Rivermark Community Credit Union Phone Number – You are using an older browser that is no longer supported by Nextdoor. Please upgrade to a supported browser in our Help Center to continue using Nextdoor.

I am seeking advice from my bank or credit union about applying for a home equity loan. See more…

Rivermark Community Credit Union Phone Number

I’m a new mom trying to be a stay-at-home mom to raise my kids, but god knows rent in Portland is getting tough. And only my partner is working now. I am looking for work from home. If anyone knows anything or knows the best places please let me know, I’ve actually applied to a few places. But still no reply.See more…

Unitus Community Credit Union News Via Flashalert.net

Look on YouTube, there are many posts encouraging women to join companies. I saw it last night to work from home, can’t remember the name. I’ve heard before… see more

Rivermark is not your average credit union or bank – we’re better! ATM Open from 8:00 a.m. to 7:00 p.m. to 8:00 p.m. Online accounts and loan applications are available 24/7. Banking has never been easier. Our average member saves over $390 compared to competitors. Put more money in your pocket. If you live or work in the area you can join. With more than 40,000 ATMs across the country and powerful online and mobile banking apps. You can do business with Rivermark at your convenience. Not the other way around, Rivermark also invests in local communities. We believe the local economy is what makes Oregon a great place to live and work. When local families and small businesses did well, everyone prospered. We donate money to local charities like Doernbecher Children’s Hospital, Oregon Food Bank. And our own foundation to help everyone access the tools and resources to live happy and productive lives. Discover Rivermark today. You will be glad you did. See more… Please note that you are linking to a website that is not affiliated with or operated by Rivermark Credit Union. Rivermark is not responsible for the content of this website. Our privacy and security policies may differ from those of Rivermark.

Rivermark Credit Union has partnered with Student Choice to offer private student loans to help you achieve your college education dreams. Whether you’re about to enter college or have already graduated. We have options to help you manage your student loans. Because college memories last forever, but college loans shouldn’t.

Our innovative Student Choice private student loan solution is designed to responsibly fill any funding gaps you may be left with. After you’ve exhausted all low-cost aid sources (federal scholarships, grants, and loans).

Neighborhood Night Out 2011

Take control of your student loan repayments by refinancing with Rivermark! You may be able to refinance and consolidate federal and private student loans. (including PLUS loans) by setting up one easy monthly payment into a single manageable source of credit.

Flexible tenure (5, 10 or 15 years) and zero origination fee with competitive interest rates. Our refinance loans help you expand your capital while making your life easier.

Keep this in mind when refinancing your federal student loans. You may lose some benefits as a borrower on your original loan. These may include interest rate discounts. Repayment of principal Suspension of loan repayment or certain cancellation/forgiveness benefits. This can significantly reduce your loan repayment costs. Consider these benefits carefully when considering your options for refinancing your federal student loans. The federal government has temporarily suspended payments and interest on federal student loans. The U.S. Department of Education provides an update on the moratorium’s deadline.

What are my payment options? You can pay in full or interest while you’re in school, or wait until six months after you graduate to start making payments.

Rivermark Community Credit Union On Linkedin: Credit Union Day At The Capitol Is An Opportunity For Professionals To…

How do student loan lines work? You will be approved for a refundable amount for the remainder of your college education without reapplying each year. Your school decides how much you get each year.

How do I get my money? It goes directly to your school to pay tuition and other expenses. You will receive a check from your school if there are any remaining funds.

Can existing student loans be consolidated? Consolidate up to $125,000 of your current private student loans into one payment. There are tiered payment options to choose from. Reduce your down payment further. learn more

College Savings Tips for All Ages Many people spend more than or equal to their income each month. It makes saving money for college difficult or impossible. Here are some money saving tips for all ages.

Here Are All Of The Banks That Currently Support Apple Pay

Pay off student loans fast Dealing with a large amount of student loans can be difficult. Fortunately, there are methods you can use to manage your debt and pay it off quickly.

Going to college Going to university is a big life-changing event. Check out common college costs, pitfalls, and money-saving tips.

Keep this in mind when refinancing your federal student loans. You may lose some benefits as a borrower on your original loan. These may include interest rate discounts. Repayment of principal Suspension of loan repayment or certain cancellation/forgiveness benefits. This can significantly reduce your loan repayment costs. Consider these benefits carefully when considering your options for refinancing your federal student loans. The federal government has temporarily suspended payments and interest on federal student loans. The U.S. Department of Education provides updates on the deadline for the hiatus at scholarship.gov/coronavirus. Refinancing disclaimer to view the latest information

All loans are subject to credit eligibility and additional criteria. This includes graduation from an approved school and membership in the Rivermark Community Credit Union. You can apply without being a credit union member. But you need to be a member to get funding.

Rivermark Community Credit Union Clackamas, Or

Student loans are available from Rivermark Community Credit Union and refinance. The application process for Rivermark Community Credit Union is available from Student Choice Credit Union. Loan and repayment services are available through University Accounting Services, LLC on behalf of Rivermark Community Credit Union. Please note that you are linking to a website that is not affiliated with or operated by Rivermark Community Credit Union. Rivermark is not responsible for the content of this website. Our privacy and security policies may differ from Rivermark’s policies.

Have you found your dream home and need to refinance or use your home? Look no further than Rivermark. Our local mortgage brokers are happy to answer any questions you may have or offer advice on the home loan process. You can trust Rivermark for honest advice. Local service and competitive pricing

Your rate will not be locked until you receive confirmation from a mortgage loan officer. We look forward to serving you. Apply online and get an estimated mortgage calculator.

Start your application online for faster service. Rivermark’s mortgage experts can help you get pre-approved faster. A pre-approval shows real estate agents that you are a serious buyer. And can help expedite the transaction when you’re ready to buy. Call us at 503.906.9497.

Rivermark Opens New Cedar Hills Branch

*$300 base fee discount based on primary borrower opening Rivermark checking account and debit card at closing.

Are you thinking of buying a house? Fascinating! There are several important decisions to make when buying a home. It’s a process that can be both exciting and a little scary. Decisions like these come with a lot of planning. There are steps to consider before hiring a real estate agent and conducting an impressive search across town.

A fixed rate mortgage gives you a fixed rate and monthly payments for the entire loan term. We offer fixed rate mortgages with terms of 10, 15, 20 or 30 years.

ARMs can start at lower rates than fixed-rate loans. But the fee may be adjusted up or down from time to time. Rivermark ARMs start with introductory terms of 5, 7, or 10 years.

Ezassi Announces New Partnership With Rivermark Community Credit Union

Jumbo Loans These mortgages (for loan amounts over $726,200) are intended to make high-priced, luxury homes more affordable. Available for fixed or variable rates.

Buying a home is one of the most important financial decisions you will make. And our mortgage loan officers are ready to help you every step of the way. Below is a high-level overview of the process.

Get started by calling a member of our mortgage team. They will help you choose the right product for you and start the pre-approval process. If you want you can apply online. And a mortgage loan officer will contact you directly. Once approved, you will receive a pre-approval letter.

Renting vs. Buying a Home Find out what fits your lifestyle and budget. It is always advisable to calculate before owning a house.

Rivermark Community Credit Union, 14935 Se 82nd Dr, Clackamas, Or

Fixed Rate vs. Adjustable Rate Should You Get a Fixed or Adjustable Rate Home Loan? Here’s what you need to know about each of these rate options.

Home Loan Resources Our Home Loan Resources page has helpful articles. Calculator and other tools to help you make informed decisions

“My experience with Rivermark was excellent. The service was attentive and transparent. The prices are the best I’ve ever seen. (I shopped for weeks) and

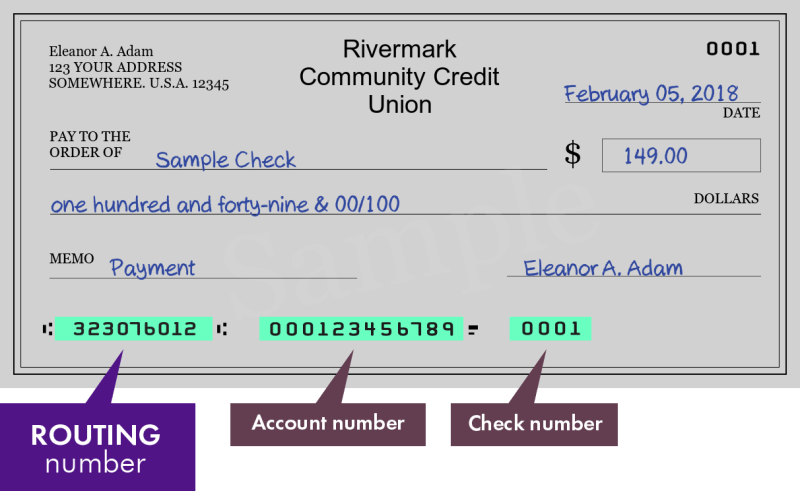

Rivermark community credit union reviews, rivermark community credit union hours, rivermark community credit union hawthorne, rivermark community credit union locations, rivermark community credit union gresham, rivermark community credit union routing number, rivermark credit union phone number, rivermark community credit union careers, rivermark community credit union portland, rivermark community credit union beaverton, rivermark community credit union login, rivermark community credit union