Navy Federal Credit Union Cd Rates Today – Many of the offers displayed on this website are from advertisers and this website has been compensated for being listed here. This compensation may affect how and where the products are displayed on this website (including, for example, the order in which they are displayed). These offers do not represent all available deposit, investment, loan or credit products.

Navy Federal Credit Union offers a wide variety of branches and ATMs, as well as many financial products and services, including loans, checking accounts, savings accounts, credit cards and certificates of deposit.

Navy Federal Credit Union Cd Rates Today

Navy Federal has several CD options to choose from, with terms ranging from three months to seven years. You can open one with as little as $50. Navy Federal CD dividends are compounded daily and monthly, and early withdrawal penalties apply, depending on the period. Here’s a look at the different types of CDs that Navy Federal offers.

Navy Federal Huntington Beach, Ca

Navy Federal offers tiered pricing for its standard certificates depending on your initial deposit and duration. The rates in the table below are divided according to the minimum deposit required. Savings accounts with larger deposits often benefit from slightly higher rates.

Because of Navy Federal’s excellent CD rates, anyone who is eligible for membership may wish to open a Navy Federal CD. Flexible options make it fit. Those who already have money in savings may need a standard certificate. These are good if you know you don’t need immediate access to money.

EasyStart certificates may be suitable for individuals looking to build up their savings. These CDs allow you to start with a minimum deposit and add money at any time. This gives you the opportunity to benefit from good interest rates while increasing your savings.

You’d like to know how to avoid early withdrawal penalties, but if you’re trying to keep your savings in a savings account, an EasyStart certificate could be the incentive for you to start accumulating savings. For example, if you have a large purchase goal in mind, you can open a CD with the length in mind. This will help prevent you from accidentally spending your savings on your way to a big goal.

Pre Qualify Not Accurate!

CDs are risk-free—you can’t lose your money—so they’re a good choice for anyone approaching or retiring who wants to avoid market volatility. The interest you earn on a CD cannot exceed the rate of inflation. The result is less purchasing power as the CD matures. But a CD is definitely better than letting the money gather dust in a traditional savings account.

In addition to offering CDs, Navy Federal is a full-service credit union with many benefits to offer members. If you decide to join, you may be able to solve all your banking needs in one place.

Those who do not meet the criteria for Navy Federal membership will not be able to open a CD with the credit union. Also, those who prefer personal access but don’t live near a branch should look elsewhere. You can cover other top CD prices with .

Another group of people who may want to pass are those who expect to have immediate access to money. CDs are intended for long-term savings, which is why they have withdrawal penalties. You can work the withdrawal fee through the CD ladder so that the maturity date varies from one to another. That way you have a full CD right away so you can withdraw money as needed.

Online Banking Guidance

If you might need the money before the due date, a CD is usually not a good idea. Instead, you can find a better fit through a high-yield savings account. High-yield savings accounts offer a rewarding way to grow your money without giving up regular access.

Before you can open a Navy Federal CD, you must join a credit union. You can join online, by phone or in person at a branch. Here’s what you need:

The credit union requires you to open a member savings account with a minimum balance of at least $5. Once you’ve joined Navy Federal, you can open a CD online, through the Navy Federal mobile app or by visiting a branch. You can also add money to eligible CDs through these methods.

When you have a Navy Federal CD, you will be notified before it expires. Unless Navy Federal receives instructions from you to the contrary, the CD will automatically renew on the same terms. You can update without penalty up to 21 days after your big CD. If you want to withdraw your money after maturity, make sure you do it before the deadline expires. Otherwise, you may face an early withdrawal penalty.

Navy Federal Credit Union Nrewards Secured Credit Card Review

If you’re looking for a new CD account, Navy Federal is worth a look. It offers CDs from three months to seven years with reasonable opening deposits. Rates are competitive, and deposits are insured by the National Credit Union Administration.

Prices are subject to change; Unless otherwise stated, the prices will be updated in stages. All other information on the account is correct as of 22 December 2023.

Editor’s Note: This content is not provided by any of the entities covered in this article. Any opinions, analyses, reviews, assessments or recommendations expressed in this article are solely those of the author and have not been reviewed, endorsed or approved by the entities mentioned in this article.

Get advice on how to reach your financial goals and keep up to date with financial news.

Newest Navy Federal Promotions, Bonuses, Offers And Coupons: April 2024

By clicking the “Order now” button, you agree to our terms of use and privacy policy. You can click the “unsubscribe” link in the email at any time. By clicking “Accept all cookies” you agree to store cookies on your device to improve website navigation, analyze website usage and assist with our marketing efforts.

Navy Federal Credit Union, founded in 1933, is a not-for-profit credit union open to current and retired members of the armed forces from all branches of the armed forces, their families and their families. Members of this federal credit union have access to many financial products and services, including stock certificates similar to certificates of deposit (CDs) available at traditional and online banks.

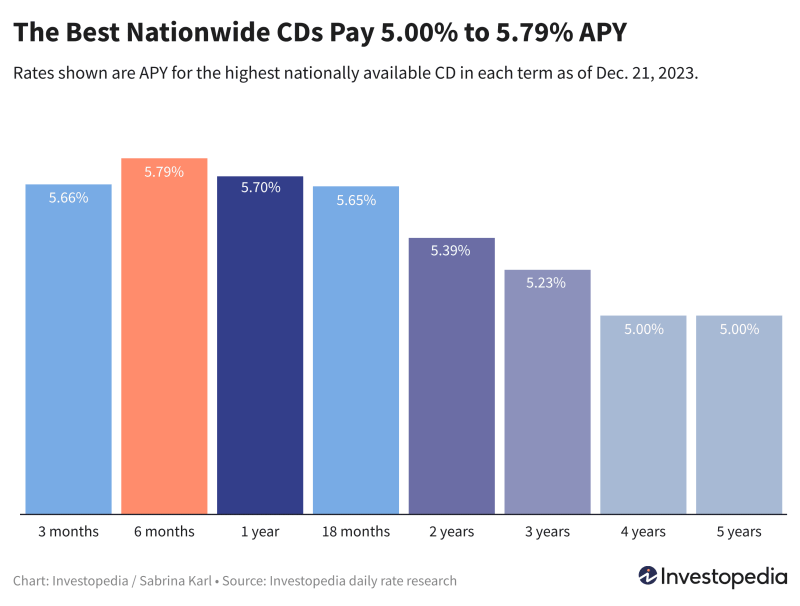

The Federal Navy CD rate is higher than the national average. And members can make use of many types of share certificates with terms from three months to seven years, depending on the savings goal; All NFCU CDs come with National Credit Union Administration (NCUA) backing of up to $250,000.

The APYs listed below are current as of the publication date of this article. We review CD prices every two weeks and update the information below accordingly.

Certificate Maturing? Know Your Options

Knowing that Navy Federal’s CD rate is above average is a good place to start if you’re considering an equity certificate. But the interest you can earn on your savings isn’t the only detail that matters when choosing a CD. Therefore, it is important to research the other important features that Navy Federal Share Certificates have to offer before opening a new account.

All Federal Navy Stock Certificates have minimum deposit requirements that you must meet. These requirements range from $50 to $100,000, depending on the type of CD you want to open (and the annual percentage return you hope to earn from the credit union in exchange for your deposit). With the credit union’s short-term and long-term certificates, deposits of $100,000 or more can help you earn a slightly higher APY on your savings (depending on the current exchange rate).

Like traditional CDs, when you deposit money into a certificate of deposit at Navy Federal Credit Union, you agree to leave the money in the account for a certain period of time. If you decide to withdraw your money before your shares mature, you will have to pay an early withdrawal penalty. However, it is worth noting that the withdrawal penalties from Navy Federal are not as high as you may find elsewhere.

Loss of interest on the amount withdrawn (for 90-180 days, depending on the term of the CD, or from the date of purchase or renewal – whichever is less)

Navy Federal Credit Union Review 2024

Loss of interest on the amount withdrawn (for 180-365 days, depending on the term of the CD, or from the date of purchase or renewal – whichever is less)

Navy Federal Credit Union is a full-service credit union serving military members, veterans and their families. Founded during the Great Depression, the nonprofit federal credit union has grown from a for-profit startup to become the largest credit union in the world with more than 12 million members.

Because Navy Federal is a credit union and not a bank, you must be a member before you can open a stock certificate or other financial account. Navy Federal has stricter membership requirements than some other credit unions.

It is also worth noting that NFCU has a small branch network. Despite its large membership, Navy Federal only has about 350 branches worldwide.

Navy Federal Credit Union Personal Loans Review

On the plus side, federal credit unions are known for offering competitive interest rates to their members. Not only can you get a higher-than-average APY on CDs from Navy Federal Credit Union,

Navy federal credit union ira cd rates, best cd rates navy federal credit union, navy federal union cd rates, navy federal credit union bank cd rates, us navy federal credit union cd rates, navy federal credit union jumbo cd rates, navy federal credit union special cd rates, navy army federal credit union cd rates, navy federal credit union current cd rates, navy federal credit union cd rates now, navy federal credit union cd interest rates, navy federal credit union cd rates