Delta Credit Union Savings Interest Rates – When it comes to personal loans, credit unions have a unique mix for their members. This article is about the special features of Delta Community Credit Union personal loans. From competitive rates to different types of mortgages to wear and tear mortgages, we provide an unbiased view to help you understand and navigate the mortgage loan process.

® ratings are determined by our editorial team. Benchmarks include financial products including taxes, fees, incentives and other options.

Delta Credit Union Savings Interest Rates

The application process was painless and I heard within minutes. This simple and quick process proved to be a great help to me in a critical time of need.

Which Is The Best Delta Credit Card Offer?

The help I got was great. My agent handled my case carefully and provided all necessary information…

The loan application process was easy, the agent I dealt with was patient and provided knowledgeable answers, and the entire process was very pleasant…

The process was quick and straightforward, which helped me especially when I was reluctant to ask for help but really needed it.

The interest rates are surprising and seem to benefit people who are facing financial problems when unwanted debts appear…

How To Avoid (and Reduce) Credit Card Interest

I have never had a problem with this company. They consistently send money on time and the repayment process is easy…

Delta Community Credit Union provides personal loans to provide members with the financial support they need for a variety of purposes. These loans are designed to meet individual needs, whether it’s debt consolidation, debt financing, home improvement or self-employment. Personal loans from Delta Community Credit Union often have competitive interest rates, flexible repayment terms and an easy application process. Members can borrow money upfront and pay it back at a set time, making it a convenient option for achieving short-term financial goals without budget constraints. Focused on member satisfaction and financial health, Delta Community Credit Union aims to help its members achieve their aspirations by providing personal loan assistance.

A versatile option that can be used for many purposes such as debt consolidation, emergency or life event. These loans give you flexibility in how you use your money to achieve specific financial goals.

These are premium personal loans designed specifically for the holiday season and are available in November and December. A holiday loan can help you cover the extra costs associated with holidays, trips and festivals, allowing you to enjoy your holidays without worrying about your budget.

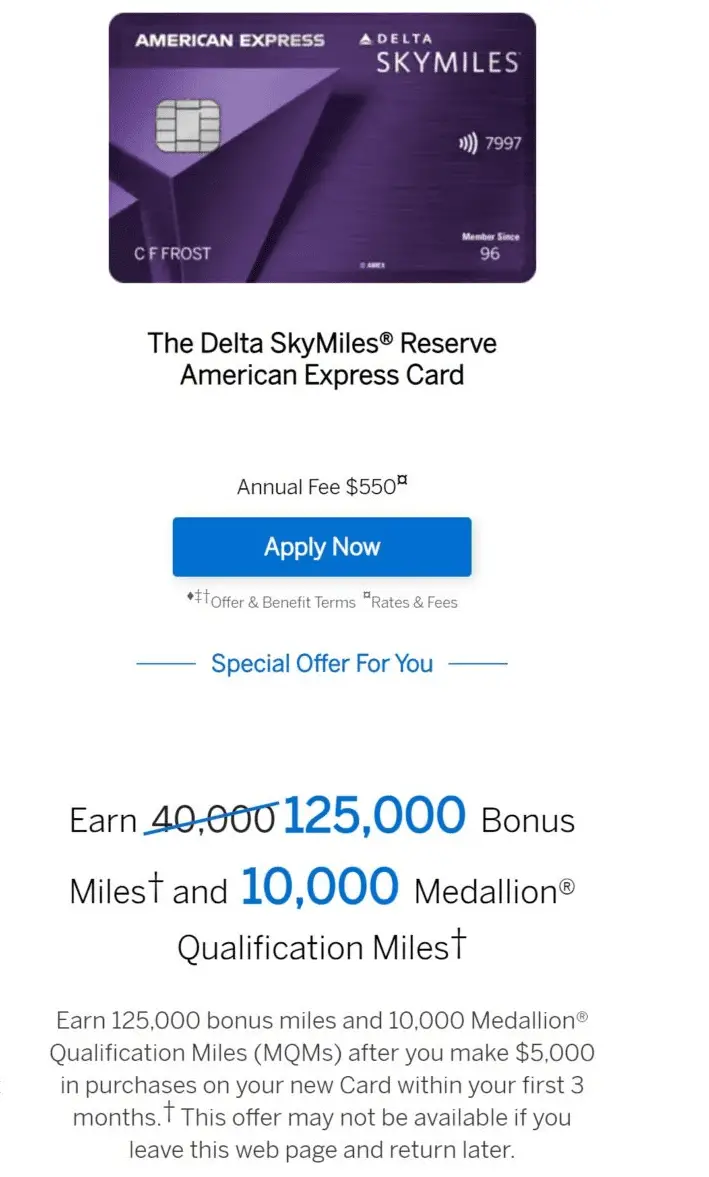

Targeted] American Express: Delta Reserve 125,000 Miles + 10k Mqm

For those dreaming of a well-deserved vacation, Delta Community Credit Union offers low-interest, fixed-rate vacation loans. These loans are designed to help you turn your dreams into reality by providing the necessary funds to make your retirement plans a reality. Whether you’re planning a vacation or an adventure, a vacation loan can help you finance your dream vacation.

Competitive interest rates. Delta Community Credit Union offers competitive interest rates on its personal loans, helping borrowers save on interest costs.

Online calculator. Credit unions offer online calculators on their websites that allow borrowers to easily estimate loan terms and monthly payments before applying.

Fast payment. Personal loans are deposited into your account the day after approval, giving you quick access to the money you need.

Understanding Credit Unions And Their Benefits

No annual fee. Personal loans from Delta Community Credit Union have no annual fees, which lowers the overall cost of the loan.

Multiple payment methods. Credit unions offer a variety of payment options, allowing borrowers to choose a repayment plan that fits their financial preferences.

Availability in the area is limited. Delta Community Credit Union personal loans are the most common in Georgia. Restrictions in this area may limit access to borrowing resources outside of this area.

Final Payments and NSF Fees. Borrowers will be charged fees for late payments and non-sufficient funds (NSF) transactions, which, if not properly managed, can increase the cost of the loan.

Best Bank Cd Rates For April 2024

Pay the transfer fee with a phone loan. The credit union charges a fee to transfer a loan over the phone from an account outside the Delta Community, which can increase the total cost of the loan.

Membership Restrictions. Delta Community Credit Union membership is limited to individuals living in certain Georgia counties, employees of certain companies and members of certain organizations. This membership restriction may limit certain borrowers’ access to its personal loan products.

Delta Community Credit Union is a limited membership credit union. To qualify for membership, you must meet the following requirements:

Peach State Federal Credit Union is a credit union located in Lawrenceville, Georgia that serves members in many Georgia counties. They offer a variety of financial products including personal loans, car loans, mortgages and savings accounts.

Delta To Open New Tier Of Premium Airport Lounges This Year

Atlanta Postal Credit Union is another Georgia-based credit union with many branches. They offer a variety of financial services including personal loans, home loans, credit cards and checking accounts.

Located in Norcross, Georgia, Associated Credit Union offers its members a variety of financial products, such as personal loans, auto loans and home loans, as well as a variety of banking services.

Headquartered in Macon, Georgia, Mid-South Community Federal Credit Union provides personal loans and other financial products to its members serving every county in Georgia.

In addition to considering a loan, individuals looking for alternatives to a Delta Community Credit Union personal loan can also check out these financial products:

Delta Skymiles Gold Business Card Review 2024

Personal loans from Delta Community Credit Union are a trusted, member-oriented service for individuals seeking financial assistance. These loans have competitive interest rates and flexible repayment terms to suit a variety of needs, from joint ventures to self-employment. Credit unions are well known for their commitment to transparency, providing borrowers with a clear understanding of interest rates, fees and repayment schedules. In addition, the convenience of different repayment methods, including automatic deductions and online payments, makes it easier for borrowers to manage their loans. However, since eligibility varies, borrowers should carefully consider their creditworthiness and credit before proceeding. Overall, Delta Community Credit Union personal loans demonstrate a commitment to the financial health of its members and provide a reliable way to meet short-term financial goals.

It is important to keep your debt-to-income ratio (DTI) below 30-40% of your monthly income. This will help you avoid financial problems in the future. Also, always evaluate the suitability and feasibility of the loan to make sure that you can easily manage the repayments.

We screened more than 100 lenders and rated them on 35 variables in six main categories: access to credit, customer relations, good service, interest rates and event transparency.

In each category, we have carefully considered the most important factors when choosing a loan provider. These factors include interest rates, loan amounts, minimum credit scores, minimum income, application fees and how quickly the money will be transferred.

Delta Skymiles® Reserve Business Card: For Business Owners Who Fly Delta And Want Lounge Access

Of course, we value our customers, so we continue to focus on customer quality, user reviews and other features that can help our customers

Our ultimate goal is to provide recommendations and expert advice to help you choose the lender that best suits your specific needs.

To qualify for a Delta Community Credit Union personal loan, applicants generally need a credit score of at least 680 to 850. Meeting these credit score requirements is important in determining whether you qualify for their personal loan products. Remember that credit scores will vary between financial institutions and lenders, so it’s best to check with your lender specifically for the most up-to-date information.

Sometimes it can be easier to get a loan from a credit union than from a traditional bank or lender. Many credit unions are known for their community outreach and may be interested in working with customers regardless of their financial situation. If you think that you do not meet the conditions for obtaining a loan from another financial institution, the credit union will give you a chance.

Virtual Annual Meeting

Credit unions often take a member-centric approach and will consider factors other than credit scores when evaluating loan applications. This will include considering your relationship with the credit union, your financial history with them and your personal situation. However, it should be noted that credit unions also have their own credit standards and policies, and qualifications may vary from credit union to credit union.

Delta Community Credit Union will report your Delta Community Credit Union account to the following credit reporting agencies:

This means that your credit information, including payment history and other related information, will be shared with credit reporting agencies, which will affect your loan fees and credit score. Delta Community Credit Union offers its members a variety of car savings options, including competitive CD rates, checking accounts and savings accounts. This guide compares Delta Community’s checking, savings, annuity and CD rates offered by other top banks in the United States.

The One Year Annual Guarantee (MYGA) is basically a CD issued by the insurance company and not the insurance company.

High Yield Savings Accounts Slash Interest Rates To ‘all Time Lows’

Credit union savings interest rates, union bank savings interest rates, credit union interest rates, delta community credit union savings interest rates, credit union savings account interest rates, credit union savings rates, credit union savings interest, alliant credit union savings interest rates, purdue federal credit union savings interest rates, credit union with best savings interest rates, delta credit union savings rates, teachers federal credit union savings account interest rates