Bankruptcy Attorneys In Knoxville Tn – Bankruptcy is a complex process, so it’s important to find the right attorney for your needs. Fortunately, The Pope Firm has the best Chapter 7 lawyers in Knoxville, Tennessee. Our team of experienced attorneys can help you navigate the complexities of bankruptcy and ensure you get the best possible outcome for your situation. We specialize in all aspects of bankruptcy law, including but not limited to Chapter 7 filings, asset protection, debt relief, and more. Whether you need guidance through a complicated Chapter 7 filing or help with asset protection and debt settlement, we can help.

We understand that filing for bankruptcy is not an easy decision. That’s why we work hard to make sure you get the best results and help you get back to work as quickly as possible. Our team of experienced bankruptcy attorneys in Knoxville, Tennessee will handle all paperwork, provide legal advice and represent you in court if necessary. We will help you make the best decision for your situation and provide you with a clear plan of action so you can move forward with confidence.

Bankruptcy Attorneys In Knoxville Tn

At The Pope Firm, we understand that filing for bankruptcy in Knoxville is a difficult process and we are here to help you through this difficult time. Our bankruptcy attorneys will listen to your concerns, explain all of your options, and help you make the best decision for your situation. We are here to support and guide you every step of the way.

Upcoming Legal Advice Clinics For The Public

If you are looking for the best Chapter 7 bankruptcy in Knoxville and need help with your bankruptcy case, please contact us today. Our experienced attorneys have years of experience in Chapter 7 bankruptcy law and provide personalized services tailored to each client’s needs. Unpaid debt can lead to many negative consequences, such as fines, evictions, debt collection, creditor harassment, civil lawsuits, and more. One solution for people who cannot pay their debts and are at risk of experiencing these consequences is to file for bankruptcy.

Although there are several chapters under bankruptcy law, the two most common types of bankruptcy are Chapter 7 and Chapter 13. At the Law Offices of Meyer & Newton, our Knoxville certified bankruptcy attorneys have handled more than 50,000 cases in the Eastern District. Tennessee. We have the knowledge and experience to help you make the right decision about whether bankruptcy is right for you and which chapter to file.

Understand that bankruptcy is not for everyone, which is why it is important to speak with our experienced legal team before filing for bankruptcy. In addition, the installation process is complicated, and it is important to make sure that things are handled correctly. Many people are denied in their bankruptcy petitions because they do not have a qualified legal counsel to guide them. Don’t let this happen to you.

Call (865) 328-7993 now for a free consultation. Our experienced and trained legal staff is ready to assist you and can make an appointment that is right for you.

University Of Tennessee College Of Law

It is important to understand the difference between the two most common types of bankruptcy, Chapter 7 and Chapter 13. Let’s start with Chapter 7. This type of bankruptcy is often called a “straightforward bankruptcy” or a “divorce.” This mainly involves forgiving or canceling your unsecured debt.

Chapter 13 covers personal debt restructuring. Savers can consolidate their loan in one monthly payment over three to five years. Once the repayment plan is successfully completed, all outstanding debts will be paid off.

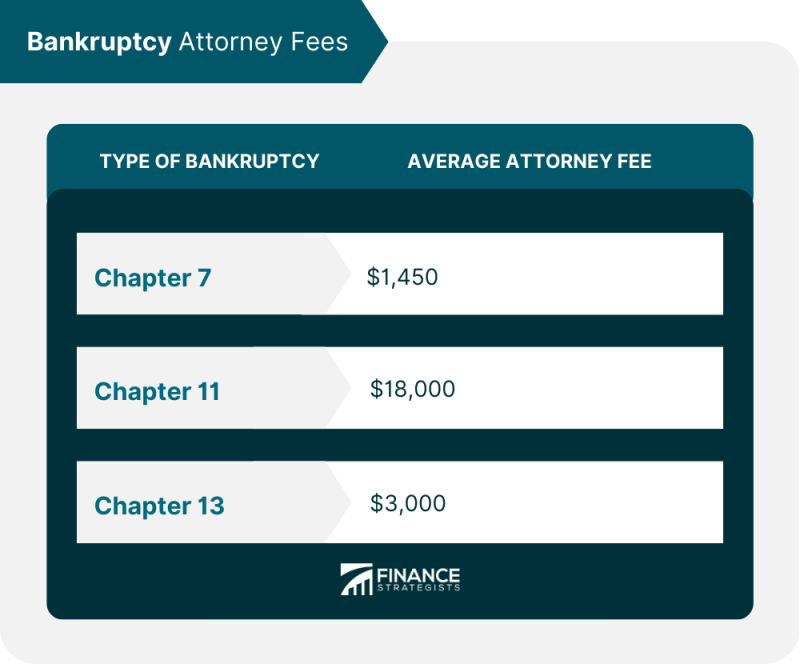

The cost of filing bankruptcy in Tennessee includes various fees and expenses. These fees can vary depending on the complexity of your case and the bankruptcy season you file. Some things to consider about the cost of filing bankruptcy are filing fees as well as hiring an attorney.

In Kentucky, there is no time limit for when you can file for bankruptcy. However, the time between filing and the type of bankruptcy you previously filed may affect your ability to obtain certain types of bankruptcy.

Tennessee Attorney General Herbert Slatery Iii To Retire This Week, Return Home To Knoxville

The waiting time between filing bankruptcy depends on the type of bankruptcy you previously filed and the type of bankruptcy you are filing now. The time frame may vary depending on the specific circumstances of your case and the bankruptcy laws in your jurisdiction. To make sure you are waiting for the right deadline, be sure to contact a qualified attorney near you at a Mayer & Newton law office.

Please be aware that while re-filing for bankruptcy is possible, the court may look at your case more closely and consider factors such as the cause of your previous bankruptcy and whether there was abuse.

Those who are facing financial difficulties and struggling to pay their debts can file for bankruptcy. Bankruptcy provides a legal process for people who are looking to get rid of their debts and get a fresh financial start. However, it is important to note that there are specific requirements and conditions that must be met to qualify for bankruptcy.

Eligibility requirements and the type of bankruptcy you can file depend on a variety of factors, including your income, assets, and the nature of your debts. The two most common types of bankruptcy for individuals are Chapter 7 and Chapter 13.

Car Accident Attorneys

To determine if you qualify for bankruptcy and which type of bankruptcy is best for your situation, it is best to consult with a bankruptcy attorney. They can assess your situation, explain the bankruptcy process and guide you through the necessary steps to file for bankruptcy.

Here we offer a free consultation to discuss your bankruptcy options. Having filed over 50,000 cases, we have extensive experience helping individuals and businesses navigate the bankruptcy process. We understand the financial difficulties that bankruptcy can cause, which is why we offer $0 in Chapter 7 and Chapter 13 cases. Our aim is to provide accessible and affordable legal services to those in need.

When you book with us, you can provide a full breakdown of bankruptcy filing costs and explain our payment options. Our team is dedicated to guiding you through the bankruptcy process and helping you get a fresh financial start.

Please note that it is important to consult with an attorney to obtain the most accurate and up-to-date information on bankruptcy attorney fees and costs in Tennessee, as these may change over time. Such as credit card payments, medical bills, mortgages, etc. Please call our office at (865) 328-7993 so we can come to our office to speak with an attorney at your convenience to discuss your Chapter 13 or Chapter 7 filing. Bankruptcy will prevent foreclosures, repossessions, and lawsuits.

The Best 10 Lawyers Near 5113 Kingston Pike, Knoxville, Tn 37919

If you can file for Chapter 13 bankruptcy, the unsecured debt can sometimes be paid less than 100%, depending on your circumstances. Car loan payments can be reduced and repaid over time.

If you can file for Chapter 7 bankruptcy, you may be able to discharge some or all of your unsecured debts, be able to offer collateral such as a car, and avoid payments on household items and items on your home. keep in Contact our experienced attorneys today to discuss your situation and develop a legal strategy to protect your interests.

To request a free consultation about your case with our law firm, call us today at (865) 328-7993.

If you are behind on your mortgage payments, facing foreclosure, or want to avoid debt collection, please contact our law firm to speak with an experienced bankruptcy attorney. Help you get debt relief.

Knoxville Law Firm

Our firm specializes in consumer bankruptcy, whether Chapter 7, Chapter 13 or Chapter 11. Richard Mayer and John Newton have more than 60 years of combined experience to bring their bankruptcy knowledge back to life.

Meyer & Newton has filed over 50,000,000 cases in the East Tennessee District. John Newton is a Chapter 7 trustee and has handled more than 15,000 cases, in addition to serving as debtor’s attorney in over 200 Chapter 11 small business reorganization cases. As an attorney, John Newton heard or reviewed six cases through the Sixth Circuit Court of Appeals.

Richard Mayer and John Newton both attended a seminar by consumer bankruptcy expert Max Gardner. Mr. Newton graduated from Max Gardner’s banking boot camp and Mr. Meyer is a graduate of the Foreclosure Defense Boot Camp.

Our experienced staff of attorneys, who have worked not only in bankruptcy courts, but also in the offices of Chapter 13 petitioners, some of whom bring a working knowledge of the process as they walk you, your own business. goes according to

Eli N. Hardin

Bankruptcy attorneys in nashville tn, bankruptcy knoxville tn, bankruptcy attorneys in memphis tn, attorneys in knoxville tn, estate attorneys in knoxville tn, female divorce attorneys knoxville tn, bankruptcy lawyers in knoxville tn, bankruptcy attorneys in mn, knoxville bankruptcy attorneys, knoxville tn personal injury attorneys, divorce attorneys in knoxville tn, bankruptcy court knoxville tn