Banks In Providence Rhode Island – The Old Stone Bank is a popular banking institution in Rhode Island, founded in 1819 as a mutual savings bank in Providence known as the Providence Institution for Savings.

On January 29, 1993, it was declared bankrupt by the Office of Thrift Supervision. Providence-based City Bank took over all savings bank deposits the following year.

Banks In Providence Rhode Island

In the early 1970s, the bank adopted a mascot and “spokesman” as the cartoon character, Fred Flintstone, who shouted in advertisements, “Yabba-dabba-doo, Old Stone loves the bank!”

Banknoten 1855 $ 1855 $10 Bank Of The Republic Providence, Ri Haxby 385 G10a Legacy Vf 20

When Old Stone Bank collapsed in the 1980s, the federal government was convinced to take over two failed savings and loan institutions, but reneged on the promise that it would not get the bank into trouble.

In 1992, Old Stone sued the government for breach of contract. In 2004, he was paid $192 million, but the appeals court reduced the award to $74.5 million and the Supreme Court refused to hear further appeals.

In July 1994, Providence-based Citizen Bank, a subsidiary of Citizen Financial Group, acquired all of Old Stone’s deposits and certain offices of Resolution Trust Corporation for $133.6 million.

As a result of the merger, Cityz closed 7 Cityz branches, 11 of the 28 former Old Stone branches, due to extensive branch overlap with the two banking institutions.

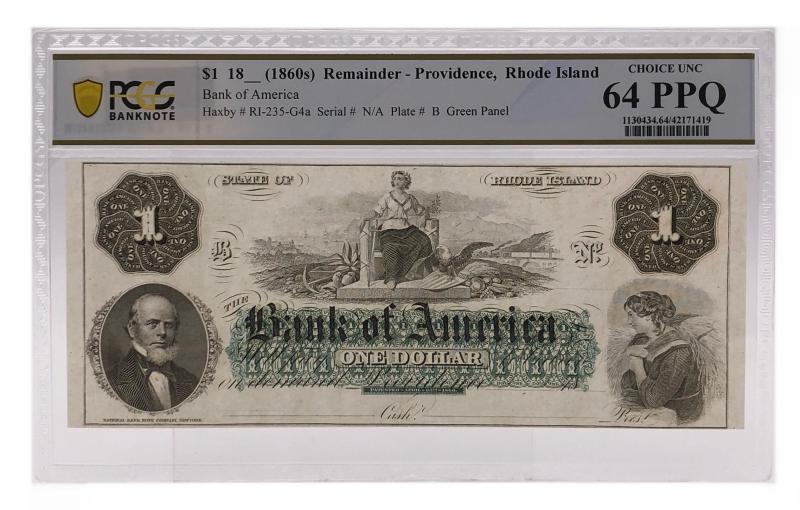

Former Bank Of America Building, Providence, Rhode Island

In its first expansion move, it acquired Old Stone Corp. the sick Seattle, Washington City Federal Savings and Loan Association for an undisclosed amount with the help of the Federal Savings and Loan Insurance Corp.

This federal bailout cost taxpayers $78.7 million. The new addition was rammed into the Old Stone Bank of Washington. Five years later, Old Stone sold Washington Savings Bank to Washington Mutual in June 1990 for $10 million.

The Landmark Old Stone Bank Building, from which the bank takes its popular nickname and houses the bank’s main branch, is located on South Main Street in Providence. The granite building with the characteristic gold leaf tower dome was designed by C.J. and R.J. Hall and Bank of 1854 is a good example of an architectural style, common from the middle of the 19th to the middle of the 20th century, which exudes stability, strength and durability.

It was sold by the Resolution Trust Corporation to Brown University in 1995 for $1.15 million, housing the Hoffer Museum of Anthropology’s collection of Native American artifacts.

Citizens Bank Unveils New Corporate Campus In Johnston

In 1999, Brown decided it was not possible to keep the collection in the building because the necessary changes would change the historic character of the building. In April 2009, Brown sold the building to Gold Dome Properties, LLC for $2.14 million. Cities Financial Group, Inc. is an American holding bank company headquartered in Providence, Rhode Island. City Bank, N.A. is a bank that operates in the US states of Connecticut, Delaware, Florida, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont and Virginia. owned by the company. So is Washington, DC.

Between 1988 and its flotation in 2014, Citizen was a wholly-owned subsidiary of the Royal Bank of Scotland.

In 1871, the Rhode Island legislature granted a second charter to form the City Savings Bank, which eventually acquired part of the group to form the City Trust Company.

The bank expanded through Rhode Island, opening a total of 29 branches in the state. It established Citizen Financial Group as its parent company, the bank acquired The Greville Trust Company in 1954.

Police: Vault Broken Into At Bank In Providence

In 1985, Citizen changed its status from Mutual Savings Bank to Federal Savings Bank. Expansion to other states began in 1986 with Massachusetts.

Under RBS ownership, Citizen owns several small banks in New Zealand and is the second largest bank in the region. In 1996, in conjunction with the acquisition of First NH Bank, Bank of Ireland acquired a 23.5% stake in the City, which RBS acquired two years later to continue 100% ownership.

In 1999, Citizens acquired the retail banking operations of the United States Trust Company of Boston and State Street Corporation, significantly expanding its footprint in Massachusetts.

Expansion beyond New Gland began in 2001, when RBS bought the retail banking division of Mellon Financial Corporation in Pennsylvania, New Jersey and Delaware for $2 billion. Overnight, City Bank became the second largest bank in Pennsylvania and the leading bank in Philadelphia and Pittsburgh.

Old Stone Bank History Of Rhode Island: The Arcade

In July 2003, the bank purchased the naming rights to the Philadelphia Phillies’ new home field, called City Bank Park.

On January 17, 2003, Citizen Financial Group purchased Commonwealth Bancorp, the parent company of Commonwealth Bank, located in Norristown, Pennsylvania.

In October 2015, RBS sold its remaining stake in City Financial Group, gradually reducing its stake through an initial public offering (IPO) launched in 2014.

In August 2004, Citizs Financial acquired Cleveland-based Charter One Financial, a unit of Charter One Bank, with offices in Illinois, Ohio, Indiana, Michigan, New York State and Vermont, for $10.5 billion.

This Is The Tallest Building In Rhode Island

Citizens Financial chose to keep Charter One’s Midwest footprint under the Charter One name, as Citizen Republic Bancorp of Flint, Michigan, already operates under the Citizen Bank name in most of CharterOne’s territories. However, it has rebranded its New York and Vermont branches as Citizens Bank. The purchase made Citizen Financial the 12th largest bank in the United States with assets of $131 billion and 1,530 branches in 13 states.

In early 2005, the City Bank banner changed to the name Charter One at the Save branch in Butler County, Pennsylvania. The rebrand resolved a 3½-year naming dispute with Butler-based City National Bank. In mid-2005, Citizen National and Citizen Financial reached a settlement. Citiz National Bank changed its name to NexTier Bank, while the Citiz Finance Group branch was renamed “Citizs Bank”.

A new corporate logo was launched on 26 April 2005, designed to reflect City Bank’s relationship with the Royal Bank of Scotland.

On September 1, 2007, the individual banks under Citizens Financial Group, with the exception of Citizens Bank of Pennsylvania, merged with RBS Citizens, NA.

Joseph Brown House (providence, Rhode Island)

In November 2008, Charter One sold its network of 65 branches in Indiana to Old National Bank, which rebranded under the Old National Bank banner.

Citizens Republic Bancorp was founded in 1871 in Flint, Michigan and merged with Republic Bank in 2006. In 2007, Republic City won cases in Michigan and Ohio to prevent City Financial from using the same name.

FirstMerit Bank acquired Republic City in 2013 and rebranded all branches as FirstMerit until 2016, when Huntington Bancshares acquired FirstMerit.

With a conflicting name no longer a problem, Citizen Bank announced on June 30, 2014 that Charter One branches in Michigan and Ohio will be rebranded as Citizen Bank. The name change officially took place on April 27, 2015, making the name Charter One in Cleveland; The city where it was founded.

The Best 10 Banks & Credit Unions Near North Providence, Ri 02908

In May 2008, Citizens Financial Group failed to publicly announce that it was under investigation by the Securities and Exchange Commission (SEC) for its involvement in the subprime mortgage crisis that devastated the US housing market and bond investors worldwide.

Royal Bank of Scotland posted the biggest loss in UK corporate history and announced cost-cutting measures at Citiges.

A Philadelphia developer sued Citizen Bank for $8 billion on January 27, 2010, over the bank’s failed divisional company, Citizen Financial Group and “its last unit, The Royal Bank of Scotland Group”.

After the effective nationalization of RBS in 2008, speculation arose as to whether RBS would retain Bank Kota. In 2012, public pressure increased in Britain to force RBS to focus on its home market and sell foreign assets, including City Bank, to recoup British taxpayers’ money. Citizs Bank also reportedly has significant interest from other foreign banks, such as Brazil-based Itaú Unibanco and Canada-Bank Toronto-Dominion, the latter of which already has a US bank. has a branch network that overlaps with Cityz’s footprint located east of the Appalachians. mountains.

Rhode Island Bank To Pay $9m To Resolve Discriminatory Lending Allegations

WE. Banks mentioned as potential buyers include JPMorgan Chase, Wells Fargo, USA. Bancorp, PNC Financial Services and Fifth Third Bank.

In February 2013, RBS confirmed at least part of the spin-off of Warga through an initial public offering in the next two years. In October 2013, RBS announced it would sell its Chicago-area branch, which represented 6% of its US deposits;

The bank began trading on the New York Stock Exchange under the ticker symbol CFG on September 24, 2014, raising $3 billion.

In June 2016, it was announced that Citizen Financial Group had become a member of the Fortune 500 for the first time.

Industrial National Bank Building In Providence Is The Tallest Building In Rhode Island, But Has Been Abandoned For 10 Years.

In August 2015, the Consumer Financial Protection Bureau (CFPB) and other federal regulators imposed almost $35 million in fines on Citizens Bank for “failing to fully credit customers’ accounts for their deposits.” The regulator said that between 2008 and 2013, “the bank’s actions shortchanged customers by millions of dollars.”

A joint action by the CFPB, FDIC and the Comptroller’s Office found that Citizen Bank engaged in “deceptive practices” by sometimes failing to give customers their full deposits.

Hotels in providence rhode island, marriott in providence rhode island, dentist in providence rhode island, lofts in providence rhode island, providence in rhode island, colleges in providence rhode island, restaurants in providence rhode island, churches in providence rhode island, jobs in providence rhode island, lawyers in providence rhode island, attractions in providence rhode island, mansions in providence rhode island