Commercial Auto Insurance Las Vegas Nv – As a business owner, you may own one or more vehicles, such as taxis, limousines or buses. The right commercial auto insurance policy will protect you from accidents, injuries and other things that can affect your investment.

The Department of Transportation studied the impact of distraction on commercial motor vehicle (CMV) crashes and safety issues in 2009. They found the following:

Commercial Auto Insurance Las Vegas Nv

Commercial vehicle insurance is a general term that refers to most commercial vehicles, including but not limited to:

How Much Will Nevada Auto Insurance Rates Go Up?

Commercial vehicle policies include passenger cars used for business, as well as SUVs, light trucks, buses, limousines, taxis, taxis and other vehicles used only for business.

The use of this car is related to various risk factors, including how you use it, frequency and distance traveled each year, etc. Insurance companies consider these risk factors along with any efforts your company has made to improve driver safety when evaluating your company’s coverage amount.

If you are looking for coverage information for trucks and heavy equipment used for business purposes, check out the Commercial Vehicle Insurance section.

Commercial auto insurance is similar to personal auto insurance in terms of basic coverage, such as liability, comprehensive, collision and other types of coverage specifically for commercial vehicle use. Commercial auto policies are designed to protect your business from major losses that could impact your business’s financial well-being.

Leavitt Insurance Agency

Business insurance policies include many types of coverage: some are mandatory and some are optional. Typical policies include a combination of the following:

Bodily Injury Liability: This section of a commercial auto policy covers damages to others in an accident caused by you or your employees. Bodily injury coverage provides compensation for medical expenses, funeral expenses if necessary, and costs associated with a lawsuit. The amount of compensation your business receives depends on the limits placed on your personal injury liability and your deductible.

Liability for property damage: This coverage reimburses the cost of repairing property damage caused by you or your employees. The amount of coverage you receive depends on the limits you set and your deductible. It is best to work closely with an independent adjuster to assess your risk, and the potential cost of injury, property damage and legal fees. For better coverage, consider purchasing a business loan policy.

Collision: Like your personal insurance policy, a good business auto policy should include enough coverage to pay for vehicle damage in the event that you or your employees cause an accident.

Frazier Insurance & Financial Services

M: Comprehensive coverage, also known as “collision exclusion,” is essential coverage for damage to the vehicle or loss resulting from events other than a collision. These reasons can be nature, theft and vandalism.

Underinsured and Underinsured Drivers: If one of your drivers is involved in an accident caused by an underinsured driver, this coverage will help pay for damages and injuries to your vehicle and driver, up to to the limits specified in your policy. . .

Medical payments: This cover reimburses the medical and/or funeral expenses of you, your driver and passengers after an accident.

Additional Coverage Options: A variety of additional coverage options may be available depending on the insurance company you work with and the state where your business is located. For example, you can purchase coverage for your employees when they drive cars or trucks that don’t belong to your company.

Top 10 Best Commercial Insurance In San Francisco, Ca

You can also purchase coverage for a replacement car if your company car is in the shop. You can choose to receive towing and roadside assistance. Some insurance companies also offer specific coverage for loading and unloading companies, due to the increased risk of liability.

The right business insurance can protect you, your company and all the drivers of your company car, truck, van or limousine in the event of an accident. One of the most important ways to protect your business is to have adequate liability coverage if you or one of your employees causes an accident that injures others or damages their property.

Small businesses and entrepreneurs often use their own vehicles without thinking about it. However, it is important to know that your personal insurance may not cover the business use of your vehicle.

It is common for small business owners to send workers to other jobs, whether it is picking up groceries from a grocery store or giving business advice from the airport.

Nevada Llc: How To Start An Llc In Nevada In 12 Steps

If an employee is behind the wheel of their vehicle and the business owner does not have commercial auto insurance that covers the employee and their vehicle, any injuries or damages from the accident may not be covered.

No matter how much or how often you and your employees use personal vehicles while doing business, having adequate coverage can help prevent financial losses from putting your business at risk.

An independent carrier like First Choice Insurance Group can handle all of your business insurance coverage through one office. We sit down with you, get to know your company and find out how you and your employees use your business vehicle.

We ask a few questions so you can not only get the perfect quote, but also get the discount you can get.

Best Cheap Car Insurance In Las Vegas For 2024

If you’re looking for commercial auto insurance in Las Vegas, or if you already have coverage but aren’t sure if it’s comprehensive or affordable, we’ll give you an open coverage quote to see if you can afford it. do. the best

We use cookies to provide you with a better browsing experience, analyze site traffic and personalize content. The purpose of the cookie. OK Commercial insurance varies from state to state, with each state having different requirements for each buyer. Being a business owner in Nevada means knowing the different coverage options offered by the state before signing up for your preferred option. Below, Red Rock Insurance has several business coverage options that businesses can use.

Companies operating in the Las Vegas, NV area are required to have workers’ compensation insurance to protect their employees while they are on the job. This policy applies to part-time and full-time employees in the event of a work-related injury or illness, and helps to recover medical expenses incurred.

Commercial auto insurance is a state requirement for businesses and company-owned vehicles. With this coverage you are insured against property damage and bodily injury if your company vehicle is involved in an accident.

Insurance Rate Trends In 2023

Professional liability insurance provides coverage for negligence claims from companies that are primarily engaged in consulting work. Examples are insurance companies, law firms and the accounting profession.

If you need help dealing with common risks such as defamation, defamation and damage to customer property, general liability insurance can help. It will reimburse your legal fees when such an event occurs, as well as medical costs and property damage.

This coverage option combines general liability coverage and property insurance and serves as a comprehensive policy for businesses in Las Vegas, NV. Covered items include damage to company property, customer injury and damage to customer property.

Cyber liability insurance protects your business during a cyber attack. This cover ensures that the legal costs arising from the legal action are covered, as well as the costs of monitoring and notification to customers.

Gina Arrieta Garcia Agency

You should consider the options discussed to see if there is something that suits your needs. If you need one of the options above, contact Red Rock Insurance today. Our Nevada agents will help you find the right business listing for your business needs. Partner Content: This content was created by Dow Jones business partners, independent of the newsroom. Links in this article may earn a commission. Learn more

Written by: Daniel Robinson Written by: Daniel Robinson Author Daniel is a leading author and has written for a number of car magazines and marketing companies in the US, UK and Australia, specializing in the topics of car finance and car repair. Daniel is the leading authority on auto insurance, loans, warranty options, auto service and more.

Editor by: Rashawn Mitchner Editor by: Rashawn Mitchner Editor-in-Chief Rashawn Mitchner is a leading team editor with over 10 years of experience in personal finance and insurance.

As one of the largest entertainment cities in the United States, Las Vegas has traffic on its streets. This is one reason why the average city car insurance rate is about 174% higher than the national average.

Best Cheap Homeowners Insurance In Las Vegas

We at the Guide team have ranked the best car insurance companies based on several factors, including reputation, customer satisfaction and price. In this article, we discuss the companies that can provide the best and cheapest coverage in Las Vegas for different driving records.

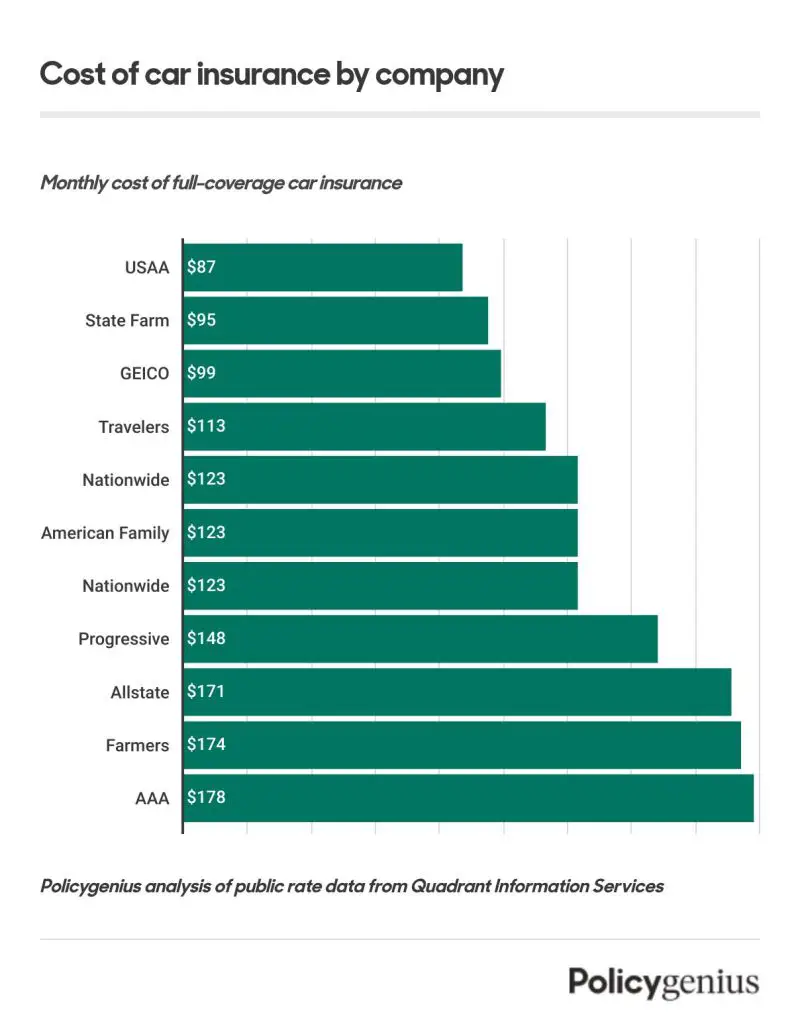

On average, USAA offers the cheapest policies with minimum coverage, and USAA is often the most affordable option for full coverage.

Cheapest Car Insurance in Nevada Cheapest Car Insurance in Nevada Cheapest Car in Las Vegas Cheapest Car Insurance

Cheap auto insurance in las vegas nv, auto insurance las vegas nv, insurance las vegas nv, commercial auto insurance las vegas, commercial electrician las vegas nv, commercial truck insurance las vegas nv, commercial electricians las vegas nv, commercial carpet cleaning las vegas nv, commercial insurance reno nv, cheap auto insurance las vegas nv, commercial cleaning las vegas nv, commercial insurance las vegas nv