Clay County Property Tax Receipt – Johnson County Md Personal Property Tax Receipt. Not getting a tax bill. Web Missouri has two ways to obtain a copy of your property tax receipt.

Account number 700280; Webb has special tax districts such as school districts and fire districts. An online tax receipt will be accepted by the Missouri Department of Revenue License Office when issuing your vehicle license.

Clay County Property Tax Receipt

Webb serves as both county officer and treasurer of the Johnson County Property Tax Department. Johnson County tax records are documents related to property taxes, employment taxes, goods and services taxes, and various other documents. Receipt of property tax. Webb serves as both county officer and treasurer of the Johnson County Property Tax Department.

Florida Property Tax

Personal Property Tax Receipts Johnson County Mo – Jefferson city, MO 65101 Phone: Web Personal property is appraised (assessed) annually by the assessor’s office. Johnson County Md Personal Property Tax Receipt.

Johnson County Mo Personal Property Tax Receipt – You can go to your local collector’s office or get one online. You can pay personal and property taxes by check, but be sure to add them correctly and pay the correct amount. Johnson County Md Personal Property Tax Receipt.

Johnson County Mo Property Tax Receipt – Account Number 700280; Total personal property taxes generally amount to $5 to $10 per person. Johnson County Md Personal Property Tax Receipt.

Johnson County Mo Personal Property Tax Receipts – Web Appraiser Aerial Maps, Tax Exempt, Personal & Real Estate Appraisals, Plat Books. The network will provide you with instant receipts to ensure they remain open. Johnson County Md Personal Property Tax Receipt.

Form Of Purchase And Sale Agreement With Big Acquisitions Llc

Personal Property Tax Receipt, Johnson County, Mo – Enter your check number for quick reference. Web Account Number or Address: Johnson County Md Personal Property Tax Receipt.

Personal Property Tax Receipt, Johnson County Mo – If you are assessed in Jackson County and have paid taxes for the past two years, Louis Assessor, if you did not own or owned personal property on January 1st. Johnson County Mo Personal Property Tax Receipt. Quitclaim Deed is a legal document issued by the Clerk of Court and Comptroller’s Office – Clay County, Florida – a public agency operating in Florida. The form can only be used in Clay County.

Answer: A quitclaim deed is a legal document used to transfer an interest in property from one party to another.

Answer: The purpose of a quitclaim deed is to transfer title or interest in property without giving any warranty as to the property’s title or condition.

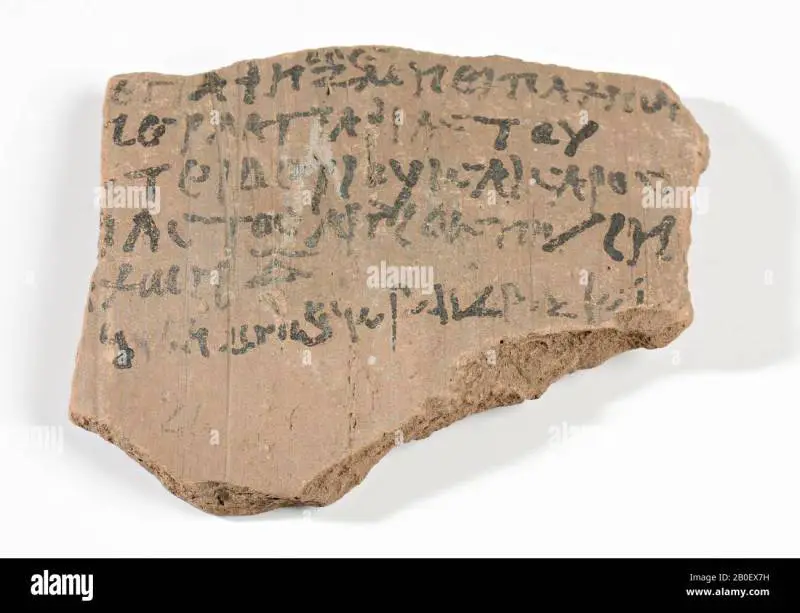

Tax Roman Hi Res Stock Photography And Images

Answer: Whoever has an interest in property ownership can use a quitclaim deed to transfer that interest to another party.

Answer: Yes, using a withdrawal claim is not guaranteed, so it is important that you fully understand the risks and consequences before using it.

Answer: You can obtain a quitclaim deed form from the Clerk of Circuit Court in Clay County, Florida or consult a real estate attorney to assist you in the process.

Download a fillable version of the form by clicking the link below or view more documents and templates from the Clerk of Courts and Comptroller’s Office – Clay County, Florida.

Personal Property Tax Receipt Johnson County Mo At Marie Molina Blog

End Claim Deed Form Clerk of Court and Controller’s Office – Clay County Florida Transfer of Property Form Real Estate Ownership Transfer of Property Form Real Estate Template Florida Legal Forms United States Legal Forms

Jackson county property tax receipt, personal property tax receipt, property tax receipt, receipt of property tax, clay county property tax, clay county personal property receipt, travis county property tax receipt, clay county tax receipt, property tax payment receipt, property tax online receipt, property tax paid receipt, clay county missouri personal property tax receipt