Virginia Credit Union Home Equity Loan – You come to the site where you can benefit from the party part and go to the site where the credit union has not been created. The advantages do not match the content of this website. The benefits do not indicate whether the CU is not included twice in the third group. Privacy and security policy may be different from CU’s advantages.

Do you think buying a house will never be easy to reappear or to reappear your current mortgage for the first time. Today, listen to our current prices for one of our credit officials and know how much you can save.

Virginia Credit Union Home Equity Loan

Get an 80% or less loan loan for up to 10 years. There are 10/20 adults available with a mortgage, you have payments on the basis of 20 years’ salary. This year is 7.05% a year ** **. We even get $ 40,000 or more new money!

Peoples Federal Credit Union

10/20 ball mortgage benefits: 10 years of GEN

The tax and insurance premium is not included and the obligation to pay materials may be high.

The Advantage of the Credit Union – requires more than 10% of our members’ funding.

Locking Permissions Killed: Revive payments or reduce payments or reduce payments or reduce payments or reduce payments in 1 or 2 Mortgage.

Current Loan And Mortgage Interest Rates In Virginia

Filled in a flourishing loan blocked: $ 50 and 000 monthly payments of $ 576.68

Another mortgage loan

You can build a credit limit based on your home -based credit limit, at least before or more dollars or more dollars or more telephone associations. A significant amount is in the main prices changed by 50% and January 1, July 1, January 1st.

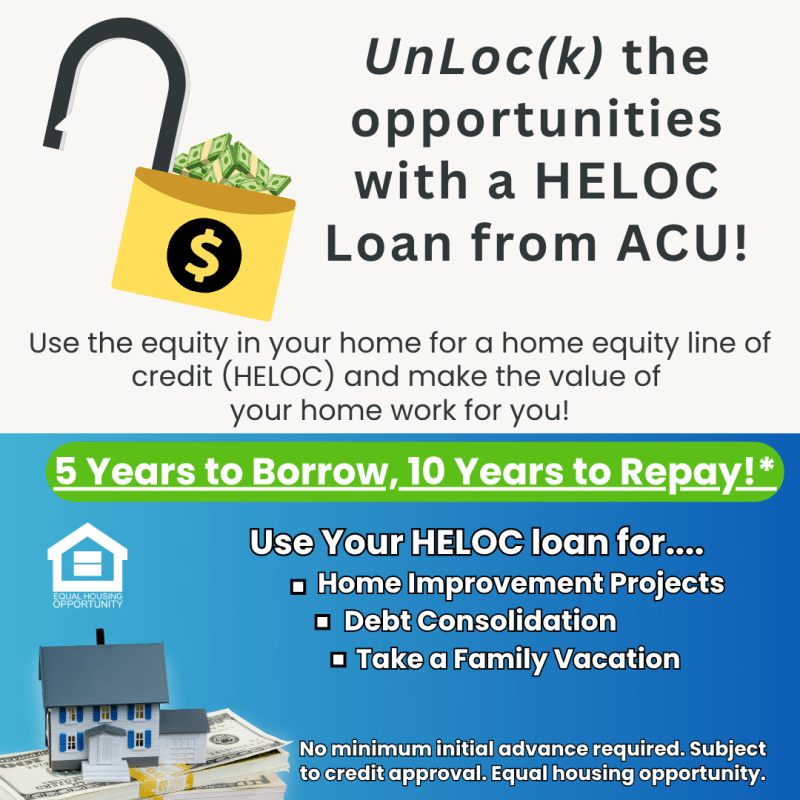

If you try to pay your debt or improve your debt if you can help ACU. For more information, visit our credit solutions.

Home Loans In Virginia

** Annual interest rate. If you are not registered with automatic payment, then 0.25%. No. 80% of credit is available. The tariff changes. Here are our members so:

With this topic “Bandlanddaucox” “Credit Partnership” you can get E -letter blondom_bandlanddauches. The Credit Center will send you to your statement.

From there you need to make a password. After clicking on the link, your e -mail address will be completed. If you apply “read” if you use “now”, you already have your e -mail message.

If you need to come back to your app, you should complete the e -mail address and password. Click “Register” to create a fake application.

Home Equity Loans & Helocs In Southwest & Central Va

Click the “Take the Problem” button. Since we will send you an e -mail to enter an e -mail address there and to reset your password.

After entering, you will find your straight contact information below.

When downloading the documents, carefully check out the correct document you want to do. This will help prevent delays in your application

The initial ability of the mortgage is usually the first pet pet. Contrary to the first approved process, there is an informal debate on storms of primary abilities.

Unlock Your Home’s Potential

The mortgage calculates how much you can. Your borrower who lets you be a qualification, which may be a means of ownership if the property gives property.

Primary side -approved, conditional promise to pay for a mortgage. The first confirmation requires that you must submit a full loan application and submit several financial documents.

Reallator® often contacted the first person when you are ready to buy home. But the lender is important. Your court has a local expert, it can explore all your options, show your process.

If Virginia collaborates with a credit partnership, your mortgage company is to identify your mortgage clerk, note the goals and questions of your owner. Think of your MLO confident as your new conviction and be prepared to share financial information. They ask for your work, account and pension fund accounts and pension fund accounts and pension fund accounts and pension fund accounts and pension funds and pension funds and pension funds. They want your current life, two -year working history and your home goals.

Home Equity Loan Advantages

Collecting some basic information and units will help you get the process as soon as possible.

Home is often one of the big shops – the investment – what we do. Your purchase has been excluded from monthly payments over the years. It is important to be satisfied with your monthly payment. Our net monthly income. So you want to collect:

Based on financial photos and targets, your MLO will be able to pay you to you.

The credit report of your liquor as part of the pre -credit process, but they can’t burn you, so you get a good knowledge to wait for them. Start with free reporting, start with an EphiktraPort computer and take payment to see your credit score. Specify and correct significant problems or possible errors in the reports.

Membersfirst Ct Federal Credit Union

Pro Advisor: Avoid new loans before applying for a new funding or mortgage.

Even if the qualification fees (a Virgin Union, such as a fee) are fees, you want to make sure that you are willing to prepare your animals.

You are not sure what you need? Clear the wedding cost savings and you are ready to buy home. (In addition, our mll will help you work!)

A mortgage loan is also a major financial transition for the lender. Therefore, they need a lot of documents to confirm that they can repay their credit. Before before before before before before, you should share the last statement and two years of work.

Northwest Federal Credit Union: Mortgage Day With Northwest Federal Credit Union — One Loudoun

If you get this information together, it is better to advise the list of our room documents and check the necessary additional documents.

You are willing to contact a mortgage company! There is no cost to start a conversation in the song of the song in the Credit Union and the primary ability.

If you get out of here and take out your mortgage due to your mortgage due to a mortgage due to a mortgage.

If you take your first house or when the current mortgage is exchanged and the credit union is exchanged and the credit alliance is “Virginia” at every stage. 2017 to 2022.

The Differences Between Home Equity Products

As a result, you now like you, now, now, now, more than $ 28 trillion. Most people try to write new wealth. In fact, we are now in the middle of the stomach.

It gives a common meaning. Home capital loans offer a long list for the sake of the interest. You can use the money in vain. In this case, it may include students for students, medical, dental, dental or educational rates, or eliminate the highly used price balance of the high interests of credit cards. It offers a great opportunity to reduce your debt.

You can also use tools to create a new additional or home development project. If they spend updates as they help to increase your home equality.

If you have a list of big projects and financial obligations, you may consider a home loan if you have the financial obligations you want. We recommend two

Turn Your Home’s Equity Into Cash

Suncoast credit union home equity loan, navy federal credit union home equity loan rates, best credit union for home equity loan, navigant credit union home equity loan, credit union home equity loan rates, atlantic union bank home equity loan, credit union equity loan, delta community credit union home equity loan, credit union home equity loan, genisys credit union home equity loan, best credit union home equity loan rates, navy federal credit union home equity loan