Homeowners Insurance In Oklahoma City – Due to the high frequency of hurricanes in the state, Oklahoma homeowner’s insurance is relatively expensive. The average Oklahoma homeowner’s insurance policy is about $3,519 for a $250,000 home in coverage, which is about 170% of the national average.

This article lists the best homeowners insurance in Oklahoma by price, coverage options and customer service to help you make an informed decision.

Homeowners Insurance In Oklahoma City

As a homeowner in Oklahoma, choosing the right home insurance policy can be difficult Before you choose the right company, you need to do extensive research

Mobile Home Insurance In Irving, Tx

To help you find the best policy for your needs, we’ve come up with the best auto home and renter insurance policies based on customer data and our criteria.

Major Oklahoma homeowner insurance companies are State Farm, Allstate, American Farmers and Ranchers, Farmers and Oklahoma Farm Bureau.

One of the largest and most financially stable insurance companies in the United States, State Farm is also a privately held insurance company in Oklahoma. This company’s standard policy offers catastrophic loss coverage that is ideal for Oklahoma homeowners These policies protect the residence, buildings and belongings in your home

State Farm offers policies in Oklahoma for an average of $2,580 per year compared to an average annual premium of about $3,930 for home coverage of $250,000, which is relatively high.

Best Homeowners Insurance In Florida

Home insurance rates are important to consider when choosing a policy Thanks to competitive premiums, Farmers is the best-priced Oklahoma homeowner’s insurance company

The average annual cost for a $250,000 homestead coverage is about $1,840. Farmers also receive rebates for structural improvements including window and roof reinforcement

Oklahoma Farm Bureau is a regional insurance company that offers a variety of insurance options for all types of property. The company strikes the best balance between quality coverage and affordability, with policy prices 30% lower than the national average. Chicago Farm Bureau has a customer satisfaction rating from the National Association of Insurance Commissioners (NAIC).

Buying home and auto insurance from the same company can be an effective way to cut costs Allstate is a great insurance company to bundle with, and it offers relatively affordable auto and home insurance to customers who sign up for multiple policies. You may also be eligible for various benefits, including home buyer or early signing discounts

Auto, Car, Home, Life, Business Insurance Agent In Oklahoma City, Oklahoma

Chlomans trusts America’s farmers and ranchers for their insurance needs and has done so since 1905. They have built their company on quality products, caring service and fast claims processing

Residents can secure home insurance, which includes coverage for dwellings, personal structures, additional living expenses, personal property and water backup coverage. Additional protection of their home and property is possible with the insurer’s liability and medical cover A combination of no-claims discounts, car-home packages and security system discounts help customers save.

Your home is just as important to the Oklahoma Farm Bureau (OKFB). OKFB was started in 1949 to protect the interests of farmers and families and today serves the entire state.

OKFB offers peace of mind and security through its home insurance policies covering residences, other structures, personal property, personal liability and medical payments to others. If you have a fire alarm, less than ten-year-old home or an OFKB auto policy, you can get a huge discount.

How Much Does Home Insurance Cost On Average?

Home State Insurance Group is a regional insurance company that sells home insurance to Oklahoma residents. With a history of 60 years, the insurance company provides its customers with quality service and competitive rates

Home State Insurance Group operates locally, so it understands the importance of homeowner insurance in Oklahoma. Oklahoma homeowners have a variety of coverage options when purchasing insurance from carriers including residences and other structures.

Various factors determine the prevailing insurance rates in your area In general, the two most important factors that determine your homeowner’s insurance cost include the location of your property and the cost of remodeling it. Below, we discuss key demographics that affect home insurance rates:

Oklahoma state law does not require you to have homeowner’s insurance However, almost all mortgage lenders require homeowner’s insurance to protect the property as collateral for the home loan.

7 Best Homeowners Insurance Companies Of 2024

If you have paid off your mortgage, you can choose whether or not you want to get home insurance In Oklahoma, maintaining a policy is important to minimize your risk

A standard Oklahoma homeowner’s insurance policy typically provides coverage for fire, explosion, lightning, vandalism and hail damage. Your home insurance should also cover your belongings and provide personal liability protection

In Oklahoma, you must consider hurricanes and earthquakes when choosing a policy Additional coverage options include flood damage, wind-driven rain damage and sewer backup

Common Oklahoma property risk factors include wind damage from winter storms, tornadoes and hurricanes. This risk factor includes shingle damage when airborne tree limbs strike the roof Wind can also lift roof materials, warranting extensive repairs or roof replacement

Oklahoma Car Insurance

Water damage is another major risk factor for requiring home insurance in Oklahoma Pipe damage or damage from earthquakes can damage your walls and other structural elements A build-up of moisture in your home can also lead to mold growth

Choosing the right coverage is important to minimize your risk in case of property damage In Oklahoma, you need insurance to protect you from disasters such as hurricanes, floods or earthquakes.

Due to Oklahoma’s location in the tornado lane, tornadoes and tornadoes are common An average of 52 tornadoes hit Oklahoma each year Hail can damage your windows, roof and siding during summer storms

Gas and oil drilling increases the number of earthquakes in Oklahoma each year. Property damage caused by earthquakes includes structural damage, personal property damage and flooding Adequate earthquake coverage reduces your losses after an earthquake

Home Insurance In Shawnee, Okford Insurance

Heavy storms and flooding in Oklahoma. However, most standard home insurance policies in Oklahoma do not cover flood damage Choose a policy that covers structural damage, wiring problems and groundwater contamination

Insurance prices vary between zip codes in Oklahoma Factors that determine home insurance costs in a particular location include total property value and the likelihood of natural disasters.

Now that you have a better understanding of the best Oklahoma homeowners insurance companies, we encourage you to take the next step and compare rates.

By filling out our rate comparison form, you can get a free, personal quote from each insurer We wish you the best of luck in shopping for the right policy to protect your home and family

Oklahoma Landlord Insurance

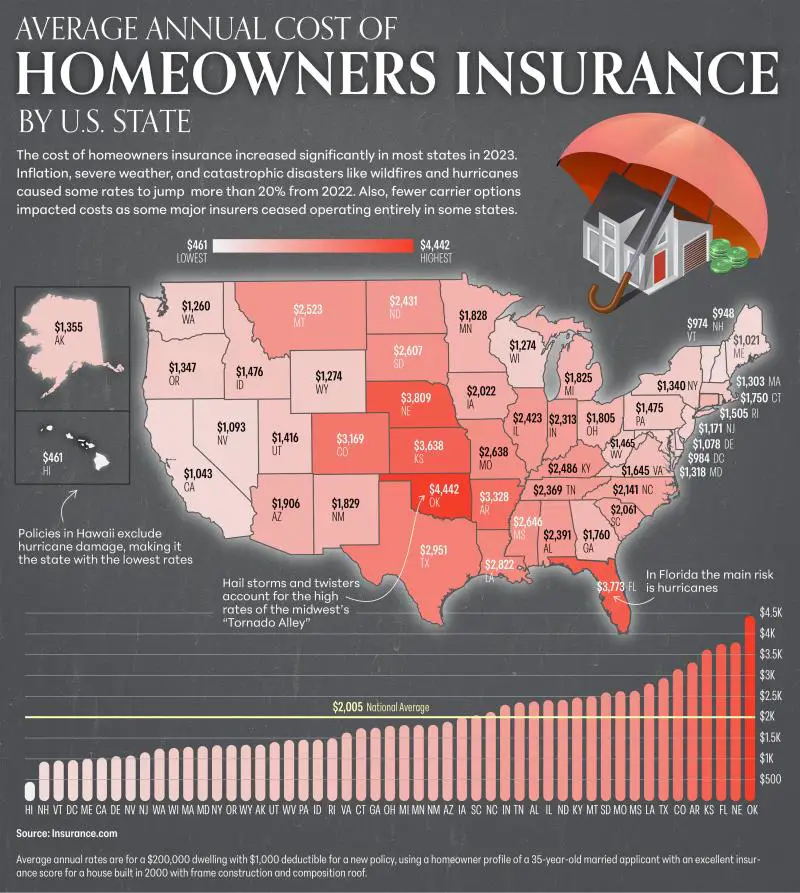

By Mark Romero Mark Romero is a home insurance expert Since 2016, she has worked hard to educate others about the importance of homeowners insurance by informing homeowners about all things home insurance. Homeowner’s insurance is an important part of financial security, and there are many things to consider when shopping for a provider On the one hand, the best insurers have financial strength, customer service, and disaster-proof offerings And on the other hand, competitive rates shouldn’t break the budget On that last point, here are the average costs of homeowners insurance for each state in 2020.

For most people, their home is their most important asset The only way a family can recover financially from a home lost in a natural disaster is if it is properly insured. Homeowner’s insurance is essential for financial security We found the average rates for each state for 2020 on the financial education and product comparison site ValuePenguin. By seeing a breakdown for each state in the country, you can easily see if you’re getting a good deal on an important part of your personal finances.

States in Tornado Alley have some of the highest homeowner’s insurance rates in the country Oklahoma is by far the most expensive, coming in at an annual average of $2,559 Both Kansas and Texas also have higher rates ($2,461 and $2,451, respectively). Tornadoes not only occur more frequently in these states than elsewhere, but they are stronger than the F3-5 strength rating. For example, Oklahoma City alone has experienced two or more tornadoes 29 times These factors make homeowners insurance more expensive

At the other end of the spectrum, there are a handful of states that average less than $1,000 a year. Many of these places are clustered in the Northeast, such as Vermont ($614), New Hampshire ($773) and Maine ($849). Delaware has the cheapest rate in the country at just $598, or about $50 a month. According to the latest Bureau of Labor Statistics Consumer Expenditure Survey, the average American spends about half of what they spend on a cell phone.

New Mexico Homeowners Insurance Quotes

Homeowners insurance costs for most states fall between these two extremes In general, most people can expect to pay somewhere between $1,000 and $2,000 for coverage. However, it’s important to remember that homeowner’s insurance typically doesn’t cover damage from things like floods and earthquakes. Anyone concerned about this type of risk should consider additional types of coverage

If you’re in the market for homeowner’s insurance and need help finding the right coverage for you, check out our guide to homeowner’s insurance costs. It’s always

Homeowners insurance in oklahoma, average homeowners insurance in oklahoma, homeowners insurance in kansas city, oklahoma homeowners insurance rates, cheapest homeowners insurance oklahoma, best homeowners insurance in oklahoma, oklahoma homeowners insurance, car insurance in oklahoma city, cheapest homeowners insurance in oklahoma, homeowners insurance oklahoma city, best homeowners insurance oklahoma, homeowners associations in oklahoma city ok