Federal Credit Union Loan Rates – Contributor Content: This content was created by a Dow Jones business partner who is not affiliated with the news organization. Links in this article may earn us a commission. Find out more

We rate Navy Federal Auto Loans 9.0 out of 10 stars for high customer satisfaction, wide range of financing options, and low prices.

Federal Credit Union Loan Rates

Writer: Daniel Robinson Writer: Daniel Robinson Writer Daniel is a contributor to the Guides team and has written for a number of automotive news sites and advertising agencies in the US, UK and Australia, specializing in topics Auto finance and maintenance. . Daniel is the Management Group’s authority on auto insurance, loans, warranty options, auto service and more.

Nf Air Force Fcu

Edited by: Rashawn Mitchner Edited by: Rashawn Mitchner Managing Editor Rashawn Mitchner is an editor on the Guides team with more than 10 years of experience in financial and insurance matters.

During the Navy Credit Union auto loan review process, our Management will review the company auto loan and payment options available to the borrower. We’ll also explain how financing works, how to apply, and other financing options, including those with the best auto loan rates and best car trade-in rates .

Auto Loan Refinancing Best 72-Month Auto Loan Rates Can I refinance my mortgage and auto loan at the same time? Auto Loan Calculator Best Auto Refinance Rates How to Pay Off Your Loan Fast Should I Pay Off My Auto Loan Early? Auto Loan Terminology: Terms You Should Know (Guide)

Highlights Average monthly savings of $150 Work with a personal loan officer to compare options A+ BBB rating

Wakota Federal Credit Union Annual Loan Sale

Featuring prices as low as 0% on select cars, trucks and SUVs Free Online Quote – Get Your Car Live Target Price Today Local Dealers Compete for Offer the best prices for new cars.

Highlights No application fees Loan is an interactive platform with banks Loan agreements and terms depend on various factors, including education and work.

All APR figures were last updated on 7/14/2023 – please check partner websites for the latest information. This rate may vary depending on your credit score, credit history and loan term.

The Guidance team is dedicated to providing trustworthy information to help you make the best decisions about your auto financing. Because customers trust us to provide fair and accurate information, we’ve developed a comprehensive ranking system to create a ranking of the best auto loan companies. We collected data from 12 credit providers to rank companies based on a number of criteria. After 300 hours of research, the result is an overall ranking for each supplier, with companies receiving the most points at the top of the list.

Simple Loan Calculator

Fleet Federal Credit Union (NFCU) can be a good choice for borrowers because of its low interest rates on auto loans and auto refinances. However, you must be a military member, veteran or immediate family member to become a member and use any of the union’s financial products.

Advantages Competitive interest rates Multiple loan term options Provides auto loan pre-approval No prepayment penalties or early fees

Cons Must be a member of a credit union to apply and qualify for an auto loan or refinance Does not offer car leasing or lease purchase options.

Navy Federal Credit Union was founded in 1933 by seven employees of the Department of the Navy. Since then, this financial institution has grown rapidly and has more than 12 million members across the country.

Home Loan Rates & Apply

Membership in NFCU is open to active duty military members and veterans, as well as active duty or retired employees of the Department of Defense. Family members can immediately become members of Navy Federal Credit Union.

Members looking for a new car can join NFCU’s Car Buying Service. This feature helps you find a new car, get personalized offers on local inventory and arrange delivery for the car you choose to buy.

Fleet Federal Credit Union offers financing on new, used and luxury vehicles. Additionally, the company also offers loans for the purchase of other vehicles such as boats, motorbikes, and RVs. Like most credit unions, borrowers who qualify as members can apply for an auto loan or refinance.

Navy Federal Credit Union offers a pre-approval process for auto loans, which can help you negotiate a better sales price with the dealer. During the approval process, the credit union will conduct a rigorous credit check and request all necessary documentation to provide you with the loan amount and term for which you may qualify. Please note that a hard credit check may temporarily lower your credit score.

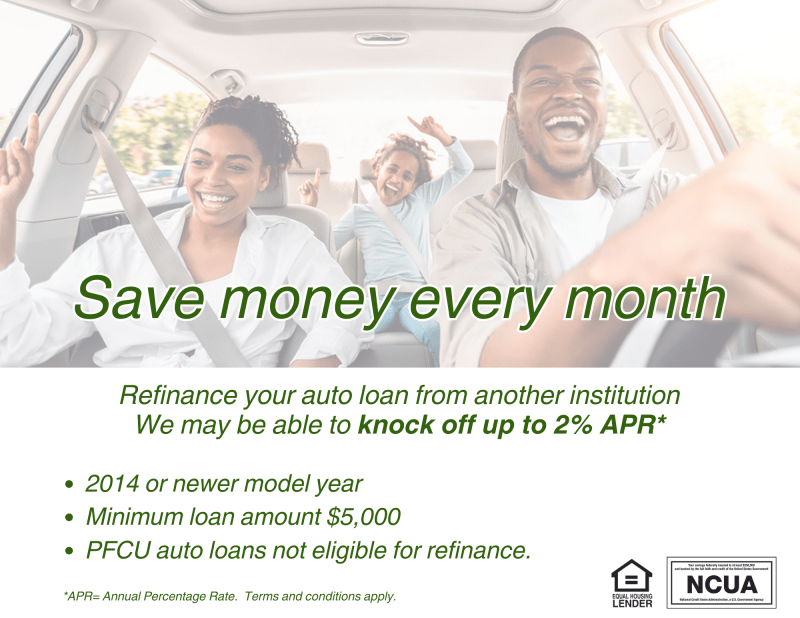

Princeton Federal Credit Union

Borrowers who qualify for a new or used car loan through Navy Federal Credit Union may receive lower interest rates. Auto loan terms range from one to eight years, although the lowest APRs are often found with loan terms lasting less than five years.

There are no application or down payment penalties for an auto loan for your new or used car. You can set up recurring payments on your auto loan through the Navy Federal Credit Union mobile app or online banking. You also have the option to pay extra if you want.

Refinancing your auto loan may be a good idea if you’ve improved your credit score or the interest rate is much lower than when you first took out the loan. Navy Federal Credit Union offers loans to refinance your car.

To refinance your car with Navy Federal, you must take out a loan of up to $5,000. The terms and APR for refinancing are the same as for new and used auto loans.

Credit Union In Salt Lake City

Our research shows that the company offers interest rates that are competitive within the finance industry, with annual percentage rates (APRs) as low as 4.54% on new car loans. However, only borrowers with excellent credit qualify for lower interest rates.

The company can also finance high-end and used cars for up to 180 months. The minimum rate for 60 months or less is 7.45% and anything above these terms is subject to an APR of 9.8% or higher.

To qualify for a Navy Federal auto loan, you must be a member. This requires you to be an active duty military member or a family member of someone who is serving. On the other hand, there are no minimum credit or income requirements to finance an auto loan with a lender.

Fleet Federal Credit Union members can apply online for auto loan approval. However, members with low credit scores should consider adding a cosigner to their application to increase their chances of being approved for federal loan products.

How Does Navy Federal Credit Union Have Such Good Rates?

If you are signing with a co-applicant, you must provide similar information about them as well.

Navy Federal Credit Union has a solid reputation supported by customer surveys and industry surveys. In J.D. Energy 2022 US Consumer Finance Survey℠, Navy Federal Credit Union received a score of 908 out of 1,000 points.

This gives the company the highest customer satisfaction score among financial institutions that offer auto loans for popular vehicles. However, Navy Federal Credit Union does not have legal standing in the investigation because of its membership.

On Trustpilot, this financial center has an average customer rating of 4.6 stars out of 5.0 from over 19,000 reviews. On the site, 90% of reviews give the company a “Good” or “Excellent” rating.

Credit Union Rates Fall Below Banks And Captives

While reviews on Trustpilot are mostly positive, customer reviews of Navy Federal on the BBB are mixed. The lender is not rated by the BBB and has an average star rating of 1.4 out of 5.0 from just over 140 users.

Our team reached out to Navy Federal Credit Union for comment on these scores but did not receive a response.

In November 2022, our Management team surveyed 2,000 borrowers across the country. Of those 2,000 people, 4% preferred Navy Federal Credit Union, making it the fourth most popular auto loan in the survey.

A Navy Federal Credit Union auto loan or auto refinance loan can be a great option for those who qualify for membership. Credit union members can take advantage of lower APRs and longer loan terms. If you’re not in the armed services or a member of a military family, you’ll have to look elsewhere for your car loan.

Expert Advice: How To Navigate Current Interest Rate Environment

While Navy Federal Credit Union can be a good choice for borrowers, its members limit who can apply for an auto loan or refinance. Search for auto loans and payment rates that will allow you to get the best APR for your new or used car. We recommend checking out MyAutoloan and Auto-Approval.

The myAutoloan marketplace allows borrowers to compare auto loan and refinance rates from multiple providers. The company offers auto loans for new and used car purchases, financing and purchases. On new car loans, interest rates start as low as 5.39% for terms ranging from 37 to 60 months. Used car loan interest rates start at 5.49% for terms between 37 and 60 months, and auto refinance rates can be as low as 4.01% for terms up to up to 36 months.

In the financial industry, myAutoloan is well known, receiving an A+ rating and accreditation from the BBB. The same goes for the company

Apple federal credit union auto loan rates, langley federal credit union loan rates, teachers federal credit union loan rates, teachers federal credit union personal loan rates, mission federal credit union car loan rates, navy federal credit union auto loan rates, coastal federal credit union auto loan rates, dover federal credit union loan rates, federal credit union car loan rates, arizona federal credit union auto loan rates, coastal federal credit union car loan rates, mission federal credit union auto loan rates