West Palm Beach Property Records Search – Palm Beach County FL Property Taxes – 💸 The Best Guide to 2024 and What You Need to Know [Rates, Reviews, Payments, Dates]

Are you thinking about buying a home in one of Palm Beach County’s many beautiful communities? Remember that purchase price isn’t everything: Property taxes can affect your home’s value.

West Palm Beach Property Records Search

One of the most confusing aspects of real estate ownership is real estate taxes. Even with similar standards, you may pay more than your neighbors, as prices vary from country to country. How are Palm Beach County bank taxes calculated? What are local property taxes?

Hilary Musser Sells West Palm Beach Mansion For Record Price

Here’s everything you need to know about Palm Beach property taxes, including tax rates, how to pay and exemptions that can lower your tax bill.

Property taxes in Palm Beach County are based on the value of the property. Palm Beach County property assessors are responsible for assessing property values and sending annual tax notices to property owners starting January 1.

Taxable gain is the estimated gain net of real estate tax deductions. The Palm Beach County IRS uses this value to calculate withholding taxes.

According to Florida law, the county assessor must remove all unrelated items after the property is sold and inspect it to equalize the price and assessment. Market price is “just price” or market value.

Related Cos. Pays $195m For West Palm Beach Site To Build Luxury Condo

Local governments such as cities, school districts, and counties set property tax rates. After the county commissioners, school board and other tax officials determine the tax rate, the county assessor multiplies the appropriate millage value by the property’s tax value and sends it to the tax collector. The chart below shows the “ad valorem” tax – or your property tax based on the value of your property – that is added to the “non-ad valorem assessment”. The latter refers to charges that can be added to your property tax bill by filing a return with the relevant authorities. A common example is the solid waste permit fee.

Tax collectors send property tax bills, collect bills, and distribute taxes to local governments and taxing entities such as school districts. Tax collectors are responsible for selling property tax receipts when taxes are due.

A tax notice or Truth in Millage (TRIM) is sent in August showing the taxable value of your property as of January 1. This notice also includes the millage rate, proposed and estimated property taxes. This is not a bill, but an estimate based on the proposed tax rate.

You can search for a Palm Beach County property tax collector online to see your property tax history, current tax liability, assessed value, assessments, property tax exemptions and current property tax rates.

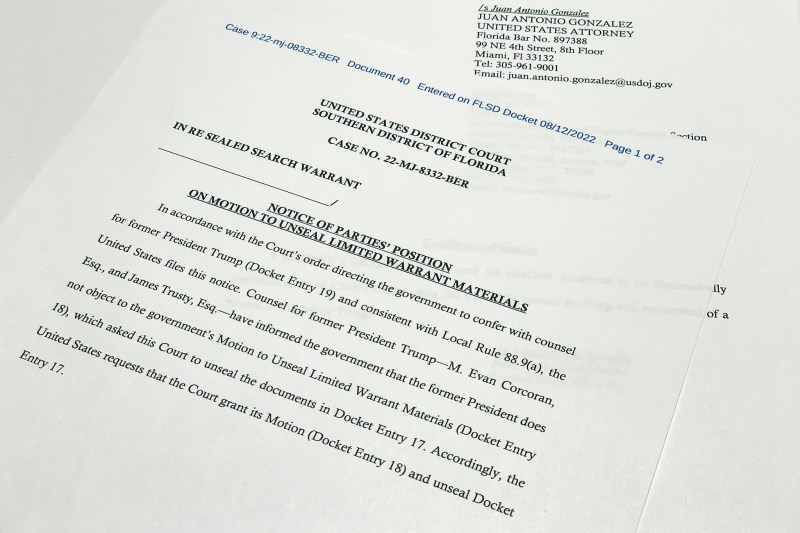

Read Fbi Search Warrant For Trump Mar A Lago Home

To check your current mill rate, use the Property Appraiser Public Access (PAPA) tool and search by address, PCN or landlord name. Under Item Details, then Taxes, click on “Tax Information” and see the total cost of your license.

Your Palm Beach property tax rate is displayed on the calculator. A million is $1 per $1,000 of value. If the mileage is 22.34, that means you pay $22.34 for every $1,000 of value.

You can use the Palm Beach County Tax Collector’s property search tool here to see your current mill rate. You will also see your required rate on your annual TRIM report.

Please note that the mileage rate for 2021 is inclusive of all tax heads. You can see the complete list of taxpayers and final discount rates here.

Lakeside Palm Beach House Get Price Slashed By About $5.5m To $34.5m

You must pay Palm Beach County property taxes between November 1 and March 31. 1% to 4% discount for early payment:

The next day after the deadline for payment of property tax becomes invalid. For 2021, taxes are due on April 1. Once taxes are paid, they cannot be paid online.

Click here to pay your Palm Beach County bank taxes online. You can search by owner name, address or property management number. You will see your current tax debt. Press the “Add to Cart” button and click “Checkout” to pay.

Note that eChecks are free, but there is a 2.4% fee for debit and credit card payments.

Rush Limbaugh’s Palm Beach Home

You can send your money to the address below. Your payment must be made on or before the due date to receive the early payment discount. Check or money order should be made payable to “Tax Collector, PBC”.

Property tax can be paid at PBC Tax Service Centre. The office also has a deposit box for payments outside working hours.

If you own a home and meet the requirements, you can get partial or full exemption from property tax. However, the mortgage becomes a substantial liability on your home and accrues interest of up to 7% annually until paid in full.

If the tax cannot be paid in full before the due date, you can apply for an installment plan. Click here to apply for Property Tax Payment Scheme. For 2021, applications must be submitted by April 30. Your tax bill is divided into four equal installments:

Justice Department Makes Redacted Mar A Lago Affidavit Public

Below is more information about business status, requesting a property tax assessment, and exemptions to lower your tax bill.

Homeowners have the right to appeal their property’s assessed value and exemption. Your TRIM report in August details your taxable income (budget changes that affect mill value) and the value of your property. If you disagree, you can appeal to the Palm Beach County Board of Valuation Adjustment (VAB) within 25 days.

This request must be submitted before the deadline. This request contains instructions that you must follow. You must provide evidence to support your claim when the property appraiser requests information to support the appraisal.

This is the Palm Beach County property tax agency. These deductions lower the value of your home and your property tax bill.

Palm Beach County Fl Property Taxes

The Palm Beach County property tax exemption is an exemption from property taxes. To qualify, the property must be your permanent residence. The Florida home mortgage deduction is $25,000 added to your first assessed value of $50,000 if you own your home as your primary residence on January 1 of the tax year. Up to an additional $25,000 if your net worth is between $50,000 and $75,000. The first $25,000 exemption applies to all property taxes, including school taxes, but the second exemption does not.

Click here for a Florida condo vacancy application that can be mailed to a property inspector or delivered in person. You can click here to e-submit your application.

Palm Beach County seniors who are 65 or older and own an independent home may qualify for this generous exemption. Your income must be below the threshold set by the Internal Revenue Service, or $31,100 for 2021. This income limit does not apply to Social Security benefits that are not taxable or tax-free interest.

The additional exemption applies only to major taxpayers, not school districts. These rulers like freedom.

Is ‘rambo’ Living In Palm Beach?

With Home Independence, you are eligible for a 3% Save Our Home (SOH) limit. This limit increases to the lesser of 3% of annual home equity in the assessed value of the property or the percentage change in the home market index, whichever is lower.

Palm Beach County Property Appraiser Dorothy Jacks, CFA, AAS, was elected to the position in 2016. The Property Appraiser has five offices open Monday through Friday from 8:30 a.m. to 5:00 p.m. For general questions you can call 561-355-3230 or contact any of the offices listed below.

Palm Beach IRS Anne M. Gannon. Municipal tax offices process vehicle ownership, registration and driver’s licenses and collect property taxes. They are actually the DMV and tax collector in Florida.

Palm Beach County Tax Collector locations can be found here. It is headquartered at the Government Center in West Palm Beach.

Palm Beach — The Hot Destination For Rich Brits And Ex Presidents

Palm Beach County property taxes are due November 1st through March 31st. Early payment loans are available during this period. The tax ends on April 1.

You can dispute the assessed value, tax liability and/or deductions by filing this appeal with the Palm Beach County Board of Valuation Adjustment after you receive your TRIM report in August.

Property taxes in Florida are paid at a flat rate. This means that real estate tax is paid at the end of the year (or at the beginning or next year) for the previous year.

Unfortunately, we can’t help you with your Palm Beach County property taxes, but we can make moving into your new home easier! Call Palm Beach’s best movers at Meehan’s Family Moving for a stress-free move to your new home.

West Palm Beach Mansion Sells For $10m

I am a third generation mover with over 20 years of experience in the moving industry. I grew up with Meehan’s original principles, which have been passed down through three generations of the movement. My #1 job is to give each client the best move.

Last update: 14

Palm beach property records search, palm beach property search, west palm beach property records, search property ownership records, real property records search, public records property search, county property records search, west palm beach property search, palm beach county property records search, georgia property records search, texas property records search, palm beach county property appraiser records search