America First Credit Union Home Refinance Rates – By clicking “Accept All Cookies”, you agree to the storage of cookies on your device to improve site navigation, analyze site usage, and assist in our marketing efforts.

A cash-out refinance pays off your old mortgage in exchange for a new mortgage, preferably with a lower interest rate. A home equity loan gives you cash in exchange for the equity you’ve built up in your property as a separate loan with separate payment dates.

America First Credit Union Home Refinance Rates

A cash-out refinance is a mortgage refinance option in which an old mortgage is replaced with a new mortgage that is higher than the amount owed on a pre-existing loan, helping the borrower access cash using the their home mortgage.

Mountain America Credit Union In Utah & The West

You will typically have to pay a higher interest rate or more points on a cash mortgage than if you refinance with an interest rate and term that keeps the mortgage amount the same.

Lenders determine how much money you can get with a cash-out refinance based on the bank’s criteria, your loan-to-value ratio, and your credit profile. Lenders will also evaluate the terms of your previous loan, the balance needed to repay the previous loan, and your credit profile.

The lender then makes an offer based on the underwriting analysis. The borrower takes out a new loan that repays the previous loan and locks it into a new monthly payment plan for the future.

The main advantage of a cash-out refinance is that the borrower can realize some of the value of the property in cash.

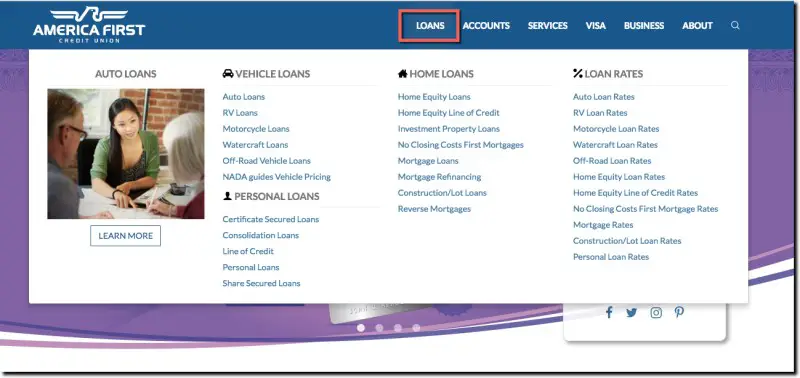

Ui Showcase: America First Credit Union’s Navigation

With a standard refinance, the borrower never sees cash on hand, just a lower monthly payment. Loan-to-value ratios for a cash-out refinance can go up to around 125%.

This means that refinancing can pay off the debt they owe, so borrowers are entitled to receive up to 125% of the value of their home. The amount above the mortgage repayment is given in cash, like a personal loan.

On the other hand, there are some disadvantages to cash-out refinancing. Cash loans typically have higher interest rates and other costs, such as points, compared to rate and term refinancing.

Cash loans are more complex in terms of interest rates and terms, and often have higher underwriting standards. A high credit score and low relative loan-to-value ratio can alleviate some concerns and help you get a better deal.

High Mortgage Rates Are Probably Here For A While

A home equity loan allows you to borrow against the equity in your home; the difference between its current value and the balance due on your mortgage. Home equity loans tend to have lower interest rates than unsecured personal loans because they are secured by your property, and here’s the problem: If you default, the lender can go after you. your home

Home equity loans also come in two forms: a traditional home equity loan (single loan) and a home equity line of credit (HELOC).

A traditional home loan is often called a second mortgage. You have a primary mortgage and are now taking out a second loan against the equity you have built up in your property. The second loan is subordinated to the first loan: If a default occurs, the second lender is placed behind the first loan to collect any foreclosure proceeds.

As a result, home loan interest rates are generally higher. Lenders are taking on more risk. A HELOC is sometimes called a second mortgage.

Current Mortgage Rates: Compare Today’s Rates

A HELOC is like a credit card tied to the equity in your home. During a period of time after taking out the loan (called the drawdown period), you can usually borrow as much as you need from your credit, although some loans require an initial withdrawal of a set minimum amount.

If you do not use your credit limit at any time during the scheduled period, you may be required to pay a transaction fee or an inactivity fee on each withdrawal.

During the withdrawal period, you only pay interest on the borrowed amount. When the withdrawal period ends, so does your credit limit. When the repayment period starts, you start paying back the principal and interest.

All home equity loans usually have fixed interest rates, but some are adjustable, and HELOCs usually have variable interest rates.

Low Interest Rates Of Housing Loans In Japan

The APR on a home equity line of credit is calculated based on the loan’s interest rate, while the APR on a traditional home equity loan typically includes loan origination costs .

The main benefit of a home loan is that it unlocks the cash value of your home equity. You will typically receive a lump sum payment, and another advantage is that it can be used for any purpose, including renovations and improvements to your property, which can then increase its value.

Discrimination in mortgage lending is illegal. If you think you have been discriminated against because of your race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take ‘ you take One of those steps is to file a report with the Consumer Financial Protection Bureau and/or the US Department of Housing and Urban Development (HUD).

In principle, a cash-out refinance gives you the fastest access to the money you have invested in your property. With a cash-out refinance, you can pay off your current mortgage and move in

Interest Rate Hike: Pros, Cons And How To Benefit

Enter a new one. This makes things easier and can quickly free up a lot of money that can even help increase the value of your property.

On the other hand, cash-out refinancing tends to be more expensive than home loans in terms of fees and percentage points. You will also need to have a good credit score to get approved for a cash-out refinance, as underwriting standards are generally higher.

If you don’t plan to live in your home long-term, refinancing may not be the best option; A home equity loan may be a better option because closing costs are lower than refinancing.

Home equity loans are easier to obtain for borrowers with lower credit scores and can unlock just as much equity as a cash-out refinance. Home loans tend to cost less than a cash-out refinance and are much simpler.

Should You Refinance Or Reprice Your Home Loan?

However, home equity loans also have disadvantages. With this type of loan, you have a second mortgage in addition to the original mortgage, which means that you now have two liens on your property, which results in having two separate creditors, one for each Creditors may have claims against your house. This increases your risk level and is not recommended unless you are confident that you can make your mortgage and home loan payments on time each month.

Your ability to borrow through a cash-out refinance or home equity loan depends on your credit score. If your score is lower than it was when you originally bought the home, it may not be in your best interest to refinance, as doing so will likely increase your interest rate.

Before the application process for one of these loans, get your three credit scores from the three main credit bureaus. Discuss with potential lenders how your score may affect your interest rate if your score is not consistently above 740.

Applying for a home equity loan or home equity line of credit requires you to submit several documents to prove your eligibility, and both loans may have many of the same closing costs such as a mortgage. These include legal fees, title searches and document preparation.

Uob Absolute Cashback Card Review (2024): 1.7% Cashback, No Questions Asked

They also typically include an appraisal to determine the property’s market value, an application fee to process the loan, points (1 point equals 1 percent of the loan), and an annual maintenance fee. . However, sometimes lenders waive these, so be sure to ask about this.

Even if you refinance your home, the equity you’ve built up in your home over the years (whether through principal repayments or price appreciation) is still yours. While your equity will change over time with home market prices and your mortgage loan balance, the refinance itself will not affect your equity.

A cash-out refinance is a type of mortgage refinance that uses the equity you’ve built up over time to give you cash in exchange for a larger mortgage. In other words, with a cash-out refinance, you borrow more than you should on your mortgage and pocket the difference.

Usually not. You do not have to pay income taxes on the money you receive with a cash-out refinance. The money you receive from a cash-out refinance is not considered income. Therefore, you do not need to pay taxes on this money. Cash-out refinancing is not income, but a simple loan.

Mortgage Refinance Options

Cash out refinancing and home equity loans can benefit homeowners who want to convert their home equity into cash. To decide which move is best for you, consider how much equity you have available, what you will do with the money, and how long you plan to stay in your home.

Writers are required to use primary sources to support their work. Includes white papers, government data, original reports and interviews

Altura credit union refinance rates, delta credit union refinance rates, america first credit union refinance rates, america first credit union mortgage refinance rates, credit union refinance rates, credit union home refinance rates, best credit union refinance rates, america first credit union rates, america first credit union auto refinance rates, credit union auto refinance rates, safe credit union refinance rates, metro credit union refinance rates