Lowest Personal Loan Interest Rates In Pune – Compare the interest rate with other factors before taking a personal loan Lower rate hikes help reduce EMIs significantly

Nivedita Sharma, a software entrepreneur living in New Delhi, had long dreamed of renovating her home. The only obstacle was money. There were always expenses that needed immediate attention, from renovations until he noticed a leak in the roof and couldn’t stop the repairs. 40-year-old Sharma decided to take a personal loan. Line up the day. He had to press a few buttons and the money was credited to his account “My good credit score and long relationship with the bank helped me get an 11 percent (interest) personal loan within minutes. “I will pay EMI (equal monthly installments) every month for two years,” he says

Lowest Personal Loan Interest Rates In Pune

Many Indians like Sharma are surprised by the easy availability of personal loans. Access to funds is no longer limited to those who live in metro areas or have good credit scores. With fintech companies filling the niche, even people with low or no credit scores have a better chance of getting a personal loan.

How Is The Interest Rate Calculated On Personal Loans?

Personal loans may be readily available, but how can you get them cheaply? Shop around for the lowest rate and choose a fixed rate loan as interest rates rise Low EMI, Low EMI There are many factors that lenders look at, including your credit score and credit profile.

There are many ways of disbursing personal loans. Some charge you low interest rates, while others offer flexible payment options. Choose the one that suits you. If you have a good credit score, banks offer personal loans at lowest interest rates. A long and stable relationship with the bank makes it even easier. With a pre-approved loan, you don’t need any documents. The only drawback is the lack of flexibility. Banks usually don’t allow partial prepayment.

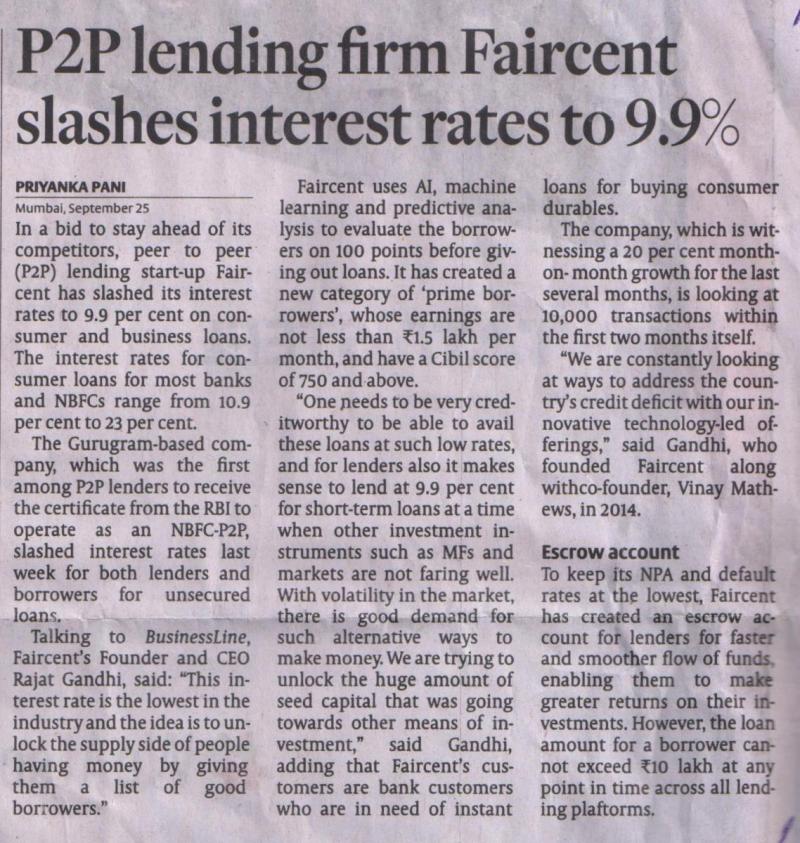

NBFCs can be your second option “NBFCs are active proponents of using technology in lending and the speed and convenience it provides make it its biggest USP. The loan amount, interest rate and tenure offers are tailored according to the bank’s competitors and the customer’s risk profile. Another big advantage means flexible payment options and fully transparent payments,” says Manish Chaudhary, chairman and CEO of Pune-based NBFC Poonawala Fincorp.

Another option is fintech companies like Navi Finserv and LoanTap. They are popular among millennials and self-employed for their less demanding eligibility criteria but there is a downside as not everyone is technologically literate. Not everyone has a smartphone and it can be addictive, says Mel Gerard Carville, executive director and board member of global consumer finance provider Home Credit NV.

Sbi Personal Loan Info Interst Rate

The growing demand for personal loans is reflected in CMIE’s latest economic outlook. Then, from December 2021 to March 2022, outstanding personal loans increased from 2.4 percent to 4 percent. Credit demand picks up as economy emerges from Covid-19 shadow CMIE said recovery in bank credit demand started in the second half of FY22, which analysts say will continue into FY23.

Among various types of personal loans, personal loans such as credit cards, home loans, vehicle loans, consumer durable loans have contributed to the growth. Together, these account for over 90 per cent of outstanding personal loans – an increase of Rs 57,165 crore per month in April 2022. However, month-on-month growth fell to a five-month low of 1.7 percent. High inflation, which affects consumer demand, could prompt the Reserve Bank of India (RBI) to double the repo rate to 4.9 percent in 36 days. With personal loans on the rise, is it the right time to take out a loan? Here are some factors you should consider

In this rising interest rate environment, it is important to compare the interest rates offered by lenders before applying for a personal loan, as the lowest rate will lower your EMI. Your credit score is directly related to your interest rate and the credit score is the only factor within the lender’s control that affects the interest rate.

A credit score is a three-digit number assigned to an individual on a scale of 300-900. It is based on each bureau’s unique algorithm; A score of 750 or above is considered good. To get a cheap personal loan, remember to maintain a good credit score, because a bad score means a higher interest rate… If your credit score is above 750, chances of getting a personal loan are high, says Sattam. . Kumar is the CEO and co-founder of LonTap, an online retail asset distribution fintech firm. Another factor that determines your loan price is your profile, your income level, and your occupation will affect the interest rate

Top 10 Personal Loan Banks And Nbfcs In India (2024)

Low interest rate should definitely be the main criterion while choosing a personal loan According to experts, it is better to opt for a fixed rate personal loan with increasing interest rates. Says Sahil Arora, senior director at fintech firm Pasabazar, “Voice rate personal loans are facing an increase in repo rates.

Arora said that while public sector banks (PSBs) generally offer personal loans at variable interest rates, most private banks offer personal loans at fixed interest rates. Moreover, one should go with banks with good CASA ratios as such lenders increase rates at a slower pace than low-performing banks. CASA is the ratio of current and savings account deposits to total bank deposits

There are other variables that you need to consider, such as processing fees, legal fees, penalty fees, and prepayment fees. Similarly, the personal loan borrower should ensure that the interest rate, processing fee, tenure, early payment, foreclosure fee and other personal loan details written in the loan agreement are as mentioned in the onboarding process. Surprise after getting a loan

Before taking a personal loan, explore other options available in the market. For example, if you want to take a personal loan for furniture or electrical appliances, getting no-cost EMI for six to 12 months offered by many shops is a great deal. So, be patient and compare the offers of all lenders

Instant Apply Idfc First Bank Personal Loan Online

It is very important that you get a personal loan from an RBI regulated source and not from unscrupulous lenders who charge you astronomical interest rates. “As a consumer, you should be aware of the remedies offered by industry regulators, like the RBI, so you can take it up with the authorities concerned,” says loan tapper Kumar.

Historically, people borrowed from close friends and family or local moneylenders in times of emergency. With the rise of fintech apps, you can now get loans from a variety of sources. However, be careful when choosing these “These are new sources, and regulators have been slow to bring them all into this scope. , or saving, or buying an insurance policy, don’t worry about who the provider is; you shouldn’t think I’m taking too much risk because I got it from supplier A instead of supplier B. It’s not about the provider, it’s about the product. So as a consumer I should have the same protections,” says Carville.

Sharma closes leaky roof by borrowing from controlled sources Loans flow like water Don’t be tempted by easy money; Choose the right financial option and realize your dreams like him BANK OF MAHARASHTRA PERSONAL LOAN PROCESS WITHIN A WEEK Existing customers and pre-verified customers can get their loan approval within 48 hours

A personal overdraft is a credit bureau that gives you a license to withdraw something as needed. Likewise, you can pay in full when your situation is perfect. Until now, these are the most preferred loan solutions that are always responsive to changing personal support needs.

Get Fixed Interest Rates On Loan For 5 Years Deals Of Loan

Contact Bank of Maharashtra Overdraft Office for Unexpected New Developments Customs Development Office has all the best facilities

Unsecured personal loan interest rates, lowest interest rates for personal loan, lowest personal loan interest rates, lowest interest on personal loan, interest rates for personal loan, business loan lowest interest rates, lowest loan interest rates, lowest interest personal loan, lowest bank personal loan interest rates, lowest personal loan interest rates in india, lowest interest for personal loan, best personal loan interest rates