Oregon Community Credit Union Eugene – OCCU will host its annual Shred Fest event this Saturday to encourage people to securely destroy sensitive documents such as bank statements and tax records.

Eugene, Ore. – Oregon Community Credit Union will host its annual Shred Fest, where residents can safely dispose of sensitive documents.

Oregon Community Credit Union Eugene

Oregon Community Credit Union’s annual event, scheduled for Saturday, May 6, will allow people to drop off four boxes of documents, including bank statements and tax records, that will be distributed free of charge, OCCU officials said. The credit union is asking that people bring at least one canned food item for Lane County Food.

Northwest Resource Federal Credit Union Changes Name To Trailhead Credit Union

The event runs from 9 a.m. to 2 p.m. at the OCCU Center at 2880 Chad Drive. In addition, OCCU members can receive two boxed clippings each day from now through May 15th in any department.

The goal of the measure is to securely transfer sensitive data and protect against fraud and identity theft. Last year, OCCU shredded more than 6,000 pounds of documents and donated more than 1,600 pounds of food for Lane County.

OCCU has been hosting Shred Fest events for more than a decade, said OCCU Community Relations Director Laura Brown. While the COVID-19 pandemic has cut personal events, OCCU has still been able to support members who support the branch.

The event has returned to its special form the past two years, and Brown said he’s looking forward to this Saturday’s event. Brown said the event is open to all individuals, families and businesses, not just OCCU members.

Selco Community Credit Union Ranked “best Credit Union In Oregon” By Forbes

© Copyright 2024 Allen Media Broadcasting, 2975 Chad Drive Eugene, OR | Terms of Use | Privacy Policy – Oregon Community Credit Union (OCCU) has become one of the first US credit unions to participate in a pilot program to test the benefits of a four-day, 32-hour work week with an internal call center team.

The four-day work week is booming in other industries and countries — especially because of the COVID-19 pandemic — as companies use the product as a measure of real productivity rather than logged hours.

According to information from OCCU, the pilot will consist of four eight-hour shifts and crew members will be compensated at the rate of five eight-hour shifts.

He will have one day off a week; Spending more time with family, attending meetings and generally avoiding the usual stressful role.

Selco Community Credit Union Awards Spark! Creative Learning Grants

“We’re excited to see if the four-day work week is a good fit for OCCU. We hope that stepping outside the boundaries of the traditional work week and finding innovative solutions will have a positive impact on the well-being of our team members.” has the potential to increase productivity, reduce turnover, increase productivity and in turn provide the best possible experience for our members.”

OCCU said it will not change business hours or hire additional staff to support the new program during the trial period.

Instead, the team is expected to work to ensure that overall productivity is high and that absenteeism, unscheduled time and turnover remain within acceptable limits.

If the four-day, 32-hour business pilot is successful, the credit union will consider expanding the model to other business units. At Oregon Community Credit Unions, we have strong relationships with our members. This makes them different. They have many unique experiences with their members, from buying their first car to volunteering for a local charity. With these adventures come great stories, and we love to share them over and over again.

Together, We Help Make Oregon Even Better

Once upon a time, being a credit union was enough to set it apart from the competition and other big banks. Now that consumers have credit union options and the ability to bank online, it’s even more important to differentiate yourself from not only the big banks, but other credit unions as well.

We started with company members to highlight what makes OCCU different. With over 150,000 members, every member has a unique story. We were able to connect with members on a personal level by sharing these amazing stories of how OCCU has helped change their lives. From its members, from the community, OCCU truly sets it apart. This has helped them become the second largest credit union in Oregon with over $1.7 billion in assets, and we help them tell every story.

With over 150,000 members, OCCU wanted to hear what sets them apart. We asked some to share their stories.

Random acts of kindness make everyone smile. That’s why Oregon Community Credit Union offered the University of Oregon campus surprises, high fives and lots of hugs.

Oregon Community Credit Union To Host May 6 Shred Fest

Oregon Community Credit Union exists not only to serve the community, but also to be a part of the community. Employees are given a day off each year to complete volunteer projects, proving that change sets OCCU apart.

Oregon Community Credit Union has undergone extensive renovations to most of its updated locations, including new photography requirements. Credit unions in Oregon are warning about a scam involving fake text messages. Texts look legitimate and can be deceptive because people usually react quickly to texts.

Matthew Wilson, senior vice president of risk and management at Oregon Community Credit Union in Eugene, said in some cases, fraudsters have been able to access members’ accounts and withdraw thousands of dollars.

“That kind of offense, you don’t want to trust anybody at that point,” Wilson said. “A lot of members are embarrassed that they’ve fallen for a scam. That’s part of the other message we’re trying to get out: don’t be embarrassed. These are people trying to get into your account and steal money.”

Occu Expands Its Commitment To The Pathwayoregon Program

Wilson said the so-called “smile” scam is a problem across the United States. If you don’t trust your credit union, they recommend ignoring the text messages. You can check for unusual activity by calling the credit union, visiting the credit union’s website, or using its app.

If you think you have been a victim of fraud, contact your financial institution immediately. The next step is to submit your credit report and report it to the Internet Crime Reporting Center.

Sign up to receive important news and culture from the North West delivered to your inbox six days a week.

The failure of Silicon Valley Bank and Signature Bank had a ripple effect throughout the financial sector. Angela Jackson, co-director of the Portland Seed Foundation, spoke with Weekend Edition owner Lillian Karabaik about how Portland’s startup community is responding.

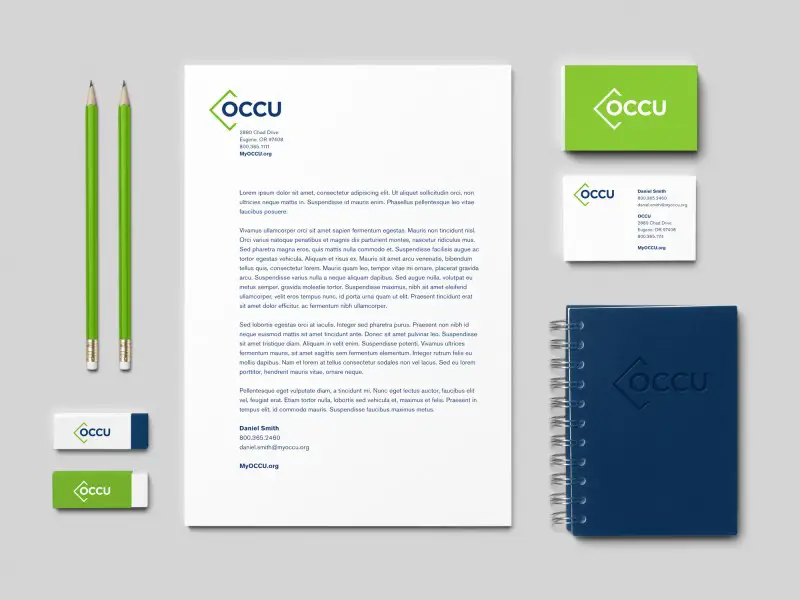

Oregon Community Credit Union Images, Stock Photos, 3d Objects, & Vectors

Portland financial institution Albina Community Bank recently completed a merger with the California-based bank. The move has deep resonance for many in once-black Portland.

Oregon community credit union, oregon community credit union hours, oregon community credit union eugene oregon, selco community credit union eugene oregon, first community credit union eugene oregon, northwest community credit union eugene oregon, oregon community credit union heloc, western union eugene oregon, oregon community credit union hours eugene, oregon community credit union springfield, 1st community credit union oregon, community credit union portland oregon