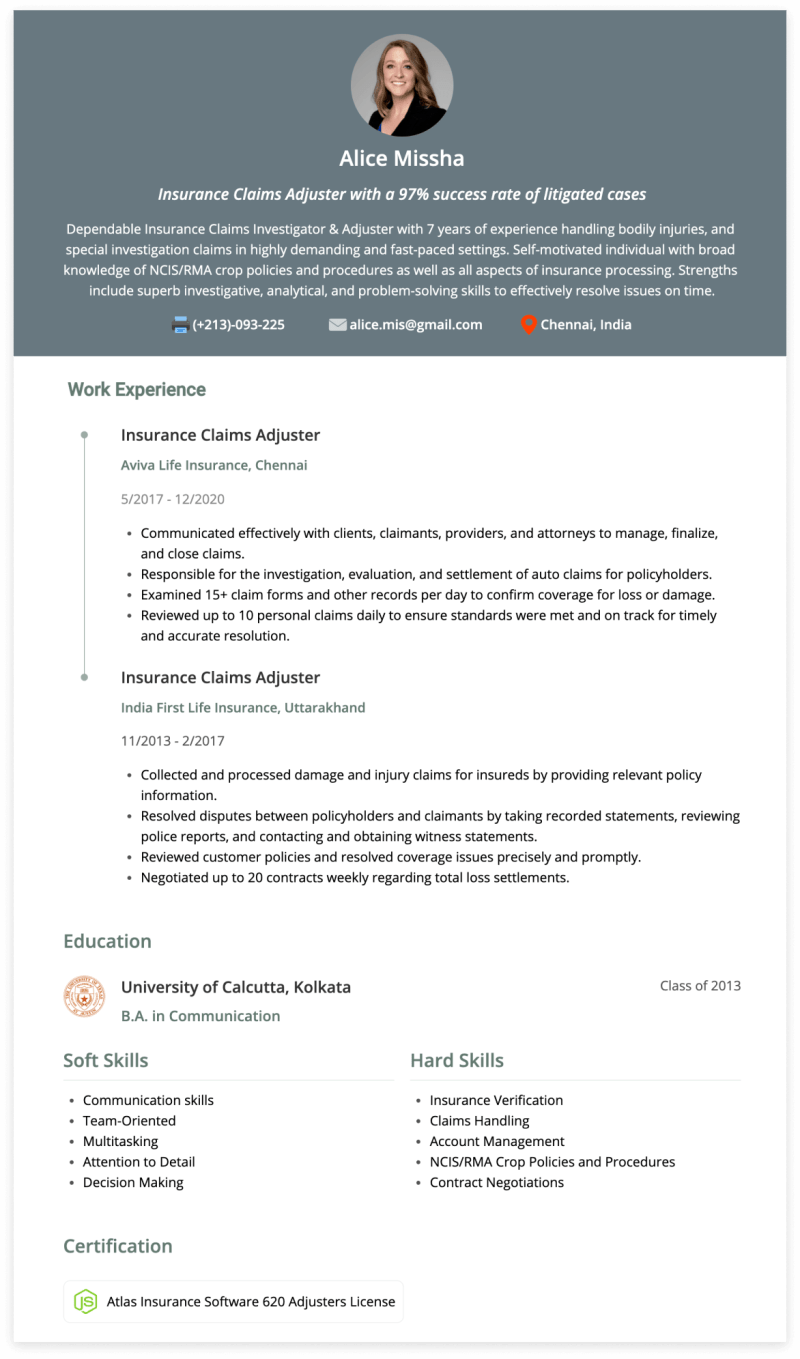

Bodily Injury Adjuster Job Description – The contact information section is an important part of your claims adjuster resume. A recruiter should contact you as soon as possible if they want to offer you a job. For this reason, you must submit:

Work experience in the field is an important part of your claims adjuster resume. This is something that the boss really cares about and pays a lot of attention to.

Bodily Injury Adjuster Job Description

However, this section is not just a list of your past claim adjustment responsibilities. It is designed to present you as a good candidate by showing your relevant achievements and should be specifically tailored to the specific adjustment role you are applying for. The work experience section should contain a detailed summary of your last 3 or 4 positions.

Texas All Lines Adjuster Exam Questions And Answers Explained

Make sure education is a priority on your claims adjuster resume. If you have been working for a few years and have some stable positions, prove your education after the experience to adjust the claim. For example, if you have a PhD in neuroscience and a master’s degree in the same field, list only your PhD. In addition to the doctorate, there is a master’s degree, followed by a bachelor’s degree, and finally an associate’s degree.

These are the four additional pieces of information you should include when listing your education on your resume.

When listing skills on your resume for a claims adjuster, always remember to be honest about your skill level. After the experience, include the skills section.

• Act as a backup machine operator during breaks and meals if needed • Select regional adjuster and coordinate the adjustment process • Coordinate with insurers/insured/brokers/consultants if needed and Correspondence with IA • Provide guide/instructions…

How Long Does It Take To Receive An Insurance Claims? The Process

• Perform additional duties as directed by the manager • Experience in managing HRSG installations required • Hammers, beam cutters, files Grinding irregular edges or structural parts to facilitate joining of edges • Crane operator Signals…

• Excellent interpersonal skills with a diverse group of contacts. • determine the amount of customer financing according to needs; Create case deposits for use by clients and regulatory authorities • Instant payments to claimants (with client funds) and…

• Confirmation of guest orders, including any special needs or requests from the lounge server through the hotel’s point of sale system; Verify completed orders with the original guest order • Serve and take orders from guests seated in the bar area, each offering attractive and clear…

• Collect information and documentation to support patient visits • Be responsible for following all policies, procedures and practice guidelines • Promote collaboration among all members of the healthcare team • Maintain complete, timely and accurate that clinical…

Insurance Claims Adjuster Job Description: Salary & More

• Records and reports of all necessary repairs; Change as instructed • Adapt to company growth and new directions • Availability of work O.T. hours, especially to support employee commuting • Providing and managing facility maintenance programs  …The primary duty of a claims adjuster is to determine whether a party is entitled to money due to a incident such as a personal Injury or property damage. The people served by claims adjusters are the people who pay the insurance policy. The claim adjuster is also the person who decides the amount of compensation. In most cases, the claim adjuster is an employee who works for the insurance company. Others work as independent consultants who act as plaintiffs’ representatives. Jobs include insurance auditors, insurance adjusters and insurance claims examiners.

Claims adjusters work in many areas, including casualty, property, auto or medical claims. To become a claims adjuster, you must have a good understanding of your area of expertise, be able to negotiate settlements and review policies. Restart your claim adjuster by clicking the “Use this restart” button.

There is currently a high demand for claims adjusters in the job market. Considering this case, there are also many competitors. This means you need to stand out from the other candidates. One of the best ways is to have a professionally written resume. If you don’t know how to do it, we are here to help you.

Write a compelling summary of your needs Organizer Resume The first tip for a well-written resume is to create a professional-looking summary. This will help your hiring manager read your document better. If you don’t know how to create an interesting summary, we will help you. Our website is full of summaries to help you improve your summary writing.

Insurance Adjuster: Occupations In Alberta

Include your skills and talents related to the position in the claim adjustment. To make sure you land your dream job on the first try, create a resume that includes your skills and abilities related to the position you’re applying for. When writing this section, make sure you are honest and learn the skills you are writing about.

Discuss your past accomplishments in relation to the claims adjustment position. It is better if you include your achievements in recent years that are relevant to the position you are applying for. You may consider writing about your professional experience. This will help your hiring manager get an idea of your competition. It also increases your chances of getting hired. Be sure to list only experiences and accomplishments that are relevant to the position. Remember to use professional words.

Dynamic claims adjuster with the drive and experience to provide clients with an exceptional level of customer service. Develop ability to accurately investigate situations and resolve claims expeditiously in accordance with company and regulatory standards. By demonstrating continued adherence to best practice requirements and a commitment to industry and company ethics.

Most of the failures in life are people who don’t realize how close they are to success when they give up. ~Thomas Edison

Claims Adjuster With 7 Years Of Experience Attempting To Transition To Claims/insurance Operations

In the next 3 years I would like to work in an insurance company where I can use my communication skills and research abilities to provide better customer service.

Haven’t received an email yet? Please check your mail and your spam box. Resend confirmation email Claim your next job with help. Read the guide below and then edit this claim adjustment example to get started right away. You can easily create a summary in just a few minutes. Just enter your details, download your new one and start your job application today!

What does a claims adjuster do? How to Write a Claims Adjuster Choosing the Best Format for a Claims Adjuster Summary Example: Career Overview Work History Example Resume: Check Your Success Resume Skills Example: List Your Best Claims Adjuster Learn Create a sample layout and best design for claims adjuster

As a claims adjuster, you deal with people at risk. They lost and approached an insurance company to help them recover as much as possible. This means you need to demonstrate suitability, competence and good investigative skills when you start your job search.

Insurance Claims Adjuster Cover Letter Examples

Writing guides and examples for over 300 professions will help you get there. We offer easy-to-use builder and design templates that make it easy to create your job application.

Every 2 weeks, our experts gather the best career advice you can read in 15 minutes or less. Straight to your inbox!

Our newsletter is on its way. The best and job tips from our career experts will be delivered to your inbox every 2 weeks!

Claims adjusters investigate insurance and property damage claims to determine the company’s liability for a specific injury. They can handle auto, life or home insurance claims. Some claims adjusters can handle all types of claims, while others specialize in certain areas.

Claims Adjuster: Definition, Job Duties, How To Become One

To hear the case, the claims adjuster will interview the claimant, witnesses, police and other people involved in the claim. They may also review medical or other records related to the claim. They then review the insurance policy and assess the risks, damages, property damage or personal injury involved in the case. Claims adjusters share their findings and inform claimants of their findings. Then they consult with the claimants to find an appropriate settlement for the claim and issue a compensation amount.

Some claim adjusters are independent contractors, working for a third party or themselves, who are hired by insurance companies to handle individual claims.

The average salary for a claims adjuster is $55,478, Payscale reports, and ranges from $41,000 to $81,000.

Before you start writing, you need to understand the structure of a claims adjuster. Your resume should include the following:

Auto Claims Adjuster Resume Samples

Usually the s follow in reverse chronological order. This means you list your last position and start working backwards. Regardless of the specific requirements of your profession, we recommend this format as it is popular with recruiters and applicant tracking systems (see expert advice below).

Whether you’re looking to change careers, just starting out, or have years of experience, you may want to consider the other formats we offer as chronological alternatives or hybrids. We do not recommend Active Style unless you have specific knowledge or skills

Usaa bodily injury adjuster salary, bodily injury adjuster training, remote bodily injury adjuster jobs, bodily injury claims adjuster job description, bodily injury claims adjuster, attorney represented bodily injury adjuster, unrepresented bodily injury adjuster, progressive bodily injury adjuster, bodily injury adjuster salary, bodily injury adjuster, bodily injury adjuster job, allstate bodily injury adjuster