Penfed Credit Union Auto Loan Rates – Many of the offers that appear on this site are from advertisers that appear on this website and are paid to be listed here. This fee may affect how and where products appear on this site (for example, the order in which they appear). These offers do not represent all deposit, cash, loan or credit products available.

Pentagon Federal Credit Union offers military and government employees an easy and fast solution for car payments. While Penfed currently serves more than 1 million members from the Army, Air Force, Coast Guard, Department of Defense and other government agencies, anyone can participate as long as they meet the following eligibility requirements:

Penfed Credit Union Auto Loan Rates

Like banks, credit unions accept deposits, make loans, and offer a variety of financial products. However, credit unions are operated by members who control the operations of the financial institution. Credit unions often offer the lowest rates and rates for credit cards and loans; This makes Pentagon Federal Credit Union a good choice for car loans. Additionally, if you apply for a PenFed car loan online, you can take advantage of online-only promotional rates.

Penfed Affiliate Program: Everything You Need To Know (2024)

If you are negotiating a car loan, you can work directly with the dealer and get the loan through their finance department. However, working with a dealer does not guarantee the best car loan rates and terms. Since credit unions often offer low rates on new car purchases, a PenFed car loan may be your best option.

Penfed members and eligible to apply for car loans online:

To illustrate the savings, members donating a $15,000 car for 60 months pay a monthly premium of $259. Online-only promotion rules are subject to credit approval. Even though the interest rate is higher for 72 months loan, the interest rate remains cheaper than the interest rate offered by most banks. A 75-month PenFed Fire Loan requires a 15 percent down payment.

Pentagon Federal Credit Union doesn’t just offer new car loans. Credit unions offer incredible rates when buying a used car. Apply online for a Penfed used vehicle loan and you may be eligible for:

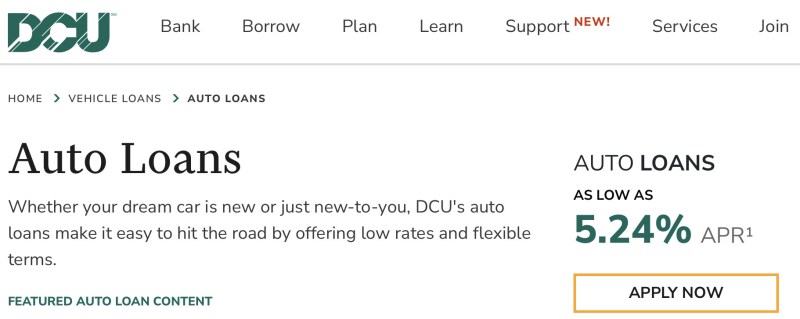

Dcu 65 Month Auto Loan Rate Increased From 1.49% To 1.99% To 2.24% To 2.74% To 3.24% To 3.99% To 4.49% To 5.24%

As with new vehicle loans, this upgrade rate is subject to credit approval. However, this badge is valid on all model year vehicles with a price tag up to $70,000. Restrictions apply. For example, a used car’s mileage cannot exceed 125,000.

Did you get money from a dealer or other bank? Through PenFed’s auto loan refinancing program, you can refinance your existing auto loan and lower your loan interest rate.

What does it really mean? A lower interest rate can lower your monthly auto loan payment and free up money for other purposes. You can pay off your debt or increase your savings. Device support features include:

You certainly have options when it comes to car financing. But if you can get the lowest rate and save on your monthly car payment, why not apply for a PenFed auto loan?

New Penfed Service Provides Members With Auto Loan Term

If you are a member of Pentagon Federal Credit Union and are eligible to become a member, apply online today. You can get an instant price quote that will bring you one step closer to a new vehicle. If you have an existing car loan, paying off the loan opens the door to better terms and cheaper payments.

Dave Ramsey: Your Cars, Trucks, Boats, and Motorcycles Shouldn’t Be Worth More Than Half Your Annual Salary – Here’s

Get advice on how to achieve your financial goals and stay up to date on the most important financial issues of the day.

By clicking ‘Sign Up Now’ you agree to our Terms of Use and Privacy Policy. You can click the ‘Unsubscribe’ link in the email at any time. Founded in 1935 and headquartered in Tysons, Virginia, Pentagon Federal Credit Union (PenFed) is the nation’s second largest credit union. As of April 28, 2023, its assets were over $35 billion.

Best Auto Loan Rates & Car Finance Lenders (2024 Guide)

Currently, PenFed serves more than 2.9 million members worldwide and offers a variety of financial products and services, including certificates of deposit (the credit union equivalent of certificates of deposit), checking accounts, credit cards, personal loans, loans, vehicle loans, student are Debt, Debt and. more.

PenFed has more than 50 branches nationwide and is affiliated with Allpoint, the country’s largest ATM network. In the past, membership was limited to those with ties to the US government or military, but membership is now open to all.

PenFed offers several deposit accounts to help its members achieve their financial goals, including multiple checking, savings and stock accounts, as well as money market accounts.

PenFed members have a variety of checking account options, including a free checking account option. The credit union also offers an initial savings (share) account, which is required to start membership.

Save Money By Refinancing Your Student Loans

In addition to the above savings account options, Penfed also offers a high yield savings account to increase member’s income.

For members who want to get higher returns by keeping their money on deposit for a longer period of time, PenFed offers various certificates at rates matching the best CD rates offered by banks.

Note that withdrawals from PenFed stock before maturity will incur a penalty. If you use the certificate within the first year, all rewards will be waived. After the first year but before the maturity date, the first withdrawal penalty is 30% of the amount you earned if you held the CD at maturity (not to exceed the total amount earned).

Customers can access a powerful online banking platform through PenFed’s mobile app, which has 4.2 stars on the Apple Store and 3.9 stars on Google Play.

Penfed Credit Union Auto Refinance Review

If you need to contact a PenFed representative, you can call 724-4PENFED or 1-800-247-5626. Representatives are available Monday through Friday from 7 am to 11 pm ET, Saturday from 8 am to 11 pm ET and Sunday from 9 am to 5:30 pm ET.

You can also fill out an online form to schedule a call or get support from an online representative. The credit union also offers a chat facility that allows you to get answers to your questions or connect with a representative if needed.

If you are considering becoming a member of PenFed, there are some pros and cons that you should consider first.

Yes, PenFed is the second largest credit union serving nearly 3 million members worldwide and deposits are insured by the National Credit Union Administration (NCUA).

Best Auto Loan Rates Of April 2024

Creditworthiness depends on many factors including creditworthiness. To receive a loan, you must be a member of PedFed.

Editorial team. Links in this article may earn us a commission. learn more

Private party auto loans, which finance the sale of cars between individuals, typically have higher interest rates than buying from a dealer.

Written by: Daniel Robinson Written by: Daniel Robinson Author Daniel is a writer for the Guides team, specializing in automotive finance and automotive repair for numerous automotive news sites and advertising firms in the US, UK and Australia. Daniel is the point man on the executive team for auto insurance, loans, warranty options, vehicle services and more.

Pentagon Federal Credit Union (penfed)

Edited by Rashawn Mitchner: Rashawn Mitchner Editor-in-Chief Rashawn Mitchner is a Guide staff editor with more than 10 years of experience covering finance and insurance.

You can get more from a car through a private sale, but if you want to finance your purchase, you’ll need to find a lender that offers private party auto loans. We at the Guides team will explore what private car loans are, where you can get them and what you need to know before paying off your car loan.

We’ll take a deep dive into the market to find out which lenders offer private party car loans and which ones offer the best car loan rates and services.

Auto Loan Refinancing Best 72 Month Auto Loan Rates Can I refinance my mortgage and auto loan at the same time? Car Loan Calculator Best Auto Refinance Rates How To Pay Off Your Loan Fast Should I Pay Off My Car Loan Fast? The Complete Auto Loan Glossary: Terms You Need to Know (Guide)

What Is The Average Car Loan Interest Rate?

Highlights Work with a personal loan officer to compare options with average monthly savings of $150 A+ BBB rating

0% Down on Select Cars, Trucks, & SUVs Free Online Quotes – Get Cars Direct Target Price Today Local dealers compete to offer the best prices on new cars.

Highlights No application fee Lending is a platform that interacts with banks Approval and loan terms depend on many different factors including education and employment.

All APR statistics were last updated on 03/16/2024. Please check the partner site for the latest information. Rates may vary based on credit score, credit history and term of the loan.

Penfed Credit Union Auto Loans Review 2024

The team of guides is dedicated to providing you with reliable information to help you make the best decision regarding your vehicle financing. Because our customers trust us to provide objective and accurate information, we have developed a comprehensive rating system to create a ranking of the best auto loan companies. We collected data

Penfed credit union rates, penfed credit union auto loan, penfed credit union va loan rates, penfed used car loan rates, penfed credit union auto rates, penfed credit union cd rates, penfed credit union mortgage rates, penfed credit union savings rates, credit union loan rates, penfed credit union loan rates, penfed credit union car loan rates, penfed credit union new car loan rates