Suncoast Credit Union Interest Rates For Car Loans – If you want to lower your interest rate or lower your monthly payments, you can refinance your car loan. There are many reasons to pay off your car loan, but do you know what steps to take once you’ve made your decision?

It’s always good to monitor your credit, especially if you’re looking to apply for a loan. If you want to apply for an auto refinance to get a better interest rate, it’s best to get an idea of your credit score before you apply.

Suncoast Credit Union Interest Rates For Car Loans

If you’ve been making your payments on time and have no other credit problems, chances are your credit score has improved since you first applied for a car loan. This is a good sign because a better score will help you achieve a better level.

Education Foundation Of Sarasota County Announces Suncoast Credit Union Scholars

If your credit score goes down, it doesn’t mean you can’t pay off your loan. Keep in mind that your approval will affect your credit score and what your new interest rate will be.

Before you apply for a car refinance, take some time to gather all the necessary materials. Here’s what you need to know about today’s car loans.

You should also check that there are no prepayment penalties on your current loan. Having a copy of the loan agreement will make this process easier. If you do not have the original contract, contact the lender to obtain a copy.

Once you’ve gathered your materials, you’re ready to apply for an automatic refinance. Once your application is approved, you can decide whether or not to continue with your current loan term.

Suncoast Credit Union Continues To Serve Needs Of Polk Residents

If your goal is to save money over time, you may want to pay off your loan faster. This will help you pay less interest over the loan period.

If the goal is to lower your payments to increase your monthly budget, you can extend the loan term to help give you a cushion. If you can’t afford high monthly payments, this can be a great option because it helps you pay your bills on time so your credit score doesn’t go down.

Once you have been approved for refinancing and are ready to accept it, you can begin completing the refinancing process. The lender will have you sign new loan documents detailing the new interest rate and term.

The financial institution pays the first loan for the new loan. You now have a new loan with a new lender and can start making payments to them at the new rate.

Fall 2022 Newsletter By Suncoast On Issuu

Ready to refinance? If you want to lower your interest rate or monthly car payment, we can help.

What does it take to get a business loan? Before applying for a business loan, you need to understand the eligibility requirements and what it takes to get a small business loan. SuncoastCredit Union is near me… No matter where I am, here are some surprising things you should know when looking for a credit union near me. Even if your credit union isn’t in the area, you still have access to credit union services. What is a safety and security GAP and what does it include? If you’re making car payments, warranty coverage (GAP) is a type of coverage that can save you money if your car is lost or totaled. Let’s see what GAP is and what it entails. Most of the offers found on this site are from advertisers who have been compensated by this website for being listed here. This drug may affect how and where products appear on this site (for example, including the order in which they appear). These offers do not represent all savings, investments, loans or credit products available.

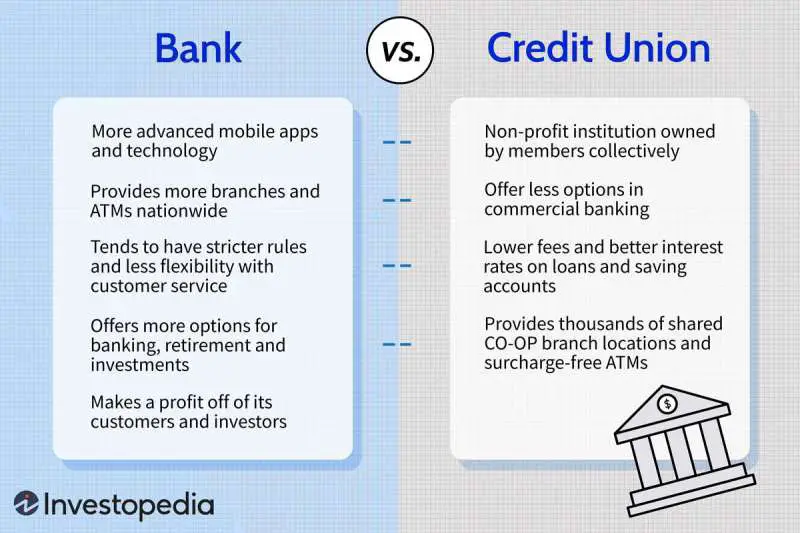

Credit unions often offer better car loan interest rates than banks or dealerships, making auto financing a great option. Non-profit structures offer lower interest rates and more flexible terms, especially for those with fair or bad credit scores. Read on to learn about the best credit unions for auto loans.

Before choosing which credit union to get a car loan from, compare APRs and loan terms. Most credit unions require certain criteria to be met in order to qualify for a loan, so make sure you qualify before applying.

Penfed Vs. U.s. Bank Auto Loans

BECU was originally created for Boeing employees and now serves the public. BECU offers automatic enrollment in its value program, allowing you to lower your interest rate as your credit score improves. In addition, BECU’s direct financing at participating dealers makes the car buying process easier and more efficient.

Why it’s special: BECU stands out with its member-centric approach, offering very low interest rates and low costs.

What to look for: BECU rates are very competitive, starting at 6.49% for new vehicles and 6.99% for used vehicles.

Penfed Credit Union offers members many auto financing options. The good news is that anyone can participate. In addition to standard financing, this credit union also offers online car buying services.

Credit Unions Vs. Banks: Which One Is The Best For You?

What makes it special: A unique car-buying tool that allows members to search for new or used cars and get a variety of information, such as price comparisons and a badge showing any Penfed discounts. Interest rates on car loans purchased through PenFed’s car buying service are as low as 5.24% in April.

What to look for: Penfed Credit Union offers 36- to 84-month auto loan terms for new cars with rates ranging from 5.24% to 7.29%.

SchoolsFirst Federal Credit Union has partnered with Autoland and Enterprise to offer customers special savings. To become a member, you must be a current or retired school employee or family member.

Important: Along with a variety of ways to save, SchoolsFirst offers guaranteed asset protection insurance with deductibles.

Spring 2023 Newsletter By Suncoast On Issuu

What to look for: SchoolsFirst Credit Union offers new and used car loans ranging from 36 to 84 months. APRs start at 6.39% for new cars and 6.59% for used cars.

Navy Federal Credit Union offers excellent auto loans to finance new cars with terms up to eight years. If you are affiliated with the military, Department of Defense, Coast Guard, or National Guard, you can join.

Why it matters: Borrowers expect convenience when applying for a loan online, and a decision in seconds. Other benefits available to members include access to GAP – Guaranteed Automatic Protection – insurance.

What to look for: Marine Alliance offers 4.54% down on new vehicles and 5.44% down on used vehicles. Car loan pre-approval and interest rates are good for 90 days from the date of approval.

The Best 10 Banks & Credit Unions In Sumter County, Fl

Membership in the NASA Federal Credit Union is open to individuals with a variety of NASA affiliations. This includes NASA headquarters, NASA centers or facilities, or current or retired NAS employees. Additionally, family members of existing NFCU members are also eligible to join. This credit union offers new and used car financing, as well as flexible terms and competitive interest rates for auto loan refinancing.

What makes it special: One of the opportunities where members can apply online and get approved quickly. With financing, members have an advantage over car dealers because they focus on negotiating the price of the car rather than the terms of the loan.

What to look for: NASA offers the same rate for new and used vehicles – rates start at 6.24%.

This Florida credit union offers a variety of auto related products to help members save money. If you live in Florida with a registered credit union, are a graduate of a Florida college, or are a qualified family member, you can join this organization.

Suncoast Credit Union Annual Report By Suncoast On Issuu

Why it’s important: Suncoast allows you to apply for a loan online, so you’ll know what your budget is when you walk into the dealership. In addition to auto financing and sales, Suncoast Auto Repair includes rental reimbursement, 24-hour roadside assistance, and travel reimbursement.

What to look for: Suncoast Credit Union offers new and used car loans with interest rates as low as 7.50% for up to 72 months.

Membership in RBFCU can be obtained through various means such as employers, places of worship, community organizations or educational institutions. Additionally, you can become a member if you have an immediate family member who is a member of the credit union. Whether you’re buying a new car, a used car or refinancing an existing vehicle, you’ll get the same rate at RBFCU.

What’s special: This credit union offers online help to members preparing to buy a used or new car with an online calculator to help them determine how much they can borrow and whether a new or used car is the best financial option. . Randolph-Brooks also offers mechanical maintenance and GAP Plus services.

Product Series Auto For Suncoast Members

What to look for: RBFCU Car Loans are available online if you’re not nearby

Credit union loans interest rates, suncoast credit union car rates, suncoast credit union car interest rates, suncoast credit union car loan interest rates, suncoast credit union rates, suncoast credit union savings interest rates, credit union interest rates for car loans, suncoast credit union auto interest rates, suncoast credit union loans, suncoast credit union interest rates, suncoast credit union money market interest rates, credit union student loans interest rates