Alliant Credit Union Interest Rates – Copywriter and credit card designer Matt Walker brings his 15-plus years of experience covering the financial industry through consumer-driven guides and in-depth features. His extensive knowledge of the ins and outs of finance enables him to translate complex financial topics into readable articles suitable for both novice and technical investors. Matt’s easy-to-follow message explains the latest in the industry — from credit cards to credit unions — and lets consumers know how to take advantage of them.

Lillian Guevara-Castro brings more than 30 years of experience in editing and journalism to the company. He has written and edited for major news organizations, including The Atlanta Journal-Constitution and The New York Times, and served as an adjunct journalism professor at the University of Florida. Today, Lillian edits all content for clarity, accuracy and relevance to the reader.

Alliant Credit Union Interest Rates

In Summary: As the nation’s largest credit union, Alliant Credit Union of Chicago uses its size and resources to better serve its members and communities. Alliant recognizes the evolving way people prefer to bank and is investing heavily in providing members with a better digital banking experience. Alliant Credit Union also uses its resources to offer similar interest rates to its 1.90% APY savings account. Community service and financial literacy are central to Alliance’s mission. All of this contributed to Alliant being recognized with our Editors’ Choice™ award. //

Alliant Credit Union Recognized For Its Tech Forward Banking Experience, Competitive Rates, And Community Service In Chicago

If you walk into Alliant Credit Union’s Chicago headquarters and find it occupied by a group of friendly volleyball players, don’t panic. You just showed up on the day of the annual Alliant Volleyball Tournament, which raises thousands of dollars each year for a charity close to the hearts of Alliant employees.

This year the tournament raised $6,000 for the Cardiovascular Research Foundation. That money was donated to the philanthropic Alliant Credit Union Foundation for a total of $12,000 in heart disease research. Employees chose this charity event in memory of an Alliant employee who passed away earlier this year.

“We’ve been doing this for 13 years,” said Jason Osterhage, senior vice president of lending. “It’s great, the staff is walking around in their volleyball uniforms.

Allianz’s commitment to the communities it serves is one of the reasons company members enjoy doing business.

Alliant Credit Union Review: Cds, High Yield Savings & Checking Accounts

In 1935, Alliant was founded in Chicago by a small group of United Airlines employees. In its first year, the credit union had 146 members and approximately $5,000 in assets. Over the years, Allianz’s membership has grown, and today it is one of the largest credit unions in the US, with nearly 400,000 members and $10.7 billion in assets. Last year there was an 11% growth in membership.

The credit union also represents a progressive approach to digital banking that surpasses the efforts of many other unions. With competitive pricing and premiums to boot, we see Alliant with us.

Osterhage said Alliant is working with a mission to provide better financial value and make it easier for people to save, borrow and pay.

“That’s how we feel about the core of our business, the plan is to do it digitally,” he said. “We’re really dedicated to this direct billing model. We make a lot of money serving our members online, and we’ve been doing it for a long time.”

Alliant Credit Union Personal Loans Review

Competing in convenience stores is not a major part of Alliant’s strategy, Osterhage said, and it will be going forward. He said Alliant is actually expanding its branch business, closing branches rather than opening new ones — in computer vision services.

“We believe that our CEO David Mooney says banking is no longer a place you go to, it’s something you do,” he said. “We are investing our resources in building digital capabilities for our members across the country.”

While many other financial institutions offer more digital services, Osterhage said he believes Allianz’s commitment to digital will help diversify the debt landscape.

Many financial institutions pay lip service to the importance of digital technology to the customer experience, but Allianz’s efforts — including the development of its own technology — show it matters.

Newest Alliant Credit Union Promotions, Bonuses, Offers And Coupons: September 2021

“We’re working hard to create a unique digital experience,” Osterhage said. “So we’re taking the time and effort to develop our own digital technology to deliver that.”

Alliant has invested in its own teams and tools to develop, build and release its own software rather than relying on other companies, Osterhage said.

Alliant has already made significant investments in several areas, including updating its website, a new mobile banking app, and a consumer credit system developed by Alliant. The lending platform was recognized with the CUNA Technology Excellence Award earlier this year.

In addition, Alliant continues to improve the digital experience for customers to purchase various products, apply or open new accounts.

High Interest Rate Online Savings Account

In addition to its commitment to providing customers with the best in their digital experience, Alliant also strives to provide the best value for money, Osterhage said.

“We are thinking about the terms of shares and higher prices,” he said. “We have a 1.90% return on our savings account. We’re always looking at those rates and looking for ways to increase them and give our members more money.”

To take advantage of the 1.90% APY savings account, members must maintain a minimum daily balance of $100. To open an account, Alliant requires a minimum deposit of $5, which is actually run by the credit union for its members. Interest is paid monthly.

Overall, Osterhage said Alliant will ditch the good press and “star sign factor” and focus on offering competitive rates to its members.

Need Your Input… Signature Fcu Or State Departme…

On the credit side, Alliant is all about simple products, low fees and short print runs, he says.

Osterhage said the credit union is very proud to offer the Alliant Advantage mortgage, which has received positive feedback from members.

A mortgage helps avoid some common barriers to buying a home, such as requiring independent mortgage insurance for homebuyers without a 20% down payment. For first-time home buyers, the Alliant Advantage Mortgage Program offers 0% down for amounts up to $500,000 and no PMI. Other home buyers can buy a new home with 5% down.

“Our members can count on us to deliver the best products,” Osterhage said. “They can trust us to take care of them on that.”

Alliant Credit Union Ceo Mooney Retires, Replaced By Keybank’s Devine

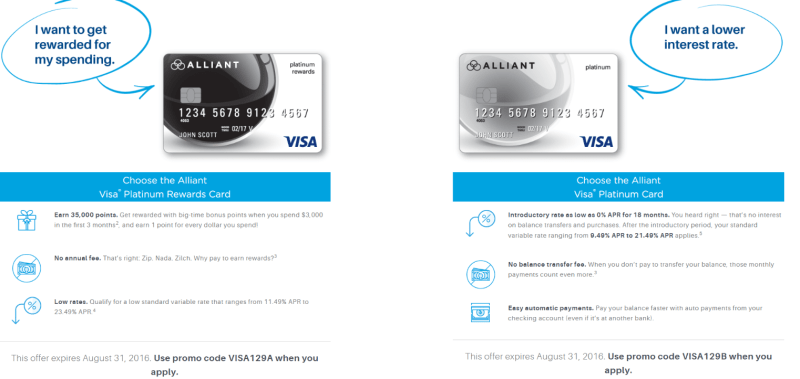

As for credit card rewards, Osterhage says the Alliant Cashback Visa® Signature Credit Card, with 3% cash back in the first year, has been one of the most popular among members since it launched last year.

According to the library’s website, the Alliant Credit Union Foundation was established in 2008 with the mission of “promoting economic and social empowerment, particularly in the communities where Alliant Credit Union members and employees live.”

“The platform really organizes our social responsibility activities, and there’s a long list along the lines of financial literacy and education,” Osterhage said. One of Allianz’s largest fundraising partners is Operation Hope, an organization working to end poverty and strengthen financial inclusion for low-income youth and seniors.

The partnership allows Alliant employees to attend high schools near the credit union’s headquarters and take classes on financial literacy and financial planning. Osterhage estimates the program has reached more than 5,000 students over the years. Alliant volunteers represent a good portion of the workforce, including CEO Mooney, Osterhage said.

Top 5 Best Credit Unions Anyone Can Join [gfc_globals Field=

This is a great program, he said. “Employees get a little training on how to present things, and then they go into the classroom, and it’s really fun.”

Alliant encourages volunteerism in other ways, including the recent introduction of a paid volunteer day where employees donate their time to a charity or cause. Osterhage said staff are meeting to organize their own volunteer teams.

The Alliant Credit Union Foundation’s website has many resources, including financial literacy quizzes, financial education activities for children, and a blog offering financial advice on a variety of topics. Organizations interested in receiving a grant from Alliant can visit the Foundation’s website to find out how to apply.

Whether Alliant employees are starting volleyball or their software development team is launching a new project, Alliant is always at the service of its members and communities.

Alliant Ceo: Consumer Savings Rates Better Than They’ve Ever Been

Osterhage reiterated Allianz’s commitment to high financial value and simplicity of the banking process. He said this commitment will continue in the future with a focus on developing and implementing a unique computer experience for members.

Advertising promotion

Alliant credit union savings interest rates, alliant credit union rates, credit union interest rates, alliant credit union ira cd rates, alliant credit union mortgage rates, alliant credit union mortgage interest rates, alliant credit union certificate rates, alliant credit union new car rates, alliant credit union ira rates, alliant credit union cd rates, alliant credit union cd interest rates, alliant credit union car loan rates