Oregon Community Credit Union Auto Loan Rates – Buying a car is fun, but now it can be an expensive proposition. Car prices have increased for new and used cars for many reasons. As a result, investing in a car purchase can make some buyers nervous. To make sure you always get the best deal on your car purchase, and don’t pay more than you should, it’s important to know how to compare car loan rates. Oregon consumers — and consumers across the country — should read on to learn how.

The average price of a new car in the first quarter of 2021 was $37,200, which represents an increase of almost 8.5 percent year over year. But it’s not just new cars that feel the price pressure. Because new cars are more expensive, people are more willing to try to buy used cars, making them even more expensive. But why does this happen in the first place?

Oregon Community Credit Union Auto Loan Rates

Together, you have an increase in demand and a decrease in supply, and as any beginning student of economics can tell you, this is a recipe for rising prices.

Credit Cards, Auto & Personal Loans At Northwest Community Credit Union

Car prices are high right now, and it doesn’t look like they will drop significantly in the near future. For this reason, it is more important than ever to make sure you get the best auto loan rates in Oregon or wherever you live.

But buying a car can be stressful, and it can be difficult to know what will be the real financial burden on your wallet at the end of the day. It can feel like salespeople want to nickel and dime you with options and services you don’t need. But getting the best auto loan rates means knowing what to expect. Here are five things you should always consider when comparing car loans from different agencies.

When you try to compare car loan rates with others, it can be confusing to compare the world, comparing each part of a loan to another. Therefore, a good tactic is to look at car loans in separate categories.

This is often the easiest part of the loan comparison because it is so simple. How much money does each lender require you to put up front? If one person asks for $2,000 in cash and the other asks for $4,000 in cash, there can be a significant increase in favor of the former. Most Americans find it easier to pay less. However, taking the money is only a small part of the car loan in the coming months and years.

Auto & Recreational

The APR, or annual percentage rate, is the interest rate at which your loan increases over the year (as opposed to increasing month-to-month). Interest is how the lending institution earns money on your loan. The higher the APR, the more you will pay over time. If we take our two hypothetical loans in advance: A loan of $2,000 can have a significantly higher APR than a loan of $4,000, making it a much less attractive deal for a decade.

At the end of the day, how much does each car cost? It is easy to calculate the final amount that the loan will pay you when all is said and done. We recommend using one of the many auto loan calculators available online to get a good sense of what you will pay over the life of your auto loan. This takes into account the addition, the APR, and the length of the loan itself.

It can be tempting to just look at the last rate at the end of the day and go with the lowest price, but sometimes even this is not the be all and end all of the price of the loan.

For most of us, debt – whether it is a car loan, a mortgage, or otherwise – is not experienced at all, but in its monthly payments. A loan with a longer term, for example, will cost you more over the life of the loan, but it can have a manageable payment that fits into your budget.

Communityamerica Credit Union: Banking, Loans & Mortgages

Let’s take two loans for example, both for a new car for $37,000. Both have an APR of 6%. The first loan has a repayment period of 5 years, while the second has a repayment period of 10 years. In total, the first loan pays much less, just under $43,000, while the second pays more than $49,000. However, the 10-year loan is only $410 per month, compared to $715 for the short-term loan. For most Americans, that small monthly payment is too easy to absorb.

This is where everything else goes. For example, if you bring in money (say an inheritance), can you pay your debt in one sum? What happens if you pay extra every month? Talk to your loan officer about the little details that can tip the scale.

Because getting a car loan in Oregon or elsewhere can be complicated, it’s important to have a lender you can trust. If you’re looking to buy a new or used car and need a car loan, contact Central Willamette Credit Union today to find out how we can help you find your perfect new ride. We provide links to third party websites independent of our CU Community. These links are provided for convenience only. We do not control the content of these sites. Privacy and security policies on external websites will differ from our CU Community. Click the “X” to stay on this site or continue.

The minimum balance to open a joint savings account is $25.00. The minimum balance in a savings account to earn APY is $1,000.

How To Compare Auto Loan Rates In Oregon

The minimum balance to open a checking account is $0. The minimum balance to earn APY is $1,000. Check Height has a monthly fee of $7. Smith Checking has a monthly fee of $8 that is waived if you maintain a minimum daily balance of $2,000.

The minimum balance to open an IRA and earn APY is $50.00. A minimum balance must be maintained in the account at all times.

Deposit Credentials: The minimum balance to open an account and the minimum balance to earn APY is $1,000. A minimum balance must be maintained in the account at all times.

The minimum balance to launch savings certificates and earn APY is $500.00. A minimum balance must be maintained in the account at all times. Available for ages 0-17.

Partners Federal Credit Union

6-month, 9-month, 1-year and 2-year certificates are eligible for a one-time price increase.

The penalties are applied only to the part of the money withdrawn: 60 days of loss of dividends for certificates with a maturity of 1 year or less and 180 days of loss of dividends for a period longer than 1 year.

Your savings and IRA funds are federally insured by NCUA up to $250,000. All credit union credit programs, rates, terms and conditions are subject to change at any time without notice.

The rates offered on cars, boats, motorcycles, ATVs, snowmobiles, snowmobiles, personal loans are fixed and based on a person’s credit score.

State Vs. Federally Chartered Credit Unions: What’s The Difference?

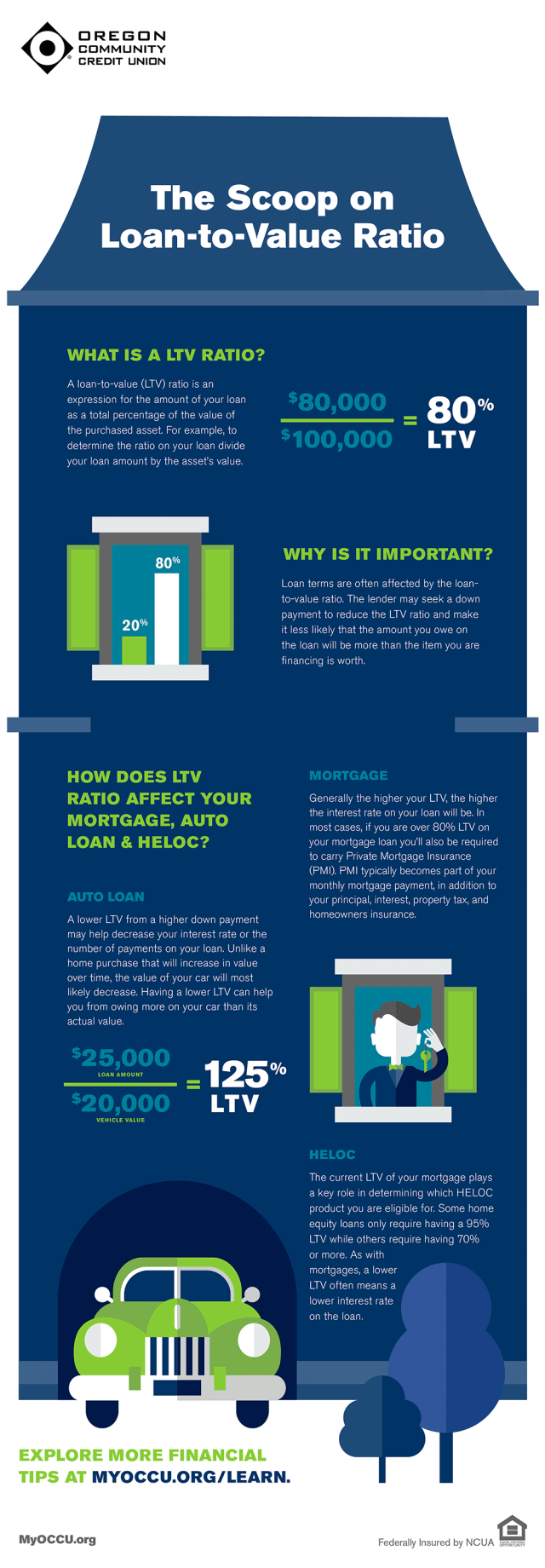

Interest Rate Increase: Extended Terms: Vehicle rates may increase from .50% – 2.00% if the loan term exceeds 60 months based on credit score. Mileage: Car loan rates will increase from 2.00% to 4.5% for high mileage (over 100,000) based on credit score. 1.00% will be added to the price for model year RVs 2008 – 2015. Call for details. When getting a loan for a new home or car, it’s important to understand what the loan-to-value ratio (LTV) is and how it can affect the terms of your loan. Our debt-to-value infographic will help. We’ve explained what LTV is, why it’s important and how it affects your mortgage, car loan or home loan.

A Loan-to-Value (LTV) is an expression for your loan amount that is a percentage of the total value of the property purchased. For example, divide the amount of your debt by the value of your assets to determine your debt ratio.

Loan terms are often affected by the loan-to-value ratio. The lender may require a lower down payment to lower the LTV ratio and make it less likely that the amount you pay on the loan is more than the value of the item you are financing.

In general, the higher your LTV, the higher the interest rate on your loan. In most cases, if you have more than 80% LTV on your mortgage loan, you also need private mortgage insurance (PMI). PMI typically becomes part of your monthly mortgage payment, in addition to your principal, interest, property taxes and homeowner’s insurance.

Auto Loans — Us Community Credit Union

A lower LTV than a higher payment can help lower your interest rate or the number of payments on your loan. Unlike buying a house that will increase in value over time, the value of your car will most likely decrease. Having a low LTV can help you get more money on your car

Oregon community credit union car loan, oregon community credit union rv loan rates, oregon community credit union cd rates, delta community credit union loan rates, oregon community credit union refinance rates, delta community credit union auto loan rates, community first credit union loan rates, community choice credit union auto loan rates, community choice credit union car loan rates, community choice credit union loan rates, oregon community credit union mortgage rates, first community credit union auto loan rates