Western Federal Credit Union Auto Loan Rates – We provide links to third party websites, independent of WV FCU Member Choice. These links are provided for convenience only. We do not control the content of these sites. The privacy and security policies of external websites will differ from those of WV FCU Member Choices. Click CONTINUE to continue or “X” to stay on this site.

Motorcycle Loans Motorcycle Loans ATV Home Loans Home Equity Loans Business Improvement Loans Payday Loans Loans Taxes Pay Your Loan Online

Western Federal Credit Union Auto Loan Rates

Online Banking MCWV App Bill Payment Credit Note Monitoring Account Order Form Loan Application Loan Application Company Debit Card Adjustment Member Limit

Live Update: Federal Reserve Interest Rates Unchanged

Are you ready to stop dreaming about that new car and drive it instead? Accelerate your dream with a limited-time special car loan now available at Member Choice West Virginia. Currently, at MCWV, you can get rates at 4.75% APR with terms up to 75 months. So, whether you want to refinance your current loan or buy a new car, now is the time!

If you have any questions about this offer or need further assistance, contact us today! If you’re ready to apply, get started by filling out our online car loan application today! Partner Content: This content was created by a Dow Jones business partner independent of the newsroom. Links in this article may earn us a commission. learn more

Average car loan interest rates for all credit profiles range from 5.07% to 14.18% for new cars and 7.09% to 21.38% for used cars.

By: Daniel Robinson By: Daniel Robinson Author Daniel is a columnist for The Leaders Group and has written for a number of motoring news sites and advertising firms in the US, UK and Australia specializing in motor and auto finance. Topics of care. Daniel is a leading authority on auto insurance, loans, warranty options, auto services and more.

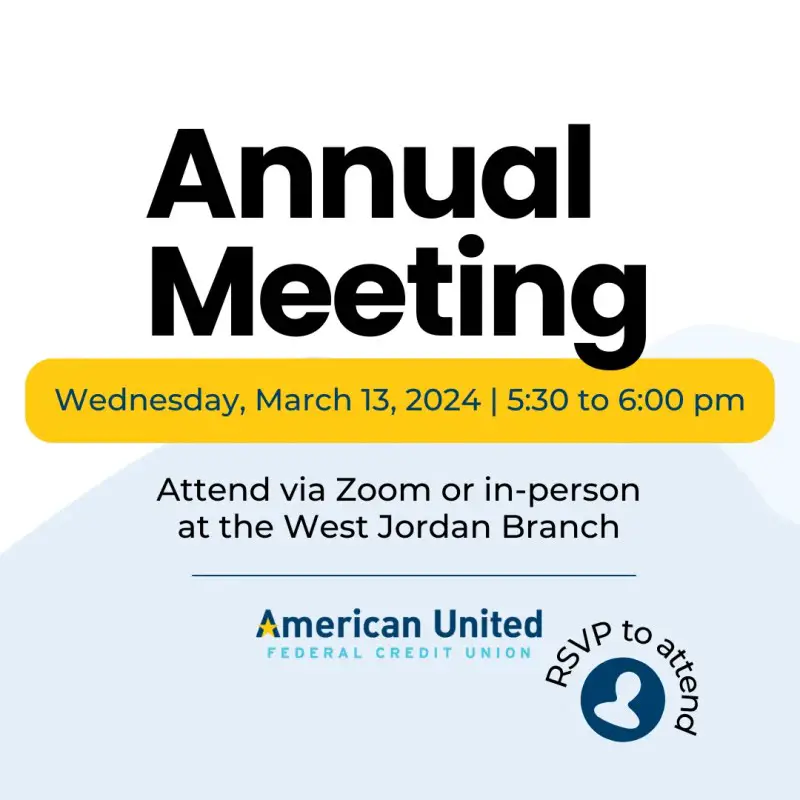

Jordan Landing Branch

Edited by Rashawn Mitchner: Rashawn Mitchner Managing Editor Rashawn Mitchner is an editorial team editor with more than 10 years of experience covering finance and insurance topics.

Many factors play into the interest rate you’re offered on a car loan, but your credit score has the biggest impact. Knowing the average car loan interest rate can give you an idea of what you’re worth and help you determine if you’re getting the best value for your car loan.

In this article, our team of guides will break down car loan interest rates by credit score, country and car type – for new and used car loans. We’ll examine how car loans work and where you can find the best car loan rates for your credit profile.

Best Refinance 72 Month Auto Loan Can I refinance my loan and auto loan at the same time? Car Loan Calculator Best Funding Rate How To Pay Off Your Car Loan Fast Should I Pay Off My Car Loan Early? Complete Auto Loan Application: Terms to Know (Guide)

Nutmeg State Financial Credit Union

Comments Average Monthly Savings $150 Work with Personal Loan Concierge to Compare Options A+ BBB Rating

Reviews Up to 0% Down on Select Cars, Trucks & SUVs Free Online Quotes – Get the best price today at CarsDirect Local dealers compete to offer the best deals on new vehicles.

Overview A no application fee loan platform that collaborates with banks to approve loans based on conditions and many variables, including education and employment.

All APR figures last updated on 14/07/2023 – please visit partner site for latest details. Rates may vary depending on credit score, credit history and loan tenure.

Auto Loans — Chaffey Fcu

Guide Group is committed to providing reliable information to help you make the best decision about your vehicle financing. Because consumers rely on us to provide objective and accurate information, we have developed an extensive rating system to compile our ranking of the best car loan companies. We’ve collected data from dozens of loan providers to rank companies on a number of factors. After 300 hours of research, the final result was the total value of each vendor, with companies scoring the most points on the list.

The average interest rate on car loans is currently 9.00%. Annual percentage rates (or APR) are the most common rates you see advertised on car loan websites. The APR includes your interest and fees and other costs that come with the loan.

There are various factors that can affect the APRs you receive. Below we outline average car loan rates by credit score, country and car type.

According to Experian’s recent State of the Auto Finance Market report, the average interest rate on car loans for all credit scores is 6.63% for new cars and 11.38% for used cars. Lenders divide people into categories — sometimes called credit bands — based on credit scoring models like FICO® and VantageScore. While other factors affect the car loan interest rate you’re offered, your credit band is the most influential on your score.

Lowland Credit Union

In the table below, you can compare used and new auto loan rates for each credit score in the FICO scoring model:

Car loan interest rates can be affected by monetary policies in each country, primarily influenced by changes in the federal treasury rate. This leads to fluctuations in market prices, which affects the interest payments of borrowers. Below you can compare average new and used car prices across all US states and the District of Columbia, according to Edmonds.

The type of vehicle you choose to finance can affect the rates you receive. Certain types of vehicles have different rates and requirements that can lead to fluctuations in the interest you pay over the course of a car loan. The chart below shows the average car loan rates for each type of vehicle.

Prices are calculated based on average car loans by vehicle type as of August 2023, according to Edmonds.

Greater Alliance Fcu Smarttrack Case Study

A car loan is a type of secured loan that uses the financial car as collateral. When you pay off a car, the lender becomes the owner of the loan and owns the car’s title until you pay off the loan.

Basically, this means that while you have the legal right to own and drive the car, it is the lender who actually owns it. If you default on your loan, the financial institution can repossess the vehicle.

When shopping for auto loans, you’ll probably see them advertised with an annual percentage rate (APR). This figure includes your interest rate and fees and other costs that come with the loan.

Before you start filling out loan applications, consider using a calculator to get an idea of how this affects the taxes you may pay. Most loan calculators allow you to enter basic information such as your desired loan amount, rate and term to determine how much your monthly car payment will be and how much you will pay in interest over the life of the loan. Will pay the amount.

Members Choice Wv Fcu

Auto loans charge interest based on a portion of your repayment capacity. The riskier the borrower’s loan, the higher the interest rate that is likely to be charged. Many factors indicate the risk of a loan and can affect the interest rate on your loan.

Credit scores have been widely used since 1989, when FICO, currently the most popular credit scoring model, introduced its system. Credit scores are designed to show lenders that you can make your required payments on time and in full. Your FICO credit score is based on the five factors below, which are weighted differently.

In the chart below, you’ll find steps you can take to improve your credit score and lower your debt ratio.

Lenders do not offer the same interest rates for car loans with credit scores. If you compare car loan offers, you can find a list of rates available to you. So it is good to buy. There are several places where you can get a car loan. Depending on your situation, some may have better loan options than others.

Pantex Federal Credit Union

Most conventional banks offer new and used car loans. Many also offer auto loans, and pre-approved loans that can speed up the car buying process and make financing easier. If you already have a checking account, savings account or credit card with a particular bank, you may have an easier time getting approved for a car loan at that financial institution. You may get a better rate.

Like banks, credit unions offer financing and financing for new and used vehicles. However, you must be a member of a credit union to access their financial products. Membership requirements vary, but the process is simple for most credit unions. Joining can be beneficial, as credit unions often offer lower interest rates and are more likely to approve loans for borrowers with bad credit.

Because they don’t have physical branches like banks and credit unions, online lenders can sometimes offer lower rates.

Jax federal credit union auto loan rates, mission federal credit union auto loan rates, apple federal credit union auto loan rates, western union loan rates, federal credit union auto loan rates, advantage federal credit union auto loan rates, arkansas federal credit union auto loan rates, coastal federal credit union auto loan rates, arizona federal credit union auto loan rates, navy federal credit union auto loan rates, az federal credit union auto loan rates, federal credit union loan rates