Usaa Auto And Homeowners Insurance – Home » Understanding Your Car Insurance Policy » Shopping for Car Insurance » How Do You Get a USAA Car Insurance Quote?

How to get a USAA car insurance quote? USAA US US Get an online USAA auto insurance quote using our comparison tool and see if you can get a discount on your online auto insurance quote from USAA.

Usaa Auto And Homeowners Insurance

Sarah Routhier, Managing Editor and Director of Outreach, has professional experience as an educator, SEO expert and content marketer. More than five years of experience in insurance sector. As a researcher, data expert, writer and editor he strives to write educational, informative articles that give you the facts you need and the best kept secrets in this vast world.

Renters Insurance Claims

Michael earned a business management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He has high level of professional skills in many areas of insurance industry. During his career, he has held many roles to assist in claims management: Claims Specialist, Claims Practitioner, Claims Accountant…

Advertiser Statement: We help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any car insurance company and cannot guarantee any company’s quote.

Our participation does not affect our content. Our opinion is our own. Enter your zip code above to use the free quote tool to compare quotes from the best car companies. The more quotes you compare, the more likely you are to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our mission is to be an objective, third-party source for all things auto insurance. We update our site regularly and all content is reviewed by auto insurance experts.

Usaa Vs. State Farm Home Insurance (july 2024)

USAA is a Fortune 500 financial services company; USAA provides investment, banking, insurance and other financial services and products to military personnel and their families.

The company was formed in 1922 after a meeting between 25 military officers at Gunter’s Hotel in San Antonio, Texas. Nearly 90 years later, the company is still based in San Antonio.

When USAA was formed, it was called the United States Army Automobile Association. Two years later, its name was changed to the United Services Automobile Association, though it maintained its original commitment to providing affordable auto insurance and related products to service members.

USAA was established for active military personnel, but its eligibility requirements have changed over the years. You must still be in the military or be related to someone who is in the military to purchase their insurance products.

Does Navy Federal Have Car Insurance?

If you or your parent or spouse is not a service member or veteran, you are not eligible for USAA membership. However, don’t worry. There are many other car insurance companies.

If you’re not sure if you meet the eligibility requirements for USAA membership, you can quickly find out on their site. You will need your date of birth, contact information, social security number, and your or your relative’s military information.

If you or a relative do not have a military connection, you cannot purchase auto insurance from USAA.

Once you know you may qualify for a USAA car insurance policy, take some time to explore their site and read about their coverage.

Usaa Vs. Geico: Pricing And Coverage Comparison (2024)

USAA auto insurance policies have many benefits like rental reimbursement, accident forgiveness and global coverage no matter where you are.

For military members transferring posts, USAA is a good provider to consider because they understand the unique needs and challenges a service member can face with auto insurance.

If you’re already a USAA member, your information is already in the system and will be imported automatically, making your citation process a little easier.

Before you start the quoting process, USAA will walk you through its offers, benefits, and some helpful tips for buying a new car insurance policy.

Usaa Vs State Farm Car Insurance: Rates & Coverage

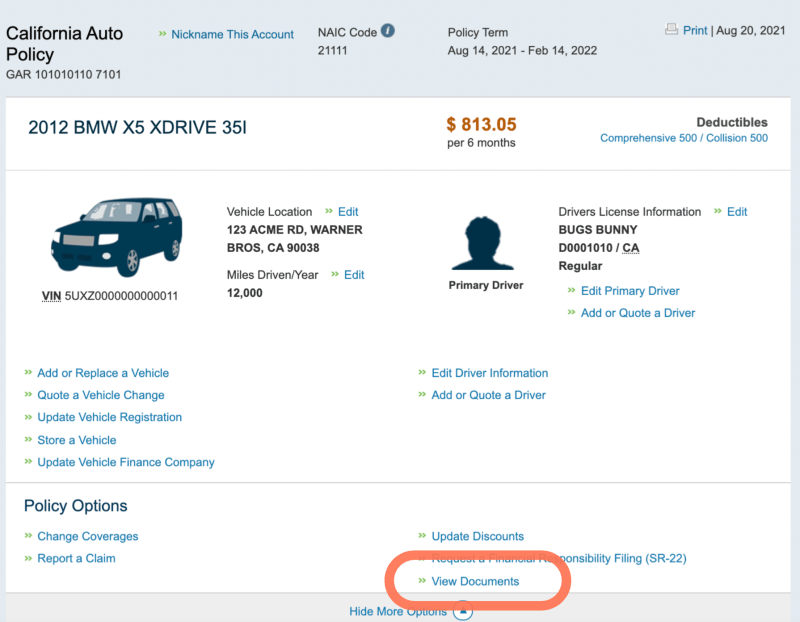

If you are a returning customer, you will be greeted with a welcome screen that reveals the benefits and coverage of your existing policy.

The tips provided by USAA are designed to help you be informed and more confident in the insurance buying process. Even if you have successfully obtained a policy before, it can be difficult to understand what car insurance limit you need and what discounts to look for.

We’ve found USAA’s quote system to be very useful and intuitive, so if you have questions about car insurance and need some extra help, this guide paired with their site is a winning combination.

For existing USAA members, most of your information can be reviewed and updated as needed. If this is your first time requesting an auto insurance quote from USAA, follow the on-screen instructions and enter the appropriate information in each box.

What Isn’t Covered By My Homeowners Insurance?

If you need to add an additional driver such as a wife, you can easily do so by clicking “Add Driver”.

You’ll need to provide the same personal details for each driver you include in your quote, so make sure you have all the information you need before you start.

You will be asked a few questions about each driver you listed. Some of them may seem unrelated to car insurance

On the side of the screen, you’ll see the phone number and hours of operation for USAA’s contact center. If you have questions about policies or need additional assistance with the quote request process, a live representative can assist you.

Is Usaa Good Car Insurance? Full Review

Don’t worry if it’s the weekend. This guide will walk you through all the steps and give you all the information you need to get a quote today.

You can manually enter the year, make and model of your car or enter your VIN. If your information is already in the system, but you have a new vehicle, update the information with your new car’s specifications.

USAA will ask questions about your car’s safety features to help you qualify for a discount. You should state how you use your vehicle and how many miles you drive each year.

USAA’s quote system includes an optional tutorial to help you determine the best limits and coverage for your policy.

Usaa Auto Insurance Accident Claims And Payout Secrets

We recommend using this walkthrough to assess your coverage needs and customize your quote as much as possible. An important part of buying car insurance is comparison shopping, and you want to make sure the rates you compare are as accurate as possible.

As you add additional coverage and explore all of your options, you’ll gain a better understanding of each company’s services and capabilities.

You can always lower your auto insurance policy if you decide to add additional coverage, but it’s best to get ahead of the curve in the buying process.

USAA provides you with detailed information about their discounts such as safe driving, defensive driving and good student discounts. Track these offers from other companies you shop with so you can save as much as possible.

Usaa Car Insurance Reviews: Costs And Ratings (2024)

You will be provided with a personalized quote and details including each coverage. You can review your custom payment limits and check for similar coverage that fits your other limits.

Make a note of these charges and keep them where you can easily retrieve them later. Before buying, it is important to get and compare multiple quotes online to find the best deal.

USAA is cheaper than other auto insurance providers because the company is the largest insurer in the military community, and this volume allows USAA to offer more competitive rates.

In short, while USAA is a strong choice for many active duty servicemen and servicewomen, retired military members and their families, the company’s online experience is one of the few shortcomings.

Usaa’s 2022 Annual Report To Members Looks Back At 100th Year Of Service To Members

Car insurance is an investment in your vehicle and your safety. To make sure you are truly protected, you need to observe the market and see what is out there.

A good car insurance company strikes a balance between cost and coverage. Don’t meet the minimum requirement, which is sometimes not the minimum requirement.

In its 2021 US Property Claims Satisfaction Survey, J.T. Power gives USAA a rating of 905 out of 1,000.

Enter your zip code on our site to be matched with multiple car insurance providers near you so you can compare rates and find the right policy today.

With All The Negative Reports About Usaa, It’s Interesting That Consumer Reports Rates Them #1 In The Usa.

John and Sarah are a military couple looking for car insurance. They decide to qualify for USAA membership and receive a quote. USAA offers significant discounts to military families, making them a more affordable option when comparing quotes from other companies.

Lisa, a member of USAA, had an accident last year. He worries about the effect on his insurance rates. However, when he requests a quote from USAA, he learns about their accident forgiveness benefits. This coverage ensures that his premiums do not go up due to his previous accident, making USAA the best option for him.

Mark, an army officer, often travels abroad on assignments. He needs

Usaa homeowners insurance quote, usaa homeowners insurance cost, usaa homeowners insurance average cost, does usaa have homeowners insurance, usaa homeowners insurance, does usaa offer homeowners insurance, usaa car and homeowners insurance, usaa homeowners insurance florida, usaa homeowners insurance coverage, usaa homeowners insurance policy, usaa homeowners insurance estimate, usaa homeowners insurance rating