Chicago Cook County Property Tax – New Tool Shows Why Property Taxes Are Rising in Cook County County residents can now type in their address and see where their property taxes go and what contributed to the increase.

According to the Cook County Treasurer’s Office, about 81 percent of Cook County residents saw their property taxes increase, while 17 percent saw a decrease and 2 percent saw the same bill.

Chicago Cook County Property Tax

Chicago’s northwest suburbs were hit the hardest, with some areas seeing an average increase of 15 percent. In the most egregious cases, single family homes in Melrose Park saw their bills increase by 134 percent. Others on the Des Plaines and Hoffman estates felt it too.

Cook County 2023 Residential Property Reassessments Soar

Feeling out of the loop? We’ll keep you updated on all the Chicago news you need to know. Sign up for Chicago Catch-Up’s weekly newsletter here.

“When someone says, ‘Hey Maria, why did my taxes go up?'” Cook County Treasurer Maria Pappas told NBC 5, “It’s very simple, I pull out my phone, I say, ‘I want show me,’ and let me show them who raised their taxes.

The bureau launched a new tool Tuesday where residents can type in their address and see where their tax dollars are going and how much they’ve grown.

“The little red arrows show what went up and how high it went,” explained Pappas. He hopes it will be an eye-opening experience when people see who is responsible for raising taxes.

Property Tax Relief For Military Members

However, the Fund said 2022 was also a perfect storm with revaluations in the north-west suburbs, the loss of Covid adjustments and an increase in commercial property vacancies.

“When the commercial [tax] goes down, residential units pick it up,” Pappas said. “Someone has to pay for it. …I’m seeing business taxes going down because a lot of mom and pop places are closing. “The little ice cream shops, the nail shops, the salons will all be closed.”

A new state “immunity” law is also a contributing factor. When businesses and individuals are successful in tax appeals, the law allows tax agencies to add the lost amount to next year’s taxes. That equates to $203.7 million countywide for the 2022 tax year, according to the treasurer’s office.

Cook County residents can also use this tool to ensure they receive frozen discounts for homeowners and seniors. They can also see if they have overpaid in the last 20 years. Pappas said the county is sitting on a $79 million overpayment.

Wttw News Explains: How Are Cook County Property Tax Bills Calculated?

Local Weather Alerts School Closures NBC Sports Chicago Investigating NBC 5 Answer Submit a Tip Entertainment Comment Chicago Baseball Baseball Chicago Bears Chicago Blackhawks US & Global Health Chicago Making a Difference Today

About NBC Chicago Our News Standards File a Consumer Complaint Submit a Photo and Video Contest Our Cozi TV Newsletter Program Using property tax classifications in Cook County makes it difficult to encourage and expand non-residential development in existing communities. In particular, commercial and industrial property in Cook County may have a higher tax burden than similar properties in neighboring counties. This may reduce the potential for non-residential development and redevelopment.

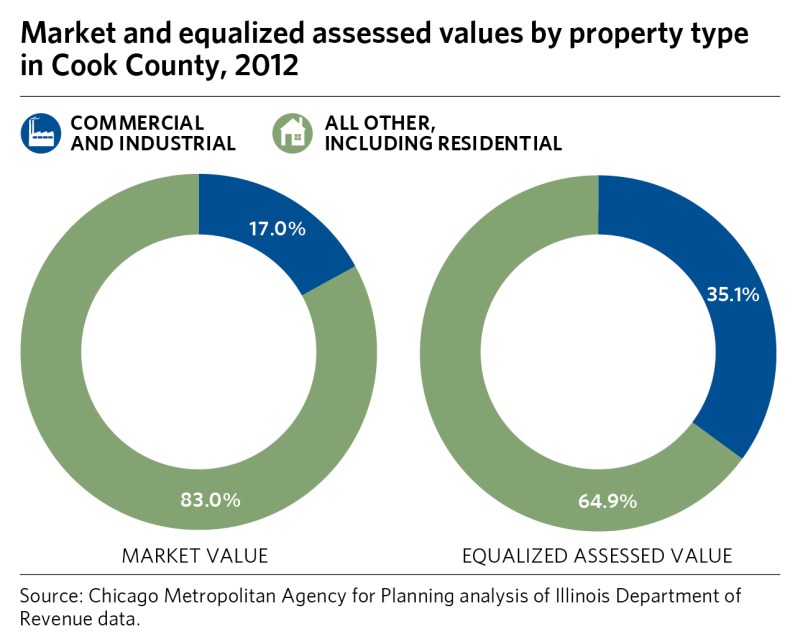

Commercial and industrial properties in Cook County account for 17.0 percent of the total market value, but 35.1 percent of the total tax base. Although the impact varies from location to location, commercial and industrial property owners have a greater tax burden than residential taxpayers in Cook. This disproportionate burden does not exist in collar counties, where commercial and residential properties are assessed at the same rate. The charts below show the effects of the classification on non-resident taxpayers in Cook County.

Classification reform could lower commercial and industrial property tax rates in many communities and make them more attractive for development. Higher tax burdens on commercial and industrial property, compared to similar properties in neighboring counties, can discourage businesses from locating in certain communities. If this results in the tax base growing more slowly than the cost of public services, residents and businesses may face higher tax rates to cover the cost of public services.

Tax Appeal Seminar

As recommended by GO TO 2040 and reinforced by the Task Force on Regional Tax Policy, it continues to study how regional property tax assessment classifications may hinder business growth and economic activity. This policy update builds on previous analysis and describes the effects of classification on property tax rates in Cook County.

The vast majority of local governments, including counties, townships, municipalities, school districts and special districts, levy property taxes. To calculate property taxes, county assessors first estimate the market value of all properties, then add a ratio of the assessment to the market value. The Illinois Department of Revenue calculates equalization for each county so that the average assessment ratio is the same in each county. This equalization is applied to the assessed values in the appropriate counties, resulting in an Equal Assessed Value (EAV). Finally, the EAV is multiplied by the combined rates of each tax district for the final property tax rate.

The state constitution allows counties with populations over 200,000 to apply different assessment ratios to different types of property. Cook County, which assesses commercial and industrial property at a higher percentage of market value than residential property, is the only county in the state that uses this assessment approach. This results in a higher property tax burden on commercial and industrial property tax payers.

In Cook County, different property classes have different effective tax rates due to classification. Although property tax rates are calculated as taxes divided by EAV, effective tax rates are property taxes as a percentage of market value. Assessing property taxes based on the actual market value of the property, rather than the EAV, allows for comparisons between property classes and geographic areas. The maps below (also available in interactive format) show the combined effective property tax rates for commercial, industrial and residential properties in Northeastern Illinois for 2012. Most areas’ residential property tax rates are below five percent, such as are most commercial rates. and industrial taxpayers in collar counties that do not use the classification. However, large parts of Cook County have commercial and industrial rates above 5 percent.

North, Northwest Suburban Cook County Homeowners See Largest Property Tax Increase In 30 Years: Study

According to the classification, effective tax rates in a given region increase when the concentration of business and industry ownership decreases. Changes in tax rates depend on a number of factors, including whether a particular property class dominates the value of property in that tax area. As shown in the chart below, land use characteristics in a community influence how classification affects effective tax rates.

If commercial and industrial property makes up a large portion of the market value of the taxing district, their effective tax rates are a function of the tax and base, not the various levels of tax assessment. This is because industrial and commercial taxpayers currently bear most of the tax burden, which will reduce the impact of differential assessment levels under the classification.

Conversely, communities with a low concentration of commercial and industrial properties can attribute their effective tax rates primarily to the classification. The majority of residential property assessed at a lower ratio results in a lower property tax base, resulting in an overall increase in property tax rates. These high rates have a disproportionate impact on commercial and industrial properties, resulting in a load shift from a large residential base to a smaller commercial and industrial base. In fact, the effect of classification on the tax burden of commercial or industrial taxpayers is stronger in areas with fewer commercial and industrial assets.

Other factors also influence the impact of classification on tax rates. For example, in some areas, very low property tax bases increase rates for many types of property. As a result, any modification to the classification system will have little impact on tax rates in these areas.

Cook County Treasurer Launches Online Tool To Show How Property Taxes Are Allocated

The use of incentive classes in Cook County is another driver that affects the impact of classification on tax burden. Many communities try to mitigate the effects of classification by giving commercial and industrial properties incentive classifications. These classes reduce the assessment level to the same percentage of the market value of the residential property for ten years, which is renewable for some incentive classes. In 2012, an incentive floor was set at 6.2 percent of the estimated commercial and industrial market value in Cook County. 81 municipalities in Cook County have at least one property with an incentive floor out of 134 municipalities.

The map below shows the tax rate ratio for commercial and industrial property taxpayers assigned to the classification, which falls between 50 and 59 percent in most areas of Cook County. In other words, for most communities in Cook County, half of the tax burden on commercial and industrial taxpayers is a function of the tax burden change in the classification system.

The analysis shows that property classification in Cook County can hinder business development and economic activity. The map below shows how effective property tax rates in Cook County would have been in 2012 if the classification had not been implemented. The map generally shows rates below 5 percent, which is in line with current rates.

Cook county property tax, cook county property tax attorney, cook county property tax liens, cook county property tax appeal, cook county tax assessor property search, cook county assessor property tax, property tax appeals cook county, cook county property tax exemption, cook county pay property tax, cook county property tax records, cook county property tax appeal attorney, cook county property tax payment