Comprehensive Insurance – The best ways to ruin your day. . . Your car is destroyed! While collisions are scary (and expensive), there’s more than one way to damage a car—it can be damaged even if you’re not driving!

Your collision insurance covers this and covers damage to your car caused by other types of disasters, such as falling trees, fires or wild animals. (Seriously, why do deer run away?)

Comprehensive Insurance

We’ll talk about what comprehensive insurance covers, how it works and whether you need it. (Spoiler alert: you probably do!)

Overview: In Which Cases Is It Helpful To Have Comprehensive Insurance? · Lhv

But first, let’s go over some basic concepts you need to know when learning comprehensive coverage.

To truly understand comprehensive insurance and how it works, it’s helpful to know some of the terms you may encounter when shopping around. here we are!

Actual Cash Value: As it sounds, this is what you would expect to get from your car if you were to sell it in its current condition. Of course it is

Collision Insurance: Consider road traffic accidents. This insurance coverage pays to repair or replace your car if it rolls over, is damaged in an accident with another vehicle or

Comprehensive Vehicle Insurance Will Make New Vehicles Costlier!

Deductible: The dollar amount you have to pay out of pocket when you file a comprehensive insurance claim. The higher your deductible, the lower your premiums – and vice versa. (More on that below.)

Comprehensive coverage as well as liability insurance, so you have this beautiful thing called full coverage auto insurance. Full coverage insurance can be expensive! But if you get a good rate, it’s worth spending the extra money to have the peace of mind that your car’s damage is covered for all types of mishaps.

Due to a collision with another vehicle or fixed object. Some of the most common examples of comprehensive coverage include:

There are many types of car insurance, so it is understandable that people confuse comprehensive insurance with collision insurance. fallacy

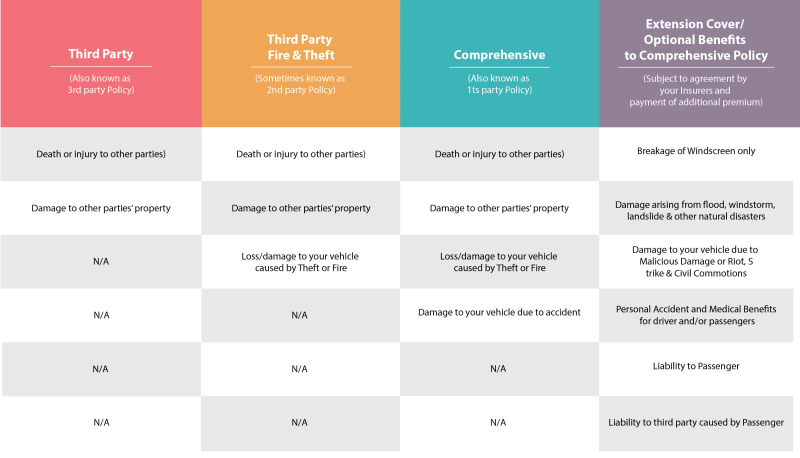

What Is The Difference Between Third Party Liability And Comprehensive Car Insurance?

For complete protection on the road or driveway. To keep them straight, let’s look at both types side by side and see where comprehensive insurance lies.

And when do you think comprehensive? Think of it as a separate (but related) coverage policy that usually doesn’t cover damage while driving. pass

Although collision is a separate type of comprehensive coverage, insurance companies often bundle it with comprehensive coverage. So don’t be surprised if you want to buy one type, you also buy the other.

A RamseyTrusted professional can research the best auto and home insurance deals to get you quality coverage without breaking the bank.

How The New Comprehensive Insurance Rules Impact You

. Have you suffered from cold damage? (Those snowballs can go deep!) The amount you pay out of pocket to repair a dent or other damage caused by a covered event may be deductible.

. The policy limit is usually what the car is worth now, not what you originally paid for it. (Sorry, but those are the rules. That’s what insurance is for.)

Anna’s car is worth $7,000. She hit a deer and did $1,500 in damage to her car. The cost of repairs is less than the total value of the car, so the insurance company will pay less

From the policy maximum. In this case, Anna pays her deductible of $500, and the insurance company pays the remaining $1,000. (Thank goodness she has an emergency fund to cover her portion of the repairs!)

What Is Comprehensive Car Insurance?

Christie’s car is valued at $10,000. One morning she got into the car to go to work. But it was stolen from her. She has a comprehensive deductible of $1,000, so the insurance company writes her a check for $9,000, the value of the car.

Jeff’s car is worth $3,000. He was driving home and a ladder fell from a construction truck in front of him. The ladder hits him and he turns serious

It was damaged under his car. Repair bill: $3,500. Since the repair costs exceed the car’s value, the insurance company decides it’s a total loss and not worth repairing.

At this point, Jeff has a choice to make. If he’s like most people who own a vehicle in total, he’ll choose a $2,000 deductible from his comprehensive coverage (the value of the car minus the $1,000 deductible). But Jeff might not be able to let go of his crush

Guide To Comprehensive Insurance Cover & Add Ons

He’s happy to watch a DIY mechanic’s YouTube channel called “Overhaul Your Underbelly!” (Hey, these guys exist and have amazing car repair skills, right?)

In this case, Jeff can settle with the insurance company to keep the pile and get a salvage bond—and he’ll also get a much lower payout because he’s buying the car back from the insurance company. Also, he won’t be able to drive it until it’s fixed

If your deductible is low, your auto insurance company will likely lose money that helps pay for repairs. To compensate for this risk, they charge higher premiums. You’ll pay more for coverage — and the longer you go without a claim, the more money the insurance company will make from your premiums.

You must file a claim. But you’ll pay lower monthly premiums – the longer you don’t make a claim, the more you’ll save.

Insurance 101: Comprehensive Coverage

And don’t forget your emergency fund! If you’ve done Baby Step 1, you can choose a deductible of $1,000, which is the amount you’ve saved for emergencies. And if you’re in Baby Stage 3 and have a fully funded emergency fund, you can get a discount and lower premiums! One of the best ways to save money on insurance is to choose high deductibles with low premiums.

What are the baby stages? It’s a step-by-step plan that millions of people have used to save money, pay off debt, and build wealth. You can learn more about Baby Steps – and many other financial topics (like insurance) at Financial Peace University.

We believe that comprehensive insurance is always a good addition to your car insurance. After all, car accidents happen, but they don’t

Comprehensive insurance protects you financially if the above types of accidents occur. Instead of paying the full cost of repairing or replacing your car after a mudslide or high-speed deer collision, you’ll get help from your insurance company—saving you money and focusing on your big financial goals.

What Is Comprehensive Insurance And What Does It Cover?

Another sad but common situation where you’ll need comprehensive insurance: if you’re leasing or financing your car. (This is something you shouldn’t have done, by the way, because debt always slows down your financial progress.) But if you get into it now, your lender probably will.

The only downside we see with comprehensive coverage is that it may end up costing you more than it’s worth, but that’s an unusual situation. For example, your car may lose so much actual cash value that it falls below your insurance amount. Will you be lucky to get $1000 from Facebook Marketplace? Then a $1,000 deductible means you’re paying for a policy that won’t cost you anything even if your car is totaled. (By the way – if your car is real

So if you ride the collar past baby stage 2, you’ll get a pass for it. . . now. But when you buy a car that’s worth a little more, get comprehensive insurance to match it! And if you already own a qualifying vehicle, you’ll need comprehensive coverage as soon as possible.

Comprehensive coverage is generally suitable for everyone. This is especially important if you live in an area prone to natural disasters, such as wildfires in California, hurricanes in Florida, or hurricanes in Oklahoma, or if you live in a large city where others are likely to be negligent and cause damage to your home. . Auto (Hello Chicago). And if

Fully Comprehensive Car Insurance: What Is Fully Comprehensive Car Insurance Coverage?

Important if you are in baby stage 1 or 2 where you don’t have enough money to replace the car.

Comprehensive car insurance is essential, but that doesn’t mean you have to pay an arm and a leg (or lungs and kidneys if your insurance company is sick) for it. It can be really affordable! Through our trusted insurance benefits network, you can find an independent insurance agent in your area to get the best deals on comprehensive coverage.

Contact a RamseyTrusted insurance professional to confirm your coverage and learn how to save money on your car insurance.

If your car is lost when you return to where you left it, it can be towed because it was parked illegally. Before you contact your comprehensive insurance provider, make sure you understand what happened. But it can also be stolen! In this case, call the number. Of course, comprehensive insurance covers theft, but remember you’ll be responsible for the deductible to replace it.

Comprehensive Insurance Coverage

If an animal is hit on the road and you crash into it or fall into a ditch trying to avoid it, any resulting damage will be covered by your comprehensive insurance policy.

Comprehensive coverage does not cover any damage to your vehicle that occurs when it collides with another vehicle or a fixed object. This is the purpose of your collision policy. Other costs you won’t be able to cover

Best comprehensive car insurance, comprehensive general liability insurance, cheapest comprehensive car insurance, comprehensive car insurance compare, comprehensive car insurance rates, best comprehensive pet insurance, comprehensive liability insurance, comprehensive business insurance, full comprehensive insurance, aami comprehensive car insurance, comprehensive motorbike insurance, cheap comprehensive insurance