First Community Bank Savings Account Interest Rate – Open a new account Now you can open an account online! Find our personal account options and click “open now” to get started. Another way First Community makes budgeting easier for you.

CREDIT CARDS First Community Bank has a credit card for every need, whether you need cash back, need a low interest rate, or need to build or improve your credit.

First Community Bank Savings Account Interest Rate

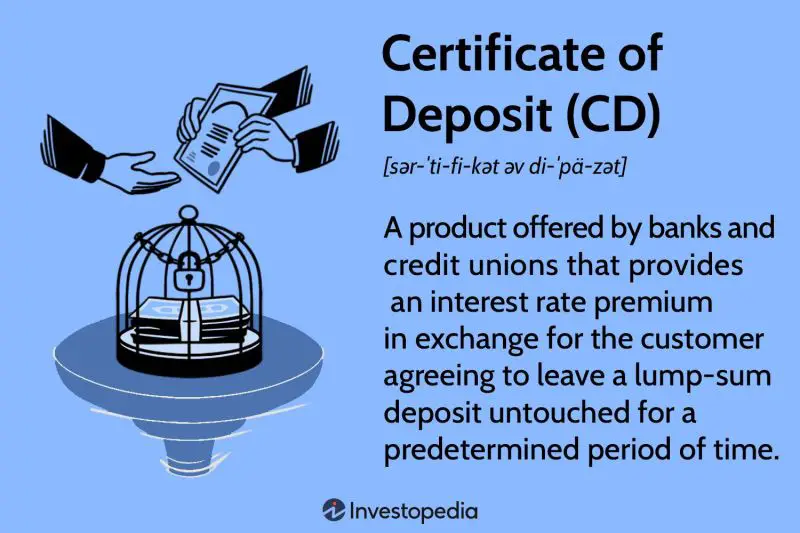

PERSONAL BANKING We offer a variety of checking and savings accounts, loans and CDs so you can manage your money your way. We are your TOGETHER financial banking center.

First Harvest Cu

MARKETS Our local mortgage brokers work hard to find you the right loan product with long-term interest rates. If you’re short on time, you can fill out your home loan application online! We hope to hear from you soon!

DEBIT CARD Our credit card is a quick, easy and convenient way to buy the products and services you need, when you want them. More information

GET MORE FOR YOUR MONEY Our GenGold ® Membership Program allows you and your family to receive discounts on the products and services you use every day. This will pay you off! More information

BUSINESS SERVICES Small and large business solutions with competitive pricing and excellent local sales service! More information

How Do Commercial Banks Work, And Why Do They Matter?

With our online banking service, you have a virtual bank branch wherever you have a computer. Set up payments, transfer money from one account to another, and more, any time of the day or night.

After June 15, 2022, the Internet Explorer mobile browser will end support and be retired, returning users to Microsoft Edge. By clicking “Accept all cookies”, you consent to the storage of cookies on your device to improve website navigation and monitor website usage. and help with our marketing efforts.

The annual percentage rate (APY) refers to how much interest you earn on your account and save compound interest. The annual percentage rate (APR) looks at how much interest you pay on the money you borrow. The terms are often used interchangeably because they are both used to calculate interest on investment and loan products. Both have a significant impact on how much you can earn or pay when applied to your account balance.

The annual percentage rate (APR) is the interest you pay on a credit card or other loan, including fees. APR is a more accurate representation of what you’ll pay in a year than simple interest because it includes fees. Federal law requires lenders to share their APR with consumers to help them compare rates and shop for loans.

The Roots Of New York Community Bank’s Troubles

The APR does not include compound interest if you default on the loan. Compound interest is the income or payment of the original interest. Added to the amount of the deposit or loan.

The APR is calculated by multiplying the periodic percentage by the number of times per year that the periodic percentage applies:

Truth in Lending (TILA) requires lenders to disclose borrowers’ APR. Credit card companies may advertise the interest rate each month. They must disclose the APR to customers before signing the contract.

The annual percentage rate (APY) shows the interest you earn over one year on certificates of deposit (CDs), money market accounts, and savings accounts. As with the APR, federal law requires financial institutions to disclose the APY so you can shop around for the highest APY. However, APY doesn’t represent the right message and special rules apply to accounts with variable APY or level APY.

Citizens Community Bank Pocatello, Idaho Falls, Rexburg, Ammon

APY is a calculation of how compound interest affects the interest rate for a year. Your savings grow faster depending on the amount of money. You earn more if your interest rate increases more often. The easiest way to calculate your APY income is to use an online affiliate calculator.

You can calculate the APY yourself by adding 1 to the term. Divide this number by the number of mixing times and multiply the result by the number of times the rice was used. Subtract 1 from this number.

You take out a $5,000 personal loan with a 5% APR. Interest is compounded every month, but you pay off the balance in equal installments over time. You pay about US$428.04 per month, divided into 12 installments. You pay $136.45 in interest per year.

Imagine you invest $5,000 in a 12-month CD with a 5% APR. Interest is compounded monthly, so your APY is 5.116%. If you don’t withdraw money from the CD now, you’ll have $255.81 at the end of the year.

Community Bank, Citizens Bank To Close Four Area Branches

The income from a CD is higher because your money grows each month and you don’t take any withdrawals. You deduct the principal and interest on the loan, even though the interest is compounded.

As a borrower, you are always looking for the lowest possible interest rate in hopes of paying down your loan. For example, if you buy a mortgage, you might choose the alendero with the lowest interest rate.

Banks often offer an APR on a loan or credit card. But, as we said, this number does not take into account the number of years of the loan if you do not pay. It can be compounded daily, semi-annually, quarterly or monthly.

The bank can offer an interest rate of 5%, 7% or 9% depending on the frequency of compounding, but you can pay a higher interest rate. The stated value does not take into account the results of capitalization, but takes into account the fees and other costs.

Accrued Interest Definition & Example

You may also want to consider the impact of monthly compounding, such as the APY. In this case, you will pay 0.38% more on your loan each year, which is a lot if you repay the loan over a 25- or 30-year period, as you do. including mortgage.

When considering different loan options, it’s important to compare apples with apples. Compare the format of the invoice so that you can determine the content.

You want to get the highest interest rate and benefit from compounding interest often when you borrow money, which is what you do when you deposit money in a bank and investment,

Let’s say you’re looking for a high-quality investment portfolio. You want an account that offers the best rate of return on your hard earned money. Pay close attention to the frequency with which your account is debited. Then compare the combination with APY offered from other banks, which will be combined at the same rate. This can make a big difference to the interest earned on your account.

What You Need To Know About New York Community Bank’s Troubles

Both are useful when you’re looking for prices and comparing what’s best for you. APY helps you know how much you’ll earn on a savings account or CD over the course of a year. The APR can help you estimate how much you owe on a home loan, car loan, personal loan, or credit card.

A good APR is a low APR. You can check the current Federal Reserve averages to compare the APR of a new car loan, personal loan, or credit card. But keep in mind that the APR offered depends on your credit score and other factors. Compare similar products whether you are shopping for credit cards or home loans. Compare cash back card APRs with other cash back card APRs.

Interest is the simple interest earned on your CD account balance. CD APY is the interest you earn during the year, plus compound interest if you don’t repay your loan.

APR and APY help you manage your personal finances. The more interest compounds, the greater the difference between APR and APY. Whether you’re taking out a loan, signing up for a credit card, or looking for the highest rate of return on a savings account, pay attention to the different interest rates offered.

Apple Card’s New High Yield Savings Account Is Now Available, Offering A 4.15 Percent Apy

Financial institutions may have different reasons for offering different interest rates depending on the borrower or lender. Always make sure you understand the rate you are being quoted, and then check out different rates from other companies.

This article has been modified to reflect that the 12-month CD example is based on a 5% APR.

Require authors to use primary sources to support their work. This includes white papers, government data, original reports, and interviews with industry experts. Where appropriate, we also cite original research from other reputable publishers. Learn more about our practices for creating accurate and unbiased content in our guidelines.

The contributions in this table are from organizations that receive compensation. This difference may affect how and where the listings are displayed. does not include all the offers available in the market.

Apple Savings Account Interest Rate Increased To 4.25% Apy

Commerce bank savings account interest rate, citizens bank savings account interest rate, bank with best interest rate savings account, united community bank savings account interest rate, chase bank savings account interest rate, first community bank savings interest rate, us bank savings account interest rate, high interest rate savings account bank, savings account interest rate, community trust bank savings account interest rate, bank of america savings account interest rate, united bank savings account interest rate