Delta Community Credit Union Auto Rates – You can access a secure site with confidential information reserved for authorized persons only. Unauthorized access or use is not permitted and is punishable by law. Violators will be prosecuted to the fullest extent of the law.

Time-Based One Time Code (TOTP) helps improve security when using Delta Community Digital Bank. TOTP is a type of multi-factor authentication (MFA) used to increase the security of account access. TOTP uses a trusted third-party app on your mobile device (phone or tablet). TOTP technology, now available to Delta community members, provides a temporary, secure numeric code (6 digits) that you can use in combination with your online or mobile banking password.

Delta Community Credit Union Auto Rates

To start using TOTP with Delta Community Online Banking or your mobile app, you must first download the required authentication app from your phone’s app store. Note that the two (2) supported authentication apps are Google® Authenticator and Microsoft® Authenticator. Important Note: Only Google and Microsoft Authenticator app(s) can be used with Delta Community Digital Banking. Below is a screenshot of the one-time registration you get for TOTP when you access your account online or in the app.

Empireone Federal Credit Union

If you later decide you want to sign up for TOTP, follow the instructions/other screens below (this section uses the icon on the page, now under How You Sign Up)

TOTP is an alternative authentication method. At this time, if you choose not to use the Delta Community online or on your mobile app, you can simply turn off the notification. Here’s how: “Don’t show me again” is the preferred option on the My Settings page in Online Banking.

When you select Don’t show me again, you won’t see the TOTP record on subsequent logins; You can later register for the service by going to the My Settings page in Online Banking or the mobile app.

Currently, it is not possible to disable other MFA authentication methods. even if; The Delta community will review new security measures that may provide additional security measures and/or ease of use.

Delta Community Credit Union — Travis Sharp

TOTP can be used for authentication through online or mobile banking, and once activated, the option will appear on both channels. The options look like this.

You look at your authentication app on your mobile device, look for the correct MFA code it generates, and enter it on the second screen.

It is not important. Note that if you’re using Face ID (biometric authentication) and “Remember this device” in your app settings, you won’t be able to object to MFA like TOTP. However, if biometric authentication and my device is lost, TOTP appears as one of the authentication options.

Yes, you can remove the verification option by switching the switch from ON to OFF in My Settings in Online Banking.

Delta Community Credit Union Online Banking Login

If you select “Register Now” at the first prompt but do not complete the rest of the steps, you may find the verification option on the MFA screen, but it will be inactive. To activate, you must register through my settings / security settings. If you change these settings, you will need to enter your current password before saving.

Yes, an email alert will be sent to the primary email on file to confirm your initial TOTP registration and if Delta Community has removed your TOTP access, notifying you of a security change. However, once registered, removing a tag from your verification application will not result in a warning.

You are leaving the Delta Community website. Delta Community does not endorse and is not responsible for the products, services or general website content on this site. The Delta Community Privacy Policy does not apply to linked websites. See the privacy statements on the site for more information.

Please note that emails are sent over the public Internet. We recommend that you do not send any personal, confidential or personal information in your message.

Credit Score: Is It Good Or Bad?

Your savings are federally insured for at least $250,000 and backed by the full trust and credit of the United States government. You can access a secure site with confidential information reserved for authorized persons only. Unauthorized access or use is not permitted and is punishable by law. Violators will be prosecuted to the fullest extent of the law.

We want to be metro Atlanta’s best place to bank, known for providing reliable value, superior service and trusted advice to our members.

On March 8, 1940, eight employees of the Delta Employees Credit Union founded Delta Air Lines with only $45 in capital. They have chosen to work as a non-profit cooperative and want to help their peers achieve financial success.

Following their example, we have become the largest credit union in Georgia and continue to embrace their philosophy of sharing our income with our members. services and large capital resources. .

Delta Community Credit Union Stockbridge, Ga 30281

Like a bank, Delta Community is federally insured and has the stability associated with one of Georgia’s largest financial institutions. Although we are big, we are dedicated to our members. You’ll love the personal service, convenience and products we offer, including free surveys, online bill pay, home loans, auto loans, business loans and retirement and investment products and services.

It is no accident that we put the word “community” in our name. Supporting the metro Atlanta community is very important to us. In this regard, we actively engage with local chambers of commerce, schools and charities and welcome opportunities to give back to the communities in which we live, work and serve.

We support the Children’s Tamar Network through our educational partners, including Credit Unions for Children and our relationships with schools and teachers in our community. Additionally, Delta Community Credit Union’s Charitable Fund allows us to support causes that support the physical well-being and financial education of youth and their families.

Visit one of our branches to review your credit union’s monthly requirements statement. Alternatively, email financials@ to request a current copy.

Dodd Frank Act: What It Does, Major Components, And Criticisms

You are leaving the Delta Community website. Delta Community does not endorse and is not responsible for the products, services or general website content on this site. The Delta Community Privacy Policy does not apply to linked websites. See the privacy statements on the site for more information.

Please note that emails are sent over the public Internet. We recommend that you do not send any personal, confidential or personal information in your message.

Your savings are federally insured for a minimum of $250,000 and backed by the full faith and credit of the United States government. Atlanta, January 13, 2021 // – Delta Community Credit Union (www.DeltaCommunityCU.com), the largest credit union in Georgia. A union with over $7.7 billion in assets, GOBANkingRates has listed it among the top 10 credit unions in the country on its “Best Banks for 2021” list.

In its ninth annual ranking, GOBANkingRates praised the Delta community for its outstanding customer service. Award-winning mobile apps; and 12-month CDs, with competitive rates and no fees.

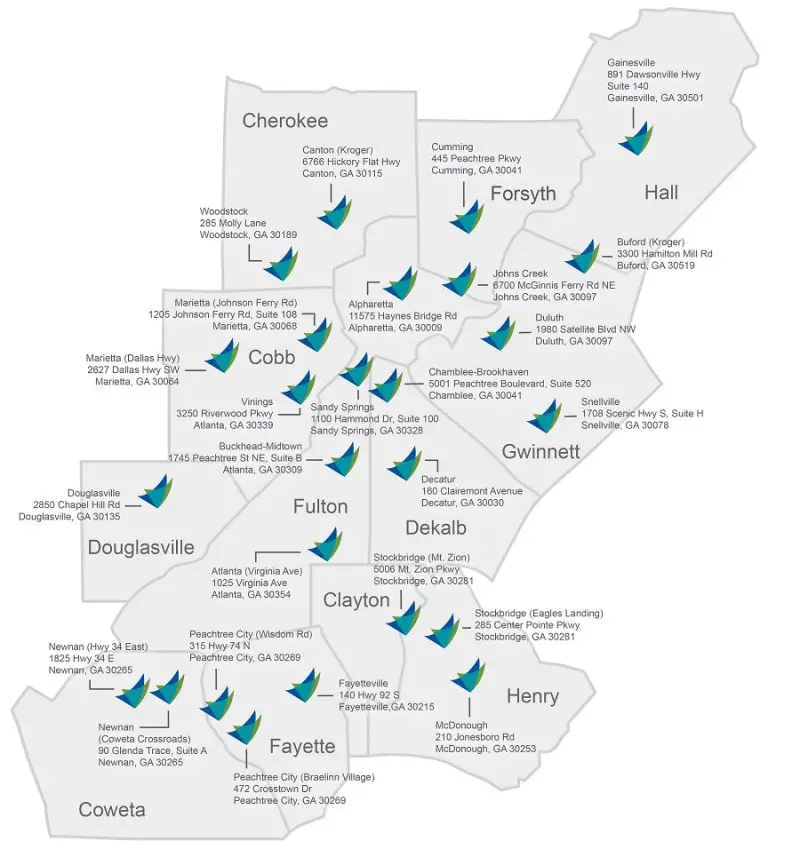

Branch Locations Map

“We are grateful for this recognition, which reflects the exceptional service and value Delta Community provides,” said Hank Halter, CEO of Delta Community. In providing competitive rates for both investment and credit products to individuals and business members as consumers continue. In the year In 2021, we will focus on providing the products and support they need to manage their homes, businesses, and finances to meet the current economic challenges.

GOBankingRates.com is a personal finance website that provides advice to consumers on topics ranging from finding the best interest rates to saving money and investing for retirement. For the 2021 list of the nation’s best banks and credit unions, GObankingRates analyzed data from more than 120 financial institutions.

About Delta Community Credit Union Delta Community Credit Union is a not-for-profit financial cooperative with a mission to provide consumers with the best service and value on the products they use to pay for household expenses, manage and save for the future. Founded in 1940, Delta Community is Georgia’s largest credit union with more than 430,000 members, 26 metro Atlanta branches and three out-of-state branch locations. It welcomes anyone who lives or works in metro Atlanta, as well as employees of more than 150 businesses including Chick-fil-A, Delta Air Lines, Restrac and UPS. To open an account, visit www.DeltaCommunityCU.com or follow the credit union on Facebook at www.facebook.com/DeltaCommunity and Twitter at @DeltaCommunity.

$25,000 Delta Community College Scholarship Program Now Accepting Delta Community Credit Union, Georgia’s largest credit union with over $8.6 billion in assets, is accepting applications for its 19th college year. …

Newnan (coweta Crossroads) Branch

Delta Community Announces 2024 Philanthropic Fund Grant Recipients Delta Community Credit Union, Georgia’s largest credit union with more than $8.6 billion in assets, is proud to announce its 2024 Philanthropy… A white circle with a black border around a chevron points upward. Click here to return to the top of the page.

The Chevron Personal Finance icon displays an expandable section or table, or sometimes previous/next navigation options. Chevron image bank

Delta community credit union interest rates, delta community credit union auto loan rates, delta community credit union savings interest rates, delta community credit union mortgage refinance rates, delta community credit union loan rates, delta community credit union savings rates, delta community credit union refinance rates, delta community credit union cd rates, delta community credit union mortgage interest rates, delta community credit union money market rates, delta community credit union heloc rates, delta community credit union mortgage rates