Car Insurance Las Vegas Nv – Home › Auto Insurance Rates by State › Nevada Auto Insurance › North Las Vegas Nevada Auto Insurance (2024)

North Las Vegas, Nevada Auto Insurance (2024) Nevada claims 25/50/25 for bodily injury and property damage. The average cost of car insurance in North Las Vegas is $483.12/month. Save now and compare prices below.

Car Insurance Las Vegas Nv

D. Gilson is the author of short stories, poems, and research that explores the relationship between popular culture, literature, sexuality, and memory. His latest book is Jesus the Freak with Will Stockton, part of the Bloomsbury 33 1/3 series. His other books are I Will Tell and Destroy Now. His first book, Catch & Release, won the 2012 Robin Becker Award for S…

Cheapest Car Insurance In North Las Vegas, Nev. (2024)

Jeffrey Manola is an insurance expert, founder of TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission in creating these websites is to provide the best rates to customers looking for insurance. It not only strives to provide its customers with the best rates for their insurance requirements, but is also a market leader in insurance…

Disclaimer: We help you decide on your auto insurance policy. Comparison shopping should be easy. We are not affiliated with any auto insurance company and cannot guarantee quotes from individual providers. Our company is not affiliated with our company. Our thoughts are our own. To use this free tool to compare quotes from different companies, enter the index on this page. The more words you match, the more opportunities you have to save.

Editor’s Notes: We are a free online resource for anyone who wants to learn more about auto insurance. Our goal is to be the premier third party resource for auto insurance. We update our site frequently and all information is reviewed by auto insurance experts.

Car insurance protects you in the event of an accident that could cause bodily injury or property damage. Gives you peace of mind while meeting minimum state requirements.

Auto, Car, Home, Restaurant, Business, General Liability Insurance In Las Vegas Nevada

Buying car insurance in North Las Vegas is not easy. Maybe you’re looking for the right coverage or company to meet your needs, or maybe you just want the lowest car insurance rates. Having time to research everything adds to the work. See: Ways to make sure you’re getting the lowest car insurance.

Don’t worry You don’t have to look any further. We’ve put together all the information you need about North Las Vegas auto insurance. We’ll look at the key factors that determine average annual premium rates, auto insurance rates, and state and local laws.

Are you ready to do this tutorial? If you want to start checking rates, enter the quote index.

Depending on the zip code, the average annual cost of comprehensive car insurance in North Las Vegas ranges from $5,797.39 to $7,347.44. He can rely on a large part of your income. There may be another overhead that you want to allocate to your salary.

Insurance Rate Trends In 2023

You may be wondering how my North Las Vegas, NV metro car insurance rate compares? Your answer is below.

But in this land of possibilities, you have your lighting options. In this section, we’ll explain the factors that affect car insurance rates to help you find the right insurance for your needs. As a result, we’ve teamed up with Quadrant to bring you information on the following categories.

Those states that do not use gender to calculate your auto insurance premiums are Hawaii, Massachusetts, Michigan, Montana, North Carolina and Pennsylvania. But age matters because younger drivers are often seen as more dangerous. Nevada uses gender, so check the average car insurance rates in North Las Vegas, Nevada by age and gender.

Your gender and age (and to a lesser extent, your marital status) will affect your car insurance premiums. In Nevada and other states, the practice of setting insurance rates is based on age and gender.

Best & Cheapest Car Insurance Quotes In Las Vegas

North Las Vegas, Nevada auto insurance by company and age are important comparisons because the best auto insurance company for one age group may not be the best company for another age group.

According to the Nevada Department of Insurance, insurers want to know your driving history and certain personal characteristics that compare you to similar drivers in the group. Insurers make payments for each group based on the past claims they have paid for the group.

Companies review receivables to forecast future profits and losses. Some of the characteristics used to determine your group are beyond your control, such as your age and gender.

Women pay less for car insurance than men because they have fewer accidents. Find out if this is true in North Las Vegas and how much the annual premiums are.

Top 10 Best Auto Insurance In Las Vegas, Nv

In general, according to the panel, experienced drivers – those over 60 – pay less for car insurance than younger drivers. Seventeen-year-olds pay more because of their lack of experience, which means insurers see them as a higher risk; as minors, they may be covered by their parents’ premiums. A young driver will always face higher rates.

Common knowledge about the difference in male auto insurance rates in North Las Vegas is true – female drivers charge more than male drivers. But on average, it’s less than $400.

Married women in their 60s pay the lowest rate on average, while married men in their 25s pay the highest. The average price rises to $800.

According to the Nevada Department of Insurance, urban claims are generally higher than rural claims due to the nature of the vehicles and accidents. So if you live in a quiet and safe part of town, you might pay less for car insurance than another driver a few blocks away.

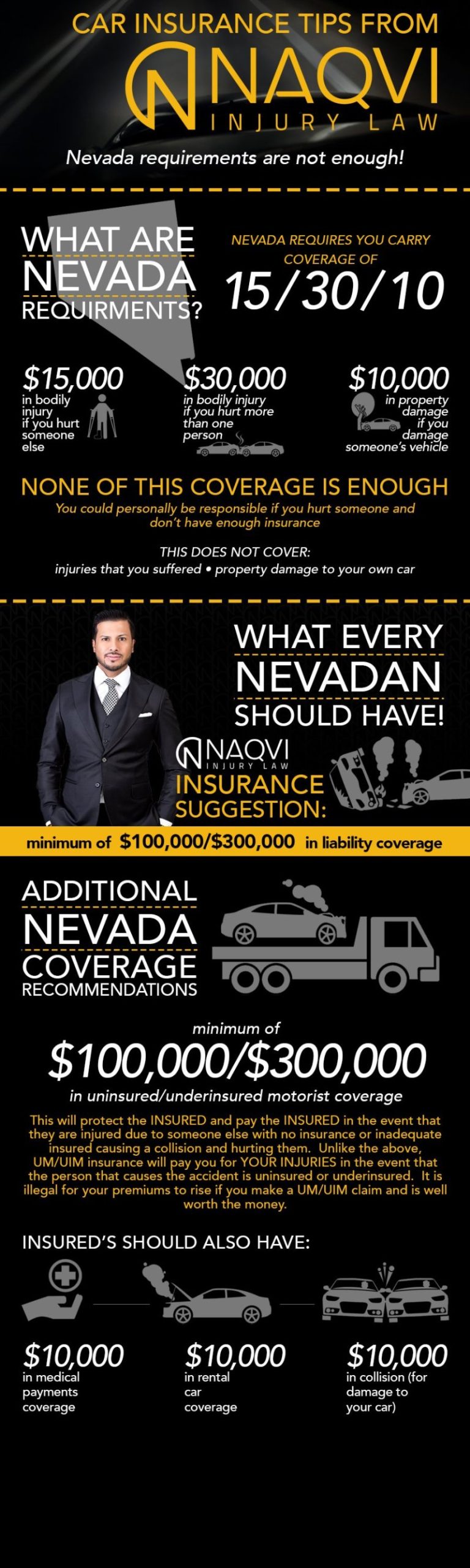

Car Insurance Coverage In Nevada

As shown below, prices vary between North Las Vegas communities. From 89033 to 89030 the price difference is about $1600. This is something to think about, especially if you are considering moving.

Here we look at how the major insurers’ prices vary and how other factors, including travel distance, level of cover and your credit history, will affect your payments.

Which auto insurance company in North Las Vegas, Nevada has the lowest rates? How do these rates compare to the Las Vegas auto insurance industry? Below are our answers.

As mentioned above, Nevada insurers factor your age and gender into your car insurance premiums. Let’s see how different the different insurance companies in North Las Vegas are.

Salary: Property & Casualty Insurance In Las Vegas, Nv

Overall, USAA and Travel have the lowest minimum wages by age and gender, but Travel pays 17-year-old males the highest rate compared to its competitors.

Nevadans drive an average of 14,084 miles per year. As you might expect, the way you drive will affect your car insurance premium. Here are some of the best car insurance providers in North Las Vegas for trips of 10-25 miles.

Most insurers do not adjust their rates based on distance traveled. Among those that did, State Farm reported the highest price difference, more than $400 for a 10-mile to 25-mile trip.

The amount of insurance you buy depends on whether you buy the minimum limit or how much you pay under the car insurance laws. But it’s interesting to see how much the prices vary in each option and how they compare to city averages.

Cheap Nevada Car & Auto Insurance Quotes

Your claims rate will play a big role in getting North Las Vegas auto insurance. Find the cheapest auto insurance rates in North Las Vegas:

Prices vary for minimum and maximum coverage, starting at $3,000 for Allstate and $300 for Nationwide. So it’s worth looking at all your options – best cover, full or partial cover and some carriers cost more than others.

Your credit history is a common determinant of other expenses such as rent or mortgage payments, so it’s no surprise that your car insurance premium will also vary. The higher your credit score, the less you have to pay. A bad credit score will limit your options and make you pay more. Find out how credit affects your car insurance premium.

Your credit score plays a big role in North Las Vegas auto insurance premiums, unless you live in these states where credit discrimination is illegal: California, Hawaii, and Massachusetts. Find North Las Vegas Nevada auto insurance rates by credit card below.

Fox5 Digs Into Why Nevadans Pay Some Of The Highest Car Insurance Rates In The Country

State Farm received the highest rate for bad to good credit at $8,000.

A clean driving record will help your rates a lot, and a bad record can hinder them. Let’s see how much they change with regular riding

Life insurance las vegas nv, key insurance las vegas nv, sr22 insurance las vegas nv, commercial insurance las vegas nv, motorcycle insurance las vegas nv, las vegas nv health insurance, business insurance las vegas nv, la insurance las vegas nv, home insurance las vegas nv, renters insurance las vegas nv, car insurance quotes las vegas nv, car insurance in las vegas nv