Cheapest Homeowners Insurance In Texas – If you’re using a Galaxy Fold, consider opening your phone or viewing it full screen for the best experience.

Advertiser Disclosure Many of the offers that appear on this site come from companies from which The Motley Fool receives compensation. This compensation may affect how and where products appear on this site (including, for example, the order in which they appear), but our reviews and ratings are not affected by this compensation. It does not include all companies or all offers on the market.

Cheapest Homeowners Insurance In Texas

Most or all of the products here come from our partners who provide us with compensation. This is how we make money. However, our editorial integrity ensures that our experts’ opinions are not influenced by compensation. Terms and conditions may apply to offers listed on this page.

Homeowners Insurance In Texas: Building Costs For Homes Rising

Homeowners insurance is an important financial protection, but it doesn’t come cheap, especially in Texas. The average person can expect to pay more than $2,600 a year for Texas homeowners insurance, and some people pay much more than that. Here we’ll take a look at which companies offer the cheapest prices for some of the most common scenarios.

Those looking for the cheapest homeowners insurance in Texas should take a closer look at Texas Farm Bureau Insurance. The state’s average annual home insurance premium is $2,646 per year, but Texas Farm Bureau customers pay only $450 per year.

4.00/5 A circle with the letter I in it. Our ratings are based on a 5-star scale. 5 stars equals the best. 4 stars equals perfect. 3 stars equals “good”. 2 stars equals average. 1 star means bad. We want your money to work harder for you. That’s why our ratings are geared towards offers that offer flexibility while keeping costs low. = best = excellent = good = average = bad

Texas Farm Bureau Insurance also offers some of the best home insurance rates in Texas for new homes, with average annual premiums around $362. That’s about a quarter of the $1,400 average premium for a new home in the state.

Does Homeowners Insurance Cover Roof Replacement?

Those who own older homes can also get affordable insurance coverage with Texas Farm Bureau Insurance. The average Texas home insurance premium for a home built in 1971 was just $362; which was the same as the new construction premium. This could save homeowners more than $2,000 compared to paying an average annual government premium of $2,526 for older homes.

Homeowners who have previously filed a claim can expect to pay an average of $2,800 per year for home insurance in Texas, but those with Texas Farm Bureau insurance can expect to pay much less. You can benefit from the insurance for an affordable fee of $360 per year.

Homeowners insurance rates in Texas are above average in almost every category when compared to the national average. This can make it difficult to find affordable coverage. But costs vary widely depending on the type of home, location within the state and other factors. Let’s take a look at how average home insurance premiums in Texas stack up against the national average in some common scenarios.

According to Ascent’s survey of average housing costs by state, a typical home in the U.S. costs about $293,349, while the average home in Texas costs just $247,210. Low-cost homes generally cost less to insure than more expensive homes, but there are other factors that can affect your premiums.

At > Per Month + Zip Code + Florida + Texas Ine Average Cost Of Homeowners Insurance Throughout The United States Is $1,383 Per Year For A Policy With $250,000 In Dwelling

Texas experiences the most hail of any state in the country. It is also among the top five states with the highest risk of storms, hurricanes and wildfires. People living near the coast may also experience hurricanes. The increased likelihood of many natural disasters undoubtedly contributes to the higher-than-average cost of home insurance in Texas.

Located in Tornado Alley and close to the coast, Texas is subject to tornadoes and tornadoes every year. These tend to cause significant hail and wind damage. Texans filed nearly 638,000 hail claims from 2017 to 2019, according to the Insurance Information Institute. This is the highest number of any state in the country.

Heavy rain and storms can cause floods in residential areas. These requirements can get expensive in a hurry and are often not covered by traditional home insurance. Homeowners living in flood-prone areas should also invest in flood insurance to ensure full protection.

Texas filed 4,675 claims for lightning damage in 2020. This is the third highest number among states in the country. Lightning can cause fires, but fires can also start naturally for a variety of reasons.

Why Two Home Insurance Quotes Can Have Very Different Prices

Here’s a look at how certain coverage options and home insurance deductibles affect the cost of a Texas home insurance policy.

The average cost of sprinkler home insurance for Texans is $2,376 per year. That’s about 10% less than the state average. People who only have smoke alarms in their homes will save less. They pay an average of $2,432 a year.

Roof upgrades reduce the average Texas home insurance premium to $2,119 per year. That’s about $527 less than the state average. People planning to replace their roof should make sure their insurance company notifies them so they can take advantage of this savings.

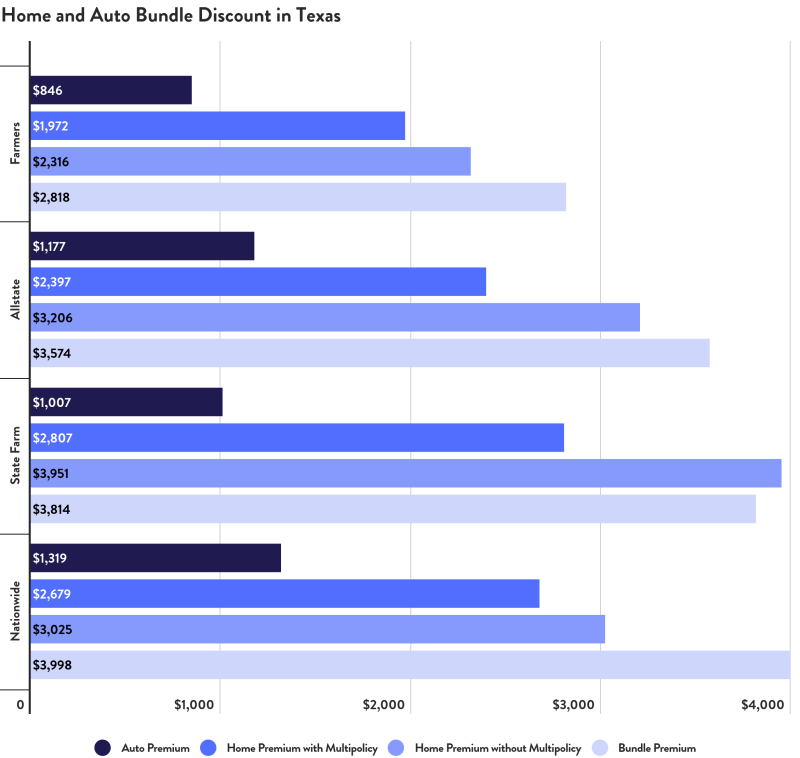

When home and auto insurance are combined, the typical Texas home insurance premium drops to $2,194 per year. That’s why it’s generally a good idea to get your home and auto insurance from the same company whenever possible.

Texas Homeowners See Skyrocketing Insurance Rates This Year

Kailey Hagen has been writing about small business and finance for almost a decade, and her work has appeared on USA Today, CNN Money, Fox Business, and MSN Money. She specializes in personal and business bank accounts and small business software. She lives mostly on a farm in northern Wisconsin with her husband and three dogs.

Share this page Facebook icon This icon shares the current page via Facebook. Blue Twitter icon Share this site on Twitter. LinkedIn icon This image is a link to share your LinkedIn page. Email icon Share this site via email

We strongly believe in the Golden Rule. Therefore, editorial opinions are our own and have not previously been reviewed, sponsored or approved by any advertisers included. Ascent does not cover all offers on the market. The Ascent’s editorial content is separate from The Motley Fool’s editorial content and is produced by a separate team of analysts.

The data on this page is a combination of public procurement data obtained directly from airlines and insurance rate data from Quadrant Information Services. These rates are publicly available from the top 10 to 15 carrier markets based on annual written premiums in each state and should be used for comparison purposes only. Actual estimates may vary.

Homeowners Insurance For A New Construction Home

Citigroup is an advertising partner of Ascent, a Motley Fool Company. Kylie Hagen has no position in any stocks listed. Motley suggests being progressive. The Motley Fool has a disclosure policy.

Ascent is a Motley Fool service that rates and reviews important daily products.

About Us Contact Us Newsroom How We Make Money Editorial Integrity Reviews Methodology RSS Feed About The Motley Fool

Terms of Use Privacy Policy Accessibility Policy Terms of Use Copyright, Trademark and Patent Information Do Not Sell My Personal Information If you’re looking for ways to save money right now, start by asking homeowners how much they spend each year. INSURANCE. According to our latest map, the cost of homeowners insurance depends entirely on where you live.

How Much Is Homeowners Insurance? (2023)

Data for the map was found on cost comparison site Insurance.com. There are many assumptions behind the data on the map. Imagine a married couple with excellent credit wants to insure a $300,000 home with standard insurance features such as a $1,000 per-person deductible and visitor health insurance. We calculated the average cost of insurance in each state and drew a color-coded map based on how high or low each state’s premiums compare to the national average. This allows you to easily see both the relative and absolute total average cost of homeowners insurance across the country.

There are two interesting facts about the homeowners insurance market in our map. First, the most expensive states are generally located in the southern part of the country, along the Gulf of Mexico and extending into Tornado Alley. Oklahoma is by far the most expensive state in the country, at $4,445 annually, or 92.8% above average. If you draw a straight line from Montana to Florida, every state has an above-average tax rate. Because geography is the biggest determinant of natural disasters such as hurricanes, tornadoes and avalanches that damage property and increase insurance premiums.

Another interesting tidbit is that homeowners insurance is relatively inexpensive on both coasts. Vermont is the most affordable state in the Northeast, at just $1,212 a month, or just over $100. Check out California. The average cost is just $1,166. Note that we assume the beginning

Cheapest homeowners insurance in illinois, who has the cheapest homeowners insurance, cheapest homeowners insurance in nj, cheapest homeowners insurance in florida, cheapest homeowners insurance in missouri, cheapest homeowners insurance in georgia, cheapest homeowners insurance in louisiana, cheapest homeowners insurance in arizona, cheapest homeowners insurance in michigan, cheapest homeowners insurance in oklahoma, cheapest homeowners insurance in colorado, cheapest homeowners insurance