Penfed Credit Union Car Loan – PenFed has gone the extra mile by offering a competitive 0.45% APY (annual percentage yield) with the ability to withdraw money from multiple ATMs. With that in mind, PenFed is our auto loan service in this article, and we’ll walk you through the eligibility process, requirements, and all the other things that help a borrower make an informed financial decision.

You can take advantage of PenFed’s competitive rates if you have an excellent credit score of over 800, and whether you’re a PenFed member or not, you can take advantage of its financing products.

Penfed Credit Union Car Loan

PenFed offered its products to former and current government or military personnel and their family members. Fortunately, things have changed and now anyone can join PenFed, become a member to take advantage of discounts and take advantage of their financial solutions.

Penfed Credit Union Opens New Financial Center At Plaza Del Caribe Mall In Ponce, Puerto Rico

All you need is a savings account and a small deposit. But if you are a member of the military or have someone in your family who is or has been in the military, you will get better rates and interest.

PenFed offers multiple and flexible auto financing options for both new and used cars, with financing options at different interest rates depending on the loan amount. Before you proceed, tell us what benefits you will get from financing with PenFed:

You can choose from 41 different types of cars and many models. You can get PenFed to calculate your monthly payment, interest, and loan amount. All calculations are made based on your purchase price, down payment, annual income and other factors.

Before you get pre-eligible, you can check all brands and models on PenFed’s official website or mobile app. You can start by choosing the brand of the car. As we mentioned earlier, you can choose from a huge range of brands; then you will find all available models.

Best Auto Loan Rates Of December 2023

Compared to other sites, PenFed cannot customize your results if you want; it has no color filters, features and other details. However, for both new and used cars, you get a fair number of options that ensure you’ll find the perfect car for you.

The interest rate and total cost of the loan also depends on the make and model of the car you choose whether it is a new or used car. To help you decide, here is a cost estimate.

Step 3. If you have already selected your vehicle, apply online and give PenFed time to process your application.

Step 4. Visit your dealer, test drive the car, and if you like it, complete the purchase.

Best Credit Unions To Consider For Auto Loans

Short terms are always a good idea because you can take advantage of low APRs and a variety of car options. Long names can limit your choice of model year. As for PenFed, rates are available for all model years up to 60 months.

However, a period of 72 months is available in 2016 and new models, which may not be suitable for those who want to buy old cars.

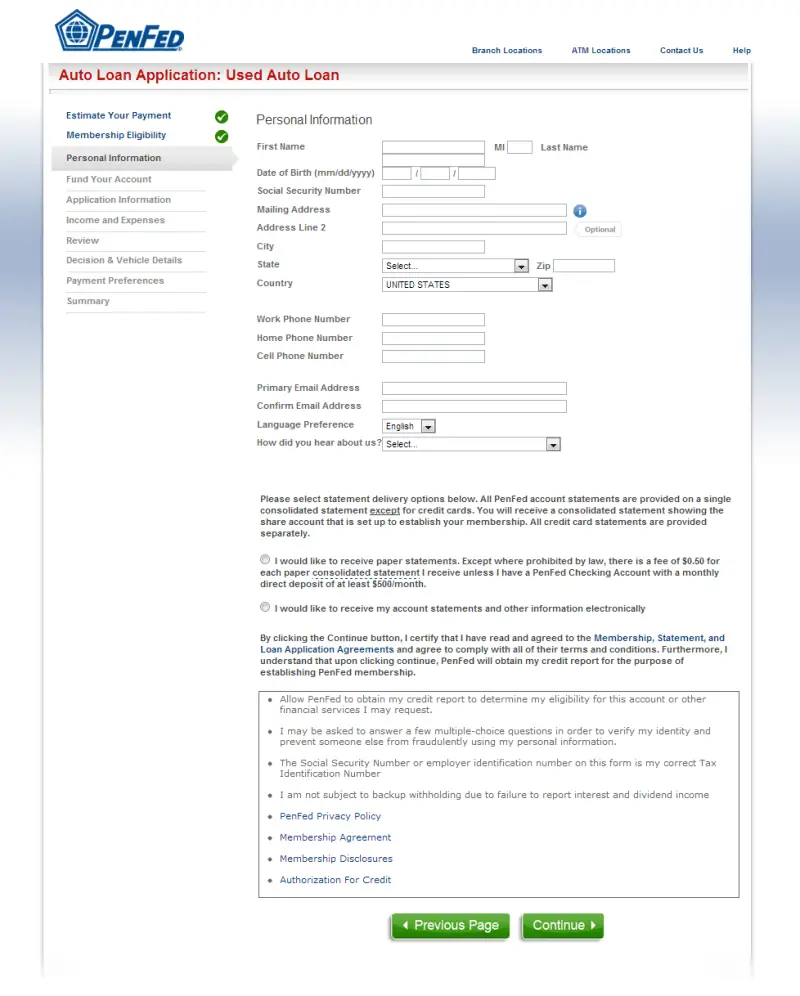

By filling out a very simple and short form with your basic information, residential information and income information, you won’t have to wait more than minutes to be pre-eligible. However, after filling the eligibility form, you need to apply for membership, which will not require much effort or time.

To set up a PenFed membership, you need to open a savings/stock account with a $5 in bank balance.

Holy Crap Penfed!!

When you click “Get Started” the site will ask you to log in with your username and password, but you don’t need to do this if you’re not a member yet, click “not a member yet”.

What’s next? After filling in the loan amount and term, you will need to provide basic information such as:

In the next steps, you will be asked to provide more information about your place of residence and annual/monthly income. In addition to employment status to get the most accurate rates and monthly payment estimates.

Yes, but you must be an active PenFed member for 60 days or more to receive discounts from certain manufacturers, including Audi, Jeep, PMW, Mercedes, Dodge, Volvo, Ram, Chrysler, Alfa Romeo, Mini and Fiat. For example, if you’re looking to buy a Jeep for $32,545 and you’re already a member, you can take advantage of the average savings ($4,040) and OEM bonus money ($1,000) by reducing the value of the vehicle to. ($27,535).

Can You Transfer A Personal Loan?

Buying online doesn’t mean you can’t get a test drive, many dealers allow delivery of your car, and when it’s delivered to your location, you choose to physically inspect it or drive it to make sure everything is in order beforehand. you complete your purchase.

PenFed offers many ways to protect and secure your vehicle. Before finalizing your purchase, a test drive can give you more confidence in your decision. However, you cannot get a guaranteed refund or refund through PenFed, but you can use a PenFed extended guarantee, GAP guarantee or debt protection.

Most car manufacturers offer a limited warranty, which is the best way to ensure a short period of time. However, when your limited warranty expires, nothing will guarantee the safety of your vehicle. PenFed offers stronger protection and an extended warranty.

As the name suggests, the GAP guarantee covers the difference (GAP amount) between the actual value of the car and the loan. For example, if the actual value of the car is $10,500 and the loan balance is $15,000, the GAP guarantee will reimburse you $4,500, which is $15,000 minus $10,500 of the actual value of the car. The GAP guarantee is offered for $499 and is available on both new and used cars, with a qualifying loan amount of $100,000 and a loan term of 84 months.

Best Auto Loan Rates & Lenders 2024

In the event that you are unable to make temporary payments for any reason, such as disability, unemployment or death, this option can give the borrower or his family time to repay the money. Depending on the plan, you can cancel between 6 and up to 12 payments.

In short, do we recommend PenFed? PenFed’s APRs are low compared to other lenders; allows you to apply online in minutes. Approval takes 48 hours, which means you don’t have to wait long, but you still have time to evaluate your options and decide if you want to finance with PenFed. So overall we recommend it.

Yes, it applies to all fifty states, except the District of Columbia, Guam, Puerto Rico, and Okinawa.

Yes, PenFed requires registration to become a member in order to receive any type of loan

Best Auto Loan Rates & Car Financing Of 2024

No, it doesn’t have a money-back guarantee, but it does offer a test drive so buyers can check the car’s performance and safety before signing the papers.

Yes, it has a simple and easy online application and a delivery option when the customer wants to get his car at the door.

You will need to provide basic information including your first, middle and last name, address, telephone number, email address, income information and residential information. The content is based on thorough research and analysis. Opinions are our own. We may receive a commission when you click or purchase from links on our site. Find out more.

Pentagon Federal Credit Union (PenFed) is a military credit union. However, they allow certain citizens to become members.

Penfed $250 Bonus For Auto Loan Refinance

Like other credit unions that earn money from interest and principal loan amounts, this financial institution takes the money it earns and offers special discounts and rebates to its PenFed members.

Penfed Credit Union serves the military and provides financial services (credit cards, savings and checking accounts, and a variety of loans) to service members experiencing hardship or working from home.

These paper and online applications are available to existing members and potential members as long as they meet certain financial product requirements.

After you have selected your loan type (personal loan, used car loan, new car loan, and mortgage loan), click “Apply Now” on the car loan page on their website.

Penfed Approved Car Loan But Declined Credit Card,…

If you are already a member, you can log in and it will help you fill in the information you already know.

Fill out the loan application with the required loan amount, valid social security number, income and contact information. PenFed allows you to borrow up to 110% of the purchase price of your new or used car.

If you’ve been a PenFed member for at least 90 days, you can get pre-approved loan rates before you start negotiating a loan.

PenFed loans are protected by the National Credit Union Administration, which is similar to the FDIC that provides loans to banks.

Penfed Credit Union To Close Fremont Branch

The amount you can be approved for will depend on your credit history and income, but the minimum loan amount is $500 and the maximum is $100,000.

PenFed has one of the lowest interest rates compared to other car loans

Penfed credit union loan rates, penfed credit union car loan rates, penfed credit union loan reviews, penfed credit union boat loan, penfed credit union heloc, penfed credit union mortgage, penfed credit union refinance car loan, penfed credit union personal loan, penfed credit union auto loan, penfed credit union car loan reviews, penfed credit union new car loan rates, penfed credit union loan