Business Insurance Las Vegas Nv – Everyone needs insurance for their property such as a car, home or business, or for something more recreational such as a boat, ATV or motorcycle. Their office also has other common types of insurance such as life insurance or business insurance. All Nevada Insurance, Inc. It serves Henderson and Las Vegas, NV, as well as Arizona, California, Colorado, Florida, Missouri, Nebraska, Nevada, New York, North Carolina and Utah.

We pride ourselves on providing quality insurance products to all the states we serve. Our licensed insurance brokers are experienced with local issues and regulations and can provide you with a personalized quote based on your needs. Don’t worry about the details of the coverage your situation requires because our agents can do it all for you. Additionally, all introductory quotes are offered as a free service to help new customers learn more about our company.

Business Insurance Las Vegas Nv

Our real estate agency deals with all types of insurance. Our representatives at All Nevada Insurance, Inc. Knows local laws and common issues facing nationals. We can help you design the best approach based on your specific needs and situation. With the right policy, you are covered in case of accidents or other unexpected damage to cars, your home, your business and the lives of you or your loved ones.

Nevada Supreme Court Hears Arguments Over Covid 19 Insurance Dispute

A home is the most important investment for most people, and homeowners insurance is the best way to protect that important asset. Each state has specific weather conditions and hazards that must be included in homeowners insurance for adequate coverage and reasonable deductibles. Life insurance is an important source of security as we age and can help family members in difficult financial situations. The money paid for a life insurance policy can be used in many ways, including a death benefit that protects your family when needed.

Contact us today for more information on our insurance rates. Our company has over 90 years of experience helping them identify their insurance needs just like you. All Nevada Insurance, Inc. The slogan is: “One call, your rates drop.”

Visit one of our many offices in Las Vegas, NV or our locations in Henderson and Utah for a quote and get your questions answered.

I am glad I contacted All Nevada Insurance to change my car insurance. Kasla is amazing, she has saved me over $250 a month. She was always there to answer all my questions. When I call, text and email she gets back to me right away. It was also a pleasure to speak with the representative face to face. Everyone there is nice and professional. I highly recommend Kasla and All Nevada Insurance.

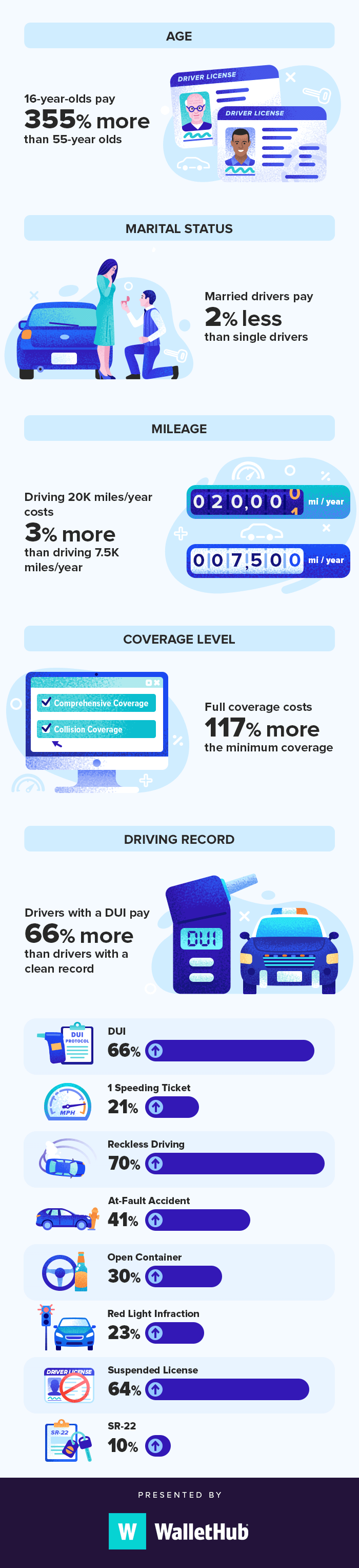

Asset Protection Infographic

Cindy is my agent and she is nice and very helpful. She communicated with me 100% and kept me informed about my process. The process was quick and easy. Very convenient and time saving for me as I have a busy schedule. I was recommended by my family who have been using them for over 10 years and we all love their customer service. I would definitely recommend them to anyone who needs it. That is why we are loyal to their company. Thank you for your services.

I have been working with them for my work for the last 3 years and they are great, customer service is the best. I used them for my car insurance and the service was excellent. I have been a customer for a while and Maria gave me a great quote. These ladies are the best, I work with Maria Rosales and Erica Torres. I love them! Running a small business requires a significant investment of time and money. Business owner insurance protects your investment by mitigating financial losses related to unforeseen events such as the death of a partner, an injured employee, a lawsuit, or a natural disaster. If you are not the owner, business insurance is generally not required by law. However, it is common practice to get adequate insurance to cover your belongings. If your business is an LLC or corporation, your personal assets are protected from business liabilities; However, no business structure can replace liability insurance that covers your business against losses.

A business insurance policy combines property, liability and business interruption coverage into one simple policy for small and medium businesses. By adding these covers, you will usually see a reduction in your premium.

Business owner insurance provides comprehensive coverage for your medium to small business. It is best suited for companies with fewer than 100 employees and less than $5 million in revenue. A business policy, also known as BOP insurance, combines different types of insurance in one cost-saving package. With fully customizable coverage options, we can tailor the package to your specific needs.

Why The Insurance Market Must Prioritize Commercial Lines Sustainability

With a business owner’s policy, your small business can get property insurance, liability insurance and additional protection all in one place. Coverage for small business owners protects you from:

Our licensed staff is ready to help you get multiple business insurance quotes. Because we are an independent insurance agent, we can shop with multiple insurance companies to help you find the right coverage at the right price.

Valley Insurance Group represents the best insurance companies in Nevada. We compare prices and coverage options to find the best policy for your needs. Call us at: 702-476-8900 or have a representative click the Request Quote button to start your quote.

Compare multiple insurers at once. Citations take a few minutes to complete. You choose the price and coverage options that work for you.

Architects, Engineers, Construction Managers

If you own a small business with commercial property and equipment, a business owner’s policy (commonly called a BOP) may be best for you. If you don’t own a property, you can get individual business insurance.

You can easily request a quote for business insurance from an accredited broker in our office. You can request a quote or contact us using the form below

Business owner insurance protects small businesses from liability claims and provides protection for your buildings, equipment and inventory. Additional coverage is available.

The cost of a business insurance policy is unpredictable. In order to get an accurate quote, we will need to assess your property and equipment and determine what coverages you need. The cost of business insurance varies widely from company to company, but quotes are readily available from a licensed agent in our office. Running a small business in Nevada comes with its fair share of challenges and benefits. As an entrepreneur, whether you’re in Henderson, Las Vegas, or Reno, you invest your time, effort, and resources into building your dream business. While the journey is fun, protecting your business from unexpected risks is essential. This is where small business insurance can play a critical role in ensuring your success.

Best Cheap Health Insurance In Nevada 2024

At Western Pacific Insurance, we understand the unique needs of Nevada businesses and strive to provide adequate insurance solutions to ensure your business thrives even in times of adversity. In this article, we’ll explore the importance of insurance for small businesses in Nevada, with a special focus on different types of businesses that are highly competitive.

Nevada is a vibrant state with a diverse economy and thriving small business community. From vibrant urban centers like Henderson to beautiful rural areas, Nevada entrepreneurs make a significant contribution to the state’s economic growth. However, the ever-changing landscape of business operations calls for a robust insurance strategy to mitigate potential risks.

Small business insurance is a comprehensive coverage plan designed to protect your business from various liabilities and unforeseen events. Depending on the nature, size and industry of your company, insurance requirements may vary. Common types of small business insurance include:

Protects your business against third-party claims for property damage, bodily harm or personal injury arising out of your business activities.

Obtaining Workers Compensation Insurance

If your business is at risk of temporary closure, we can help you recover lost income and pay ongoing costs.

At Western Pacific Insurance, we pride ourselves on being a trusted local insurance partner for small businesses in Nevada. Our experienced team understands the unique challenges business owners face and will work closely with you to assess your business’s risks and assess insurance solutions that best fit your needs and budget.

Our expertise in this area allows us to provide CPA accounting firms, credit reporting firms, financial advisors, inspection and appraisal firms, insurance agencies, landlords, mortgage brokers, real estate agents, and title and escrow agencies with specialized coverage to protect against potential liability. . Offices.

For businesses in the healthcare industry, such as clinics, doctor’s offices and healthcare providers, we offer comprehensive insurance solutions to protect against malpractice claims and other health risks.

Workers Compensation Insurance

As a commercial landlord, protecting your property and assets is critical. Our customized renters insurance plans help protect against property damage and liability claims.

Whether or not you have a consultancy or legal practice

Life insurance las vegas nv, commercial auto insurance las vegas nv, car insurance las vegas nv, home insurance las vegas nv, sr22 insurance las vegas nv, key insurance las vegas nv, las vegas nv health insurance, insurance las vegas nv, renters insurance las vegas nv, commercial insurance las vegas nv, la insurance las vegas nv, motorcycle insurance las vegas nv