Uw Credit Union Interest Rates – Help us protect you by making sure you’re the real person. Excuse the inconvenience. If you still see this message, please send an email

Help us stay safe by making sure you’re a real person. Excuse the inconvenience. If you still see this message, please contact us

Uw Credit Union Interest Rates

If at all, not injured, but they are better if they are people and machines. We apologize for the circumstances. We still look forward to hearing from you, please let us know if you email us

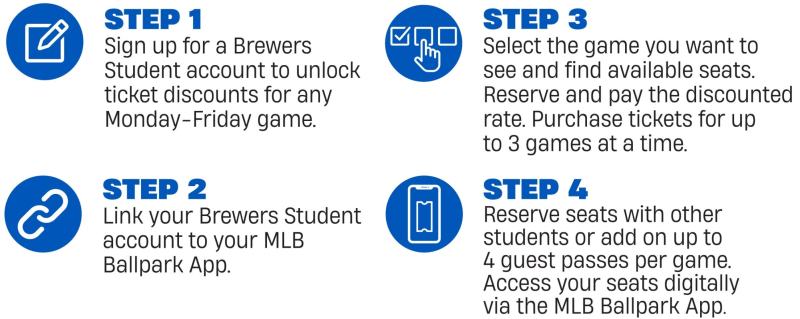

Brewers Student Special

Help us find out if this is the person you’re looking for. Eleven We apologize for the inconvenience. If you have already received your email, you will receive an email

Ayúdanos a proteger y demuéstranos que eres una real personala. Exulpa las molestias. If you continue to receive this message, we will notify you of the problem by sending an email to correo a

We need to protect you by checking that you are a real person. We apologize for the inconvenience this may cause you. If this message persists, please contact us by email

Remember to check if you have green pesos. Lamentamos Pelo is uncomfortable. If you are still receiving this message, please forward your email address

Post From Community: Uw Credit Union Invests $1.5 Million In Madison And Milwaukee To Address Racial Equity

Iutasi is a protégé demostrando che sei true personality. For this reason, it can be a concern. You’re still viewing this email from IndirizoAdam, who consults with financial experts to publish industry news to help consumers become more financially literate and improve their creditworthiness. Has 12 years of experience in storytelling, editing and design in print and online journalism and is highly knowledgeable in the credit scoring, financial products and services and banking industries.

Lilian Guevara-Castro brings more than 30 years of editorial and journalism experience to the team. He has written and edited articles for major news organizations, including The Atlanta Journal-Constitution and The New York Times, and was formerly an adjunct journalism instructor at the University of Florida. Today, Lillian edits all content for clarity, accuracy and reader engagement.

In short: Although UW Credit Union began as a financial institution for faculty and staff at the University of Wisconsin at Madison, its membership has grown significantly over the years. Today, more than 300,000 members in Wisconsin and trust UW Credit Union offer financial products and services, including the Credit-Building Suite to help you get ahead with a credit card. UW Credit Union’s strong commitment to diversity, equity and inclusion underpins its focus on community.

The Great Depression was a problem for both urban and rural populations in Wisconsin. During Dust Bowl storms, farmers lost significant income and soil. Many workers in Milwaukee lost their jobs, unemployment rose 75% from 1929 to 1933.

Credit Unions, Banks, And Other Financial Institutions

As small banks were closing across the state at the time, a group of faculty and alumni from the University of Wisconsin at Madison came together to found what is now known as UW Credit Union.

These seven founders signed the original charter on June 1, 1931 to help members obtain more affordable credit. Since then, UW Credit Union has grown along with higher education in the state.

With more than 300,000 members, UW Credit Union’s Madison campus is now part of a statewide system with a world-class reputation. UW Credit Union’s commitment to diversity, equity, inclusion and community outreach has evolved as its member network has grown.

Today, any U.S. UW Credit Union is open to all Wisconsin residents enrolled at the university. Membership is open to all individuals who live or work within five miles of any of the 29 UW Credit Union locations, regardless of educational status, as well as employees of partner health care and education facilities.

Is The Cost Worth The Degree?

UW Credit Union’s commitment to inclusion extends to its members, and the values that started it during the Great Depression continue to drive it today.

“There’s something for everyone here,” said Ian Marlette, branch manager of the UW Credit Union on West State Street in Wauwatosa, Wisconsin. “We want everyone to be included.”

One way UW Credit Union shows its commitment is by offering free credit counseling services to members and non-members alike. This means anyone can use the Internet and make an appointment at a branch and consult with UW Credit Union’s financial experts.

UW Credit Union can help them better understand their financial situation and review their credit reports for opportunities to save on interest and lower payments.

Uw Credit Union Reduces All Overdraft Fees To $5

“You work with a financial expert who stays with you and gives you a plan of action,” says Marlette. “If we get a baseline and see where you are, we can point you in the right direction.”

UW Credit Union’s credit card offering begins with a product most members use early in their credit journey – the Visa Credit Card. No Demand Visa Credit Card is perfect for students and new loan customers who want to earn points.

The Visa Rewards credit card is in the middle of the ranking. The no-annual-fee card earns cash back and bonus points on all purchases up to $2,000 spent in the first three months.

Its top-tier product is the Visa Signature Rewards Credit Card, which earns 2% back on all purchases for members with UW Credit Union Rewards Checking.

Open A No Overdraft Bank On Certified Account Now!

“We have members who live in Wisconsin and take their talents to other universities around the country and around the world,” Marlette said. “They increase their membership with us and start with their first credit card that they can keep for life.”

Marlette began her credit building journey as a student at UW-Milwaukee and obtained a Visa credit card.

“I started a membership at the UW Credit Union at the suggestion of my sister, who also attends UW-Milwaukee,” Marlette said. “I wouldn’t be a homeowner today if it wasn’t for the financial expert from UW Credit Union who supported me, gave me the education and the foundations to build credit.”

Marlette launched the UW Credit Union Campus Package, available to students and non-students 18 and older starting their credit journey. The Campus Package combines checking and savings accounts with overdraft protection, a basic card and low-interest student loans.

How Technology Is Shaping Our Future: Billions Of Self Employed Makers And A Few Mega Corporations

UW Credit Union offers credit cards and educational resources that help members build a positive financial future.

“Overdraft protection is like a secured line of credit,” says Marlette. “Because it is reported to the credit bureaus, if you use it and pay on time, you will be paid on time every month according to your credit report. If you don’t use it, you’re still building credit.

The result is a comprehensive service that is characterized by a personal approach and helps each member progress through the steps to achieve a successful outcome. Widely used by UW students, as well as non-students who want to build their credit profiles.

“We know that payment history is typically the largest component of a credit report — more than 35% of a credit score,” says Marlette. “This industry helped me get a student loan to finish my degree after spending federal funds. It helped me get my first car loan and helped me get a home loan later in life.

Working At Uw Credit Union

UW Credit Union helps create financially strong communities for members where they live and work. But that’s only one aspect of the credit union’s broader vision of community, represented by its extensive financial education resources, community outreach programs and organizational values of diversity, equity and inclusion.

In the area of financial education, a partnership with GreenPath Financial Wellness provides confidential financial counseling to all UW Credit Union members. Additionally, the Learning Center includes articles and other content that complement the individual counseling process.

“Even in our branches we use our online resources a lot,” says Marlette. “When people come to us, once we know what their financial situation is, we approach our website to make it easier for them by tailoring content to their needs.”

Perhaps due to the credit union’s origins during the Great Depression, giving back to the community is a tradition at UW Credit Union. Through partnerships with local charities, the fund distributes resources to those in need. It also offers scholarships and internships for meritorious students and offers opportunities for employees to volunteer.

Uwicu 2021 Annual Report

This commitment to inclusion begins at the UW Credit Union office and extends to its partnership with the Filene Research Institute, which supports a diverse financial workforce. Through UW Credit Union’s own Race Equity Fund, the credit union invests millions in organizations dedicated to building financial stability and closing educational achievement gaps.

It also includes the credit union’s own products, including the recently launched Expression Collection debit cards with Pride and Unity messages, and alumni, campus and mascot cards.

“We’re here to help,” Marlette said. We’re excited to be in more communities and work with more members on their financial journeys.”

Advertiser Disclosure

Wisconsin Volleyball Coach Kelly Sheffield Discusses Three Set Win Over Indiana

Credit union mortgage interest rates, credit union auto interest rates, interest rates uw credit union, uw credit union mortgage interest rates, best credit union interest rates, credit union checking interest rates, local credit union interest rates, credit union interest rates, credit union loan interest rates, uw credit union savings interest rates, credit union cd interest rates, credit union savings interest rates