Credit Union Savings Account Interest Rates – This is a summary of this topic. This is a collection of several blogs that discuss this. Each title is linked to the original blog.

Interest rate is one of the most important factors to consider when it comes to savings accounts. The higher the interest rate, the more money you can earn from your savings. However, understanding the relationship between interest rates and savings accounts can be confusing. In this section, we will explore this relationship and provide insights from different perspectives.

Credit Union Savings Account Interest Rates

Interest rates have a direct impact on the amount of money you earn in a savings account. If the interest rate is high, the interest earned on your savings account will also be high. Conversely, the lower the interest rate, the less interest your savings account earns. That’s because banks use interest rates set by the Federal Reserve Bank to determine the interest rate they pay on savings accounts.

Gxs Bank Vs Trust Bank Vs Maribank: Which Digital Bank Should You Choose?

The Federal Reserve Bank plays a critical role in setting interest rates in the United States. The Federal Reserve sets the target federal funds rate, which is the interest rate banks charge each other for overnight loans. When the Federal Reserve raises the federal funds rate, banks also raise the interest rate they pay on savings accounts. When the Federal Reserve lowers the federal funds rate, it also lowers the interest rate banks pay on savings accounts.

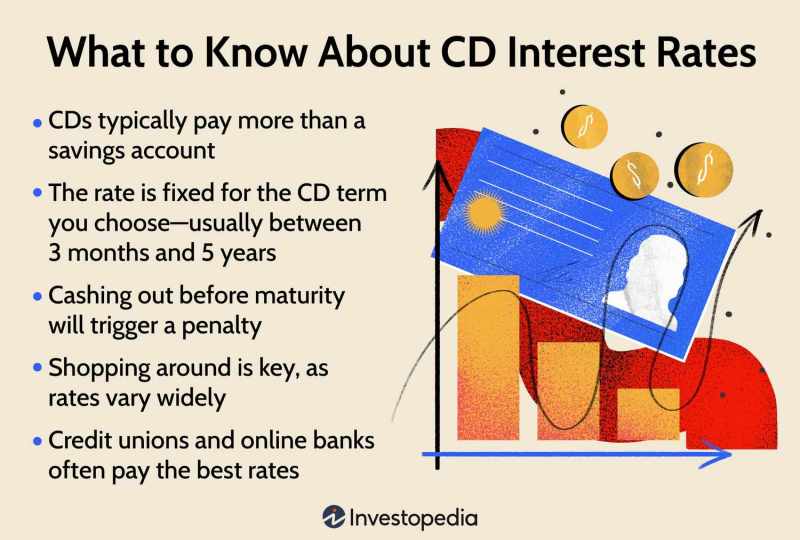

When choosing a savings account, you usually have a fixed or variable interest rate. The fixed interest rate remains the same throughout the life of the account. A variable interest rate, on the other hand, can change over time based on market conditions. While a fixed rate offers more stability, a variable rate can offer higher returns when interest rates rise.

High-yield savings accounts are a popular choice for those looking to earn more from their savings. These accounts typically offer higher interest rates than traditional savings accounts, but may require higher minimum balances or limit the number of withdrawals you can make each month. While high-yield savings accounts can be a great way to earn more savings, it’s important to compare fees and minimum balance requirements to make sure you’re getting the best deal.

When choosing a savings account, it’s important to consider your specific needs and goals. If you’re looking for a stable, low-risk option, a traditional fixed-interest savings account may be a better option. If you’re willing to take on more risk for higher returns, a high-yield savings or variable rate account may be a better option. It’s important to compare the interest rates, fees and minimum balance requirements of different accounts to find the one that’s right for you.

Canada High Interest Savings

Understanding the relationship between interest rates and savings accounts is critical to maximizing your savings. By considering the Federal Reserve’s role in setting interest rates, the difference between fixed and variable interest rates, and the benefits of high-yield savings accounts, you can make an informed decision when choosing a savings account.

Understanding the Relationship Between Interest Rates and Savings Accounts – How the Bank’s Rate Monitor Index Affects Your Savings Account

An important aspect to consider when managing personal finances is the impact of interest rates on savings accounts. The interest rate is the money a bank pays a depositor for keeping their money in a savings account. The higher the interest rate, the more money the investor earns in their savings account. This chapter explores the impact of interest rates on savings accounts and provides insights from a variety of perspectives.

1. Effect on savings growth: Interest on a savings account directly affects the growth of savings over time. Higher interest rates mean savings will grow faster, while lower interest rates mean slower growth. For example, if someone has $10,000 in a savings account with 1% interest, they will earn $100 in interest per year. However, if the interest rate is 2%, they will earn $200 in interest, so the savings will grow faster.

High Yield Savings Accounts And Cds: What’s The Difference?

2. Impact on Inflation: Inflation is the rate of increase in prices of goods and services over time. If the interest rate on the savings account is below inflation, the purchasing power of the savings will decrease over time. For example, if the inflation rate is 2% and the interest rate on the savings account is 1%, the savings will lose value over time because the interest earned will not keep pace with inflation.

3. Impact on Emergency Funds: Savings accounts are often used for emergency funds because they are easily accessible and low risk. A higher interest rate in a savings account can help your immediate funds grow quickly and provide a larger safety net in case of unexpected expenses.

4. Impact on investment decisions: When interest rates on savings accounts are low, some people may choose to invest their money in riskier assets with higher returns. This results in a higher return on investment, but also a higher risk. It is important to carefully consider investment decisions and consult with a financial advisor before investing.

5. Best Savings Account Choice: The best savings account choice depends on individual financial goals and circumstances. A high-income savings account offers a higher interest rate than traditional savings accounts, but may require a higher minimum balance. It’s important to shop around for the best interest rate and consider the fees associated with each account. You may also want to consider other low-risk investment options, such as certificates of deposit or money market accounts.

Growing Wealth Together: Credit Union Savings Accounts

Interest rates have a big impact on savings accounts and personal finances. It is important to carefully consider savings account interest rates and other investment options and your personal financial goals before making any decisions.

The Impact of Interest Rates on Savings Accounts – Interest Rates: Explore the impact of interest rates on the cost of funds

Interest rates play a crucial role in the world of finance, affecting many aspects of our financial lives. One area where interest rates have a big impact is savings accounts. Whether you have a traditional savings account at a bank or a high-yield savings account at a credit union, understanding the relationship between interest rates and savings is critical to making informed financial decisions. In this chapter, we’ll delve into the complexities of this relationship, examine how interest rates affect your savings, and what factors influence those rates.

1. Basis of interest rates: To understand the relationship between interest rates and savings accounts, it is important to first understand the basis of interest rates. In general, the interest rate represents the cost of borrowing money or the return on investment of borrowed money. When it comes to savings accounts, interest rates determine how much extra money you’ll earn from your invested funds. Higher interest rates mean your savings will grow faster, while lower interest rates mean slower growth. It must be remembered that interest rates are affected by various factors such as inflation, monetary policy set by central banks and the general state of the economy.

Why Do High Yield Accounts Have More Fees And Penalties? :: Onpath Update Post Details

2. Impact on Savings Growth: The interest on your savings account directly affects the growth of your savings. Let’s consider an example to illustrate this point. Let’s say you have $10,000 in a savings account with an interest rate of 1%. At the end of the year, you’ll earn $100 in interest, giving you a total balance of $10,100. However, if the interest rate is 2%, you will earn $200 in interest, leaving a balance of $10,200. This simple example shows how high interest rates can significantly affect the growth of your savings over time.

3. High-Yield Savings Accounts: High-yield savings accounts, often offered by credit unions, are known for their competitive interest rates. These accounts typically offer higher interest rates than traditional savings accounts, so your savings can grow faster. For individuals looking to maximize their savings potential, high-yield savings accounts are a valuable option. However, it is important to note that these accounts may have certain requirements, such as maintaining a minimum balance or limiting the number of withdrawals per month.

4. Influence of the Federal Reserve: The Federal Reserve Bank, the central bank of the United States, plays an important role in setting interest rates. By making monetary policy decisions, the Federal Reserve can influence the cost of borrowing money, and therefore interest rates on savings accounts. For example, when the Federal Reserve lowers interest rates, it seeks to stimulate economic growth by stimulating credit and spending. But lower interest rates also mean lower returns on savings accounts. Conversely, when the Federal Reserve raises interest rates, it seeks to curb inflation and control economic growth. This could lead to higher interest rates on savings accounts, which would benefit savings accounts

Best credit union savings account interest rates, credit union interest rates on savings accounts, credit union with best savings interest rates, federal credit union savings account interest rates, union bank savings account interest rates, state employees credit union savings account interest rates, teachers federal credit union savings account interest rates, delta community credit union savings interest rates, state employees credit union savings interest rates, union bank savings interest rates, alliant credit union savings interest rates, credit union savings interest rates