is located at 3000 Gracie Kiltz Lane in Austin, Texas. They plan to receive $902 million in tax credits in fiscal year 2023. Their initial $184 million property tax bill was reduced by $151 million, a huge difference of $33.4 million. As a result, this long, high-rise apartment building in Austin, built in 2001, saw a significant 18% reduction in property taxes.

Apartments at 4323 S Congress Ave., Austin, Texas $105 million in revised property tax rates in 2023; That assessment was later reduced by $31.5 million, bringing the current total of the 2023 property tax assessment to $73 million. Built in 2022, St Elmo apartments is a 387-unit building.

In 2023, Waterford Studio Apartments, located at 9100 Waterford Center Blvd in Austin, Texas, will receive a significant property tax abatement. Since the first estimate, the valuation has dropped by $28.5 million, or 77%. The property is currently valued at $8.4 million, down from its previous asking price of $37 million. This resulted in a property tax reduction of $771,346, calculated using a tax rate of 2.7%.

The examples above illustrate the potential estate tax savings that can be achieved through estate tax objections. The final property tax abatement for 2023 was calculated by comparing the initial value on the Travis Central Appraisal District report to the most recent tax assessment for the fiscal year. The Travis Center Appraisal District, which appraises all properties in Travis County, employs more than 129 people. These figures do not include disputed but non-depreciable assets, so the average depreciation increases.

Exclusive: Flannery Associates Llc Purchases More Land Near Travis Afb, Sensitive Communication Facility, Officials Say

The success rate for property tax appeals in Travis County is 65-90% each year. Property owners have a better chance of getting a tax cut if they review their estimates each year.

O’Connor is one of the largest real estate tax consulting firms in the United States, providing residential property tax abatement services in Texas, Illinois and Georgia, as well as commercial property tax abatement services throughout the United States. O’Connor’s professional team has resources and market knowledge in the areas of real estate taxes, cost segregation, and commercial and residential real estate appraisals. The company was founded in 1974 and has more than 600 professionals worldwide. O’Connor’s primary goal is to improve the lives of property owners through cost-effective tax reductions.

Property owners interested in helping with their assessment appeals can sign up for the O’Connor™ Property Tax Defense Program. Unless we lower your property taxes, there are no down payments or other fees, and our easy online registration only takes 2-3 minutes. After many requests, I have updated the Austin zip code property tax rate map! Oh! I’d like to thank the many customers and readers who have helped me figure out how valuable this map can be to you. Big thanks to my friend Steven for helping organize over 5,000 entries to create this amazing community Table Map.

As you can see, the new map is interactive and more accurate than before! Hover over a given zip code to see the average 2018 property tax rate for that zip code. You can easily highlight a zip code on the map by entering it in the search field! As a follow-up to the property tax map I created in 2015, you’ll notice the average property tax rate increases as you move away from downtown.

Geographic Information Systems (gis)

This information was collected from the Austin Board of Realtors’ Multiple Listing Service (MLS). Data covers the last 180 days of single family and condo sales in Austin as of March 10, 2019. Travis County issues new tax returns each year, so this information is considered out of date after December 30, 2019.

To read how property taxes are spent and assessed, go to https://traviscad.org/propertytaxsystem. For those who have never lived in Texas, remember there are no taxes here! Many of my clients who have moved to Austin have a lot of real estate tax issues. I don’t think their concerns are entirely unfounded, but Texas’ annual property taxes are close to what you’d pay in other states (like Arizona, for example). If you own real estate in Texas, you can file an annual tax return. Many people do this (either by themselves or by hiring a lawyer) and many people can reduce their taxes every year.

Previous Previous Where to live in Austin (or where to start looking) Next Get your garage number

Travis county property tax office, travis county property tax protest, travis county property tax bill, travis county property tax search, travis county property tax statement, pay travis county property tax, travis county property tax appraisal, travis county property map, travis county property tax assessor, travis county property tax records, property tax travis county, travis county property tax payment