Is Motorcycle Insurance Mandatory In Florida – The risk of injury when riding a motorcycle is much higher than other types of vehicle. For example, the National Highway Traffic Safety Administration (NHTSA) reported that approximately 5,014 motorcyclists died in motor vehicle crashes in 2019. Based on these numbers and other research, the ratio of motorcycle fatalities per 100 million miles traveled was 25.96. For reference, Other cars have a death rate of 1.42 for every 100 million miles.

If you are lucky enough to survive a motorcycle accident; You have huge medical bills to pay. Liability and can claim compensation. Very suitable for those who do not have motorcycle insurance. However, most people do not insure their motorcycles in the same way they insure other vehicles. Why? OK Depending on where you live, you may not need to. Some would rather take the risk than pay additional premiums.

Is Motorcycle Insurance Mandatory In Florida

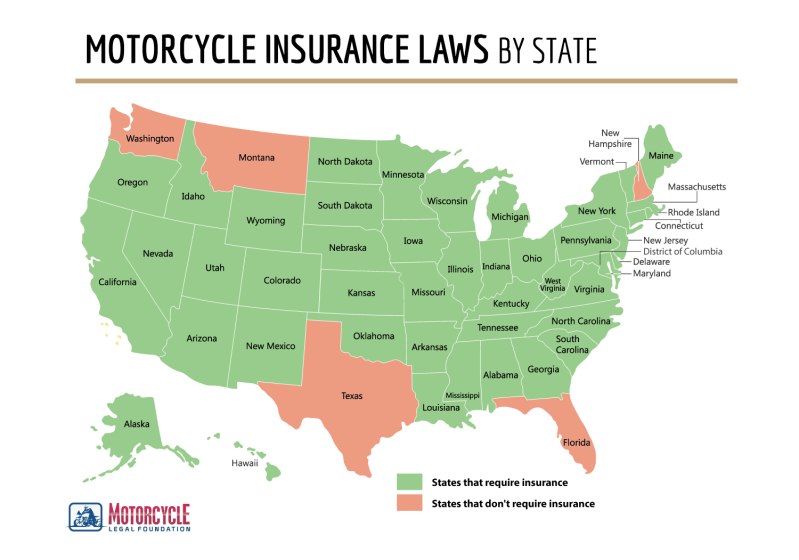

Currently, Florida New Hampshire Washington and Montana are the only states that do not require motorcycle insurance to ride a motorcycle. However, uninsured drivers still have legal penalties that drivers can face if caught without insurance in neighboring countries. Florida law does not require auto insurance, but getting a policy is still a very smart decision.

Florida Commercial Driver License Requirements

If there is an accident, you are responsible for the costs after the damage. Losses as a result of motorcycle accidents can reach hundreds of thousands. However, if you have insurance after an accident, you can prove your financial responsibility and get financial assistance for damages.

Motorcycle insurance is similar to car insurance and the coverage you get depends on your policy. Motorcycles are more prone to collisions. Completeness of liability Or they can choose to get full coverage on the motorcycle.

Collision: Collision coverage will pay for repairs that are necessary after an accident. No collision coverage. You must pay the full amount to renew the bike. Also, let’s say your bike gets into an accident. In that case, Collision Coverage can give you a value check that you can use to buy a new bike.

Comprehensive: Comprehensive coverage designed to pay off incidental financial obligations. Some examples are theft, destruction by natural disasters; Fallen trees including broken glass and so on.

How Much Is Car Insurance In Florida? (2024)

Liability: Like car insurance, Liability will pay some of the costs associated with an accident. This coverage applies to damage to other people or their property caused by your negligence or fault. Additionally, liability often ranges from the cost of repairing damages to medical expenses. The exact amount of cover you get is based on the specific policy you choose.

Full coverage: Full coverage covers collisions; It combines integrity and responsibility. With full coverage. You can be sure that your insurance will protect you in any situation. It is recommended to do everything automatically.

In the state of Florida, not everyone over the age of 21 is required to wear a helmet when riding a motorcycle. However, it is strongly recommended that everyone wears a helmet. Crashing without a helmet increases the risk of brain damage or death.

When it comes to motorcycle insurance in Florida, anyone who rides a motorcycle without a helmet must carry at least $10,000 in Personal Injury Protection (PIP). It is important to note that even if you already have PIP insurance for your car, you must still have insurance for your motorcycle.

Guide To Buying A Motorcycle In Florida

Yes. If your health insurance provides at least $10,000 in personal injury coverage. You can then calculate the coverage you need. However, some insurance policies do not cover motorcycle-related injuries, so it is important to consult your health insurance provider. If your health insurance does not cover motorcycles, you should take this as a sign to wear a helmet, as it can prove how dangerous wearing a helmet can be.

One of the main differences between regular motorcycle insurance and car insurance is the risk and cost. When purchasing auto insurance, you will often notice that your policy usually includes personal injury protection. However, because the risk of motorcycle damage is so high, many insurance companies do not automatically include PIP in your policy. It’s a good idea to check your insurance details and add extra cover if necessary.

Another difference between motorcycle and motorcycle insurance is that you can choose seasonal coverage. This type of insurance is called a “layout” policy. Basically, it refers to a coverage policy that only applies during the season you use the bike. Therefore, if you spring, for example, Summer and autumn, you can choose to cover the winter when the policy cannot be used.

Finally, when it comes to motorcycle insurance, additional costs may be required to insure the passengers. Another reason is that motorcycles are prone to accidents. Most insurance companies will pay you more for legal protection in the event of a passenger injury or accident.

Motorcycle Accident Laws In Florida

The cost of motorcycle insurance depends on the type of motorcycle you own. The amount of cover available depends on your driving record. You can expect your motorcycle insurance to range from $70 to $2,000 or more per year.

The type of bike you own can lower or increase your annual premium. For example, standard bikes usually have the lowest annual prices, followed by exercise bikes. Touring bikes have the highest prices per year.

You can speak directly with an insurance agent to find the best coverage for you and your bike. An agent can help you make the right decision for your needs and help ensure you don’t get too much or too little insurance.

When purchasing motorcycle insurance in Florida; You have two choices. You can choose to obtain insurance through a private insurance agent; Or you can go through the Florida Motorcyclist Safety Association (FMSA).

Best Motorcycle Insurance Companies Of 2024

When buying insurance through a private insurance company, the following things must be considered. First, before you decide, be sure to compare prices from different companies and shop around. Additionally, check with the company to see if it is covered in Florida.

Getting insurance from the FMSA requires you to be a member of the organization to qualify for the benefits. Membership in this organization costs $25 per year, which includes liability coverage of up to $10,000 per accident. Optional coverage can be added for an additional fee.

In the event of a motorcycle accident, medical attention is always a priority. Even if your injury seems minor, it is best to see a doctor. When an accident occurs, the body naturally releases adrenaline, a substance that makes even serious injuries painful.

Once your doctor clears you, you can start working on the financial side. If you have insurance; Now is the time to file a claim. If you have any questions or concerns, you can contact your insurance agent directly for assistance with your claim. If you do not have insurance or are afraid of a possible lawsuit. You should also consider hiring a lawyer.

The Best Cheap Motorcycle Insurance In Florida

Most states require you to have insurance for all vehicles. Florida is one of the few exceptions to this rule. However, one of the requirements for motorcyclists in Florida is that they must have personal injury insurance of at least $10,000 if they refuse to wear a helmet.

Even if the law does not require coverage for your motorcycle, it is recommended that you still get a policy that covers the possibility of an accident. The number of injuries and accidents when cycling is much higher than when driving a car. Insurance can protect you from major financial difficulties that often exceed the cost of monthly insurance payments. As you know, having auto insurance is a requirement in every state. But what about motorcycle insurance? Florida is the only state that does not require motorcycle insurance. Although Florida does not require insurance on your motorcycle. It’s a good idea to have one, especially if you’ve been in an accident and sustained serious injuries.

Motorcycle accidents resulting in bodily injury or personal injury can have fatal consequences if your insurance company or the other driver’s insurance does not have liability coverage.

Personal injury protection for motorcyclists covers medical expenses, This is necessary to cover lost wages and other damages. Although not required for motorcycle owners in Florida, if you are an irresponsible motorcyclist; You could put yourself and other motorcyclists at risk and be stuck with expensive medical bills. Here’s everything you need to know about motorcycle insurance in Florida.

Do You Need Motorcycle Insurance In Florida?

Florida does not require motorcycle insurance, which protects drivers in the event of a motorcycle accident. Florida

Mandatory car insurance in florida, is car insurance mandatory in florida, is auto insurance mandatory in florida, cheapest motorcycle insurance in florida, do u need motorcycle insurance in florida, best motorcycle insurance in florida, motorcycle insurance in florida, motorcycle insurance mandatory, do i need motorcycle insurance in florida, is hurricane insurance mandatory in florida, do you need motorcycle insurance in florida, in florida no-fault insurance is mandatory