Palm Beach Property Tax Records – If you own real estate in Palm Coast, you must pay property taxes. Your property tax bill is based on the assessed value of the property, the exemptions you qualify for, and the property tax rate. This page breaks down these costs to help you prepare for your taxes, avoid surprises, and spot costly mistakes.

Financial Budget Statements and Documents Volunteer Firefighter Retirement Plan SR100 CRA Financial Services Acquisition Property Tax Bill Explanation

Palm Beach Property Tax Records

Before buying a new home, check with the Flagler County Property Assessor’s Office about property taxes. A real estate appraiser website offers tax estimates based on a home’s location. Understand how your home is taxed and how these taxes can affect your home buying budget.

Property Taxes By State & County: Median Property Tax Bills

Every August, the real estate appraiser sends a Truth in Pricing Notice (TRIM) to all property owners based on legal requirements. This ad is important – look for it in the mail! You’ll recognize it from the prominent lettering: “Don’t pay – it’s not a fee.” A TRIM notice tells you the taxable value of your property. Taxable value is fair value less tax credits. The TRIM notice also provides information on proposed exemption rates and taxes assessed by community tax authorities. It also means when and where the government will hold public meetings to discuss your land use tax rates and thus the initial budget needed to finalize your taxes.

Property values are assessed on January 1 of each year. At least once every five years, a real estate appraiser or appraisal staff reviews and inspects all properties. Individual property values may fluctuate based on sales activity or other factors affecting property values in the area. Similar property sales are strong indicators of real estate market value.

Property tax dollars are distributed among various taxing agencies to support government services. These authorities include Flagler County Government, Flagler County School Board, City of Palm Coast, St. Petersburg. Each government decides how to use the money to provide important community services.

Florida is exempt from property taxes for qualified individuals. Some of the common property tax exemptions in Florida are: Homestead Exemption, Senior Citizen Exemption, Disabled Veterans Exemption, Widows Exemption and Military Exemption. Please note that exemption eligibility, application processes and requirements may change over time. It is important to check with the Flagler County Property Assessor’s Office or the Florida Department of Revenue for the most current and accurate information on property tax exemptions available in Florida.

Palm Beach County Rate Cut Should Keep Your Property Taxes From Rising

In 2024, Palm Coast City Council took a major step by adopting a rate of return. The decision reflects a careful balance between protecting essential public services and responsible fiscal management. By selecting a levy rate, the city aims to provide tax relief to residents while providing revenue for essential functions such as infrastructure, public safety and community programs. Collects parcel maps and related tax records from all states of Florida. Real estate appraisers standardize data into a single format and provide property search, plot map viewing and export in an easy-to-use GIS map viewer.

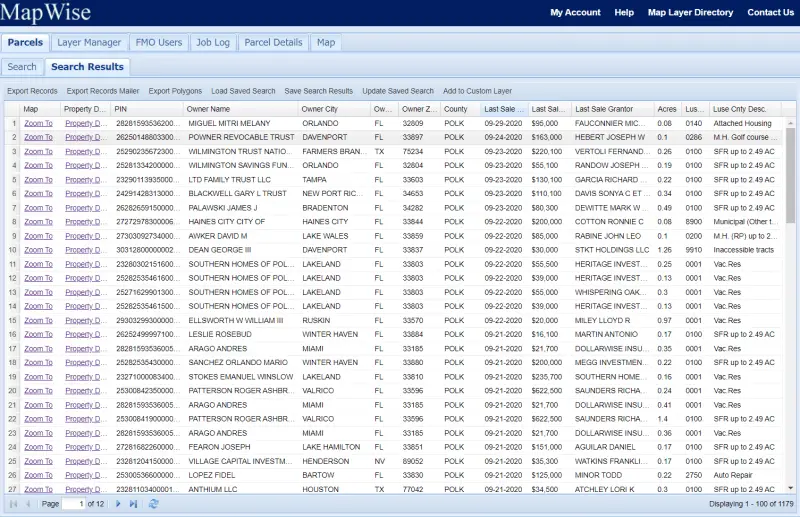

Plot maps show the boundaries of properties. The term plat map is often used interchangeably. Each parcel contains a wealth of related information, including the owner’s name, mailing address, sales information, appraisal, building information and lot address.

Save time researching Florida real estate with the same map and search interface. Quickly zoom in on an address using the address finder bar above the map. You can use the plot search form based on plot ID, owner name, area, sales and many other criteria. View a variety of map layers that include property boundaries, including FEMA flood zone maps, wetlands, aerial photographs, and elevations.

With GIS Map Viewer, you can search for properties based on various criteria, display selected plots on the map, print maps, and more.

Trump Family Insists Mar A Lago Worth Over $1 Billion After Judge Calls Value Wildly Inflated. Here’s What It Might Really Be Worth

Below is a screenshot of the parcel details page for each parcel in Florida. Most states include a direct link to the county property appraiser’s website for property records and/or the official records page for each sale involving the property.

GIS collects parcel and tax deed data from Florida’s 67 state property assessors and standardizes it into a single format. This saves time by searching and viewing package information in a consistent format.

If you use computer GIS software to manage your parcel data, you can save a lot of time identifying and processing the different file formats provided by your real estate appraiser by standardizing the data.

Package information update schedule varies by state. Certified tax documents are available in November/December of the current year. Updates to certified tax documents include the owner’s name, mailing address, sales and, in some states, tax returns. Depending on the status of the package lines, they are updated quarterly, semi-annually or annually. Monthly Updates:

Palm Beach County Tax Collector

Alachua, Bay, Brevard, Broward, Charlotte, Citrus, Clay, Collier, Columbia, DeSoto, Duval, Escambia, Flagler, Glades, Hardy, Hendry, Hernando, Highlands, Hillsboro, Indian River, Lake, Lee, Leon, Levy, Manatee . Bi-monthly updates:

Baker, Bradford, Calhoun, Dixie, Franklin, Gadsden, Gilchrist, Golf, Hamilton, Holmes, Jackson, Jefferson, Lafayette, Liberty, Madison, Putnam, Suwannee, Taylor, Union, Wakulla and Washington.

If you have GIS software and are only interested in packet data, we provide state-standardized packet data for use in your GIS software. Form files contain more than 100 data columns. All properties, including houses, are included. Contact us for more details.

I am happy to renew my subscription. I have a subscription to LoopNet, MLS, Xceligent, and I use your site more because it covers the entire state of Florida, is up-to-date, and is the best for my appraisal work. I am amazed at the accuracy of the data. Thanks for the great site. Palm Beach County FL Property Taxes – 24 2024 Ultimate Guide & What You Need to Know [Rates, Review, Fees, Dates]

Palm Beach Gardens Mansion Flips For Record $22.5m

Thinking of buying a home in one of Palm Beach County’s many beautiful cities? Remember, purchase price isn’t everything: property taxes can have a big impact on your home’s affordability.

One of the most confusing aspects of real estate is property taxes. Even with similar values, you may pay more than your neighbor, and prices can vary from city to city. How are Palm Beach County property taxes calculated? What are the state property taxes?

Here’s what you need to know about Palm Beach property taxes, including tax rates, how to pay, and exemptions that can reduce your tax bill.

Palm Beach County property taxes are based on the assessed value of the property. The Palm Beach County Property Assessor is responsible for assessing property values by January 1st and sending property owners an annual notice of property taxes.

Palm Beach Is Sold Out’ After Frenzied Pandemic Property Sales

The taxable value is the value less the property tax exemption. The Palm Beach County Tax Collector uses this value to calculate your debt.

Florida law requires the state appraiser to remove certain deductions from the property at the time of sale and appraise it at fair value and assessed value. The sale price will be “fair value” or market value.

Property tax rates are set by local governments such as cities, school districts, and counties. After the county board, school board, and other taxing authorities determine the tax rate, the county assessor multiplies the appropriate rate by the property’s tax value and sends a certified tax receipt to the tax collector. Note that the figure below adds “ad valorem” taxes to the “non-assessed” – or your property tax based on the value of the property. The latter refers to fees that tax authorities may add to property taxes. A common example is the government fee for solid waste.

The tax collector remits property tax assessments, collects fees, and distributes taxes to local governments and taxing agencies, such as school districts. The tax collector is also responsible for selling property tax certificates.

Trump’s Defense At Civil Fraud Trial Zooms In On Mar A Lago

In August, we will send you a Property Tax Proposal or Land Use Notice (TRIM), which will include the taxable value of your property as of January 1st. The notice also includes proposed tree and estimated property taxes. This is not a bill, just an estimate based on proposed tax rates.

You can conduct an online search from the Palm Beach County Tax Collector to view property search history, current tax payments, assessed value, assessments, property tax exemptions and the current property tax rate.

To check your current salary, use the Property Appraiser Public Access (PAPA) tool and search by address, PCN or property.

Palm beach property tax appraiser, west palm beach property records, west palm beach property tax records, palm beach property records, palm bay property records, virginia beach property tax records, palm springs property tax records, palm springs property records, palm beach gardens property records, palm beach property records search, palm beach county florida property tax records, palm beach property tax collector