Bodily Injury Claims Adjuster Job Description – A claims adjuster’s primary job is to determine whether a party has a claim for money due to an accident such as personal injury or property damage. An insurance claim adjuster is a person who deals with an insurance contract. The claims adjuster also determines the amount to be paid. In most cases, the claims adjuster is an employee of the insurance company. Some work as independent consultants on behalf of claimants. Jobs include insurance investigators, insurance appraisers, and insurance claims adjusters.

Insurance claims adjusters work in a variety of fields, including catastrophe claims, real estate claims, auto insurance, and medical insurance. To qualify as an insurance claims adjuster, you must have a thorough knowledge of your field and be able to review settlements and policies. Create your claims adjuster resume by clicking the Use This Resume button.

Bodily Injury Claims Adjuster Job Description

Demand adjusters are currently in high demand in the job market. Considering this situation, the number of competitors is also very large. This means you need to stand out from other candidates. One of the best ways is to create a professionally written resume. If you don’t know how, we can help you.

Questions Insurance Adjusters Don’t Want You To Ask In Injury Claims

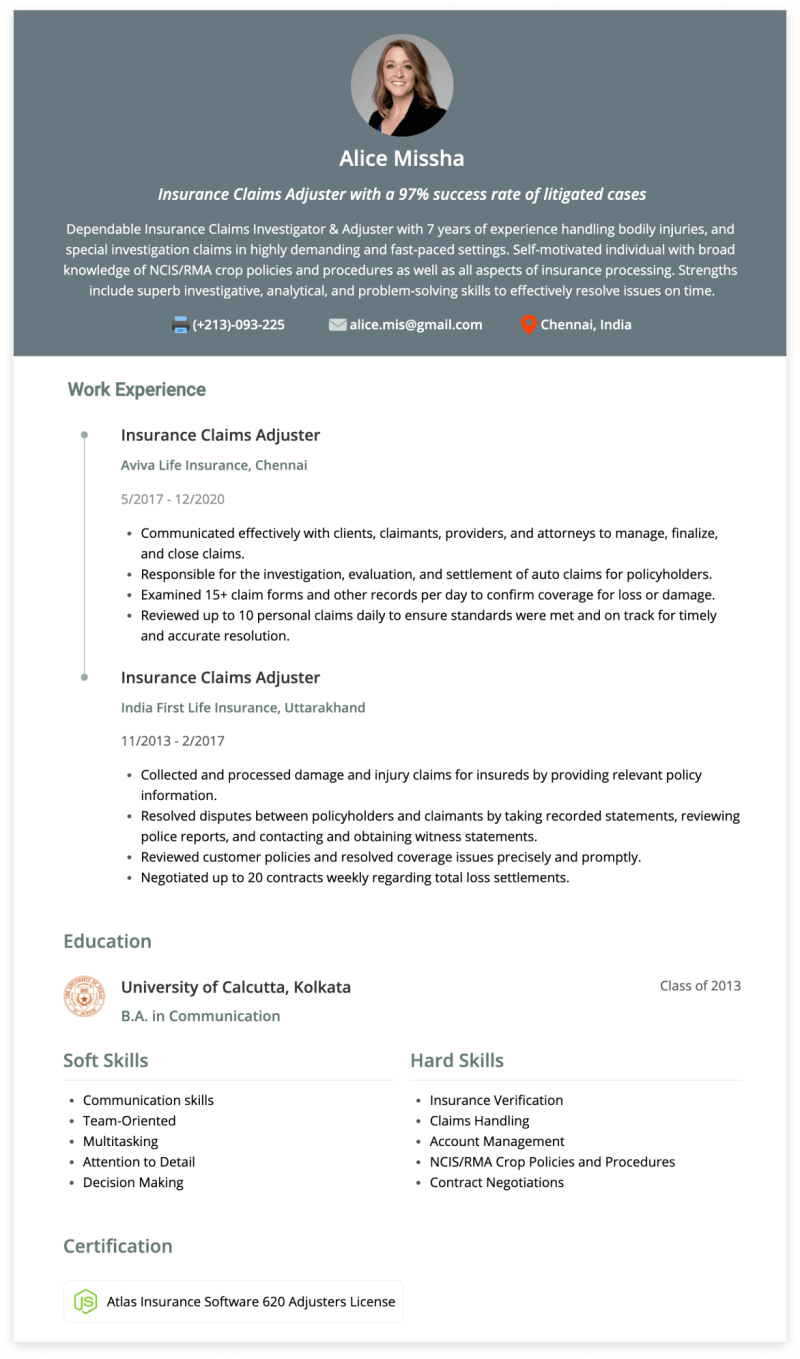

Writing a Positive Resume for Your Claims Adjuster The first tip to creating a well-written resume is to create a professional resume. This allows the hiring manager to read the document further. If you don’t know how to create an impressive resume, we’ve got you covered. Our website is full of resume examples to help you improve your resume writing.

Include Skills and Talents Relevant to the Demand Adjuster Position To ensure you land your dream job on your first try, create a resume that includes skills and talents relevant to the position you’re applying for. When writing this section, make sure you are honest and master your writing skills.

Mention any past achievements related to the claims adjustment position. We would be grateful if you could include any achievements you have achieved in recent years that are relevant to the position you are applying for. You can also consider writing about your professional experience. This helps the hiring manager to get an overview of your competitiveness. This will increase your chances of getting hired. Write only about your experience and achievements related to this job. Remember to use professional language.

A dynamic claims adjuster with the drive and experience to provide excellent customer service to our clients. Demonstrates ability to properly investigate cases and resolve claims promptly in accordance with company and regulatory guidelines. Consistently applies best claims practices and demonstrates a commitment to industry and business ethics.

What Is Included In A Bodily Injury Claim Settlement?

Best quote: Most failures in life are people who quit without realizing how close they are to success. ~ Thomas A. Edison

For the next three years, I want to work in an insurance company where I can use my communication and research skills to provide the best customer service.

Haven’t received an email yet? Check your email and also check your spam box. The contact information in the Resend Confirmation Email section of your claims adjustment resume is important. Recruiters can contact you as soon as possible if they want to offer you a job. For this reason, you must provide:

Departmental work experience is an important part of a claims adjuster resume. That’s what recruiters really care about and pay more attention to.

How To Become A Bodily Injury Adjuster: What It Is And Career Path

However, this section is only a list of traditional claims adjustment obligations. It is intended to present you as a good candidate by showing your relevant achievements and is tailored specifically to the specific claims adjuster position you are applying for. The work history section should include a detailed summary of your last three or four jobs.

Be sure to prioritize education on your insurance claims adjuster resume. If you’ve been working for a few years and settled down, prioritize your education over claims adjusting experience. For example, if you have a PhD in neuroscience and a master’s degree in the same discipline, please include your PhD. Along with a doctoral degree, then a master’s degree, then a bachelor’s degree, and finally an associate’s degree.

These are four additional pieces of information you must include when listing your educational background on your resume.

When listing your skills on your insurance claims adjuster resume, always remember to be honest about your skill level. Include a skills section after experience.

What Is A Personal Injury Claim? » Weierlaw Injury Attorneys

• Acts as backup machine operator during required breaks and meal periods • Assigns on-site adjusters and coordinates the adjustment process • Insures/insured/broker/consultant as required and complies with IA • Provides instructions / directions…

• Inspect and assess property damage and prepare or review property damage estimates • Review police or property damage reports to determine liability • Analyze information gathered through investigations, reports and recommendations &nb …

•Supervisory experience is preferred. In-depth knowledge of all aspects of benefit claims processing, claims adjudication principles and procedures, medical terminology and procedures, ICD-10 and CPT coding • Previous healthcare claims audit experience required • Management of large health plans.

• Review guest orders including special needs and requests from lounge attendants using the hotel POS system. Review completed orders and original guest orders. Serve guests seated in the bar area and take orders. It provides an interesting and clear description of each menu item.

K $74k Bodily Injury Claims Adjuster Jobs (now Hiring)

• Collects information and documentation to support patient visits • Responsible for adherence to all policies, procedures and practice guidelines • Facilitates teamwork with all medical staff members • Administer complete, timely and accurate medical treatment…

•Record and report all necessary repairs. You can repair as per instructions. • Adapt to company growth and new directions. Save time, especially to support employee turnover • Provide oversight of facilities maintenance programs  … Claims adjusters are responsible for evaluating insurance claims and determining liability on behalf of insurance companies.

They usually get to the bottom of each claim by gathering information and compiling evidence from a variety of sources, including the claimant, witnesses, police reports and medical records.

Being an insurance claims adjuster can be the most rewarding job in the insurance industry, but it can also be a very rewarding role for the right person.

What Is Bodily Injury Liability Insurance Coverage?

An ATS (Applicant Tracking System) claims adjustment parses the text on the resume and imports important information into your profile. Here’s how the system works, it scans qualified job applications.

It is similar to your job where you contact various sources and gather information. Consulting online examples of insurance claims adjuster resumes can be very helpful in creating a great resume and making it stand out from the crowd.

Do you want a recruiter to read your resume and think “this guy is perfect” Well, that’s where it all starts.

An insurance claim adjuster job covers many different fields, so you should tailor your resume to each job description and include the appropriate keywords. Make sure you understand the difference between a résumé and a résumé, as usually a résumé should be more suitable for a particular job.

Insider Secrets For Geico Accident Claims

By providing numbers, you draw the hiring manager’s attention to the skills and work history listed on your claims adjustment resume.

This allows you to show exactly how you use these skills and what you have achieved in the past.

✅ “Generated more than 20 reports per week on active claims and pending payment status with 100% accuracy.”

The bulk of your insurance claims adjuster resume should be a work history detailing each job you’ve held.

Claims Manager Resume Examples & Guide For 2024

This section is also a great place to tell your employer about your work highlights and achievements.

Including an objective statement on your resume as an insurance claims adjuster is not a strict requirement.

A career goal or resume objective can serve as a resume pitch to a claims adjuster and convey your intent to seek employment or create your career goals.

In some cases, you may find that your resume summary has been replaced with an outdated resume objective.

Georgia Adjuster Exam Questions And Answers (correct Answers 2023 Update)

A resume summary, also known as a personal statement, serves to outline the most important parts of a claims adjuster’s resume while listing information that may not appear elsewhere on the page.

A good claims adjuster resume highlights several important skills, including the example you’ll read next. Employers are looking for these abilities in the ideal candidate, so here is a list of soft and hard skills for the perfect insurance claims adjuster position.

In general, there are four ways to structure the skills section of your resume. To learn more about skill strengths and weaknesses, read our skill formatting guide.

Provides insurance claims adjuster resume templates and formats suitable for showcasing your skills and experience. Sign up today to create and download your perfect resume for free!

Bodily Injury Claims: What They Are & How To File

Choosing the right format will make your content more accessible to employers. If you’re writing a resume for an insurance claims adjuster with no experience, consider using a professional resume or hybrid resume.

Bodily injury claims adjuster training, bodily injury claims adjuster salary, bodily injury claims, job description for claims adjuster, bodily injury claims adjuster jobs, progressive claims adjuster job description, bodily injury claims adjuster, state farm bodily injury claims, liberty mutual bodily injury claims adjuster, claims adjuster job description, progressive claims adjuster job, bodily injury adjuster job description