Legal Malpractice Insurance Requirements By State – By clicking the “Accept all cookies” button, you agree to the storage of cookies on your device to improve website navigation, analyze website usage, and assist with our marketing efforts.

Malpractice insurance is a type of professional liability insurance taken out by healthcare professionals. This insurance protects health care providers from lawsuits against them due to negligent or intentionally poor treatment decisions. Malpractice insurance covers the death of the patient.

Legal Malpractice Insurance Requirements By State

Most doctors require malpractice insurance throughout their careers, and for good reason. According to a Johns Hopkins University study, medical errors are the third leading cause of death in the United States, after heart disease and cancer. Medical negligence can occur at the time of diagnosis, during treatment or as part of post-treatment counselling. About 250,000 deaths in the U.S. each year are caused by medical malpractice.

New York Lawyers Insurance

Almost 10,800 medical malpractice claims were paid in 2022, according to government figures. About a third of doctors say they have been involved in a lawsuit at least once in their careers. This highlights the importance of malpractice insurance for the healthcare professional.

Medical malpractice insurance requirements vary by state. Some states require insurance, while others require minimum coverage to participate in state claims assistance programs.

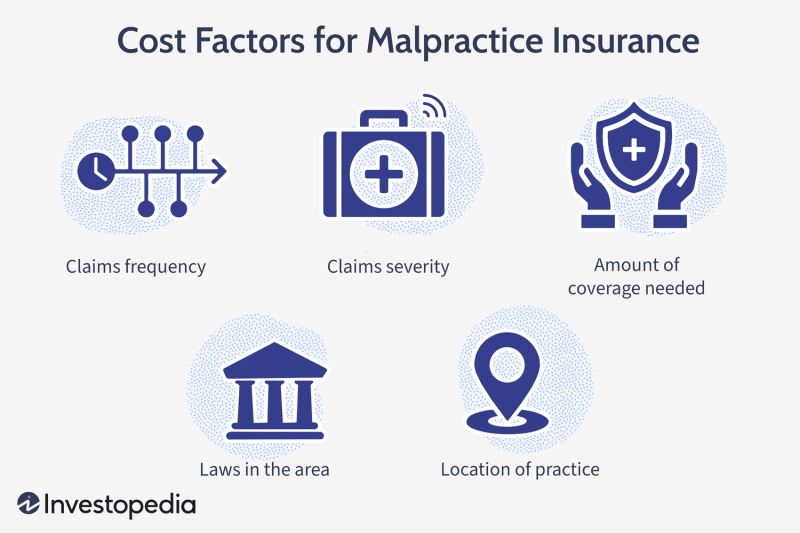

Medical malpractice insurance premiums are generally based on the doctor’s specialty and geographic location, not claims experience. This means that even if a doctor has never been sued, they may end up paying very high premiums. Premiums may be higher depending on factors such as the amount of cover required, the severity of the claim, the frequency of the claim, the location of the practice and the legislation in this area.

There are many options for obtaining malpractice insurance. In its most basic form, an insurance policy for an individual or a group can be purchased by a private insurer. Individual or group policies can also be purchased by a health risk retention group (RRG). RRG is a group of medical professionals organized to provide malpractice insurance. Another option for obtaining malpractice insurance is through an employer coverage plan, such as a hospital.

Professional Liability Insurance Coverage

People who work at federal medical centers do not need malpractice insurance because federal law gives those employees immunity from civil lawsuits. If circumstances warrant, insurance can often be obtained through state and local agencies.

The two types of policies that a health care provider can purchase are a claims-based policy or an event-based policy. The Claims Policy only covers claims once treatment has commenced and is valid at the time of the claim. An occurrence policy covers all medical claims that occur during the policy period, even if the policy has lapsed.

The types of expenses covered by a fault policy are broad. These include all legal costs, such as attorney fees, settlement and arbitration costs, medical expenses, and punitive damages.

In a medical malpractice lawsuit, the plaintiff must prove that the medical professional violated the general standard of patient care as established by the medical community. For a medical malpractice lawsuit to be successful, three things usually need to happen:

What Is Hospital Indemnity Insurance?

Requires writers to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. Where appropriate, we cite original research from other reputable publications. You can find out more about the standards we follow when creating accurate and unbiased content in our editorial policy.

The offers shown in this table are from compensation companies. This compensation may affect how and where ads are shown. does not cover all market offers. Professional indemnity insurance protects business owners from lawsuits from customers due to unsatisfactory performance. Also known as errors and omissions (E&O) or malpractice coverage, this policy may be required by law in your country or countries where you do business.

State laws often do not require companies to carry professional indemnity insurance. However, some professionals may require this coverage to obtain a business license in their state. You may need this policy for government or customer contracts, or to work in a legal or healthcare environment.

Regardless of government requirements, any business offering professional services or advice should carry this insurance to protect against legal costs due to errors and omissions.

Indemnity: What It Means In Insurance And The Law

Professional liability insurance for healthcare providers is often known as medical malpractice insurance. Although there are no federal requirements for this coverage, some states and health care facilities may require it.

For example, many hospitals and clinics require doctors to cover a certain amount of malpractice in order to have the privilege of practicing or licensing there.

While other health-related professions, such as therapists and counselors, typically do not require malpractice insurance, it is a good idea to invest in this insurance to avoid the risk of a client’s lawsuit, which can run into the thousands of dollars.

If you work in real estate or insurance, some states may require you to carry professional liability insurance, known as errors and omissions (E&O) insurance, before issuing your license.

Legal Malpractice Under Colorado Law

For example, the state of Nebraska requires the state program administrator to certify to the real estate commission that all applicants for new licenses (or renewals) have proof of errors and omissions insurance.

In Rhode Island, insurance producers are required to carry an E&O policy with a limit of $250,000 per occurrence and an aggregate limit of $500,000.

Most states do not require lawyers to carry malpractice insurance, although some states require lawyers to notify their clients if they do not have a certain level of coverage.

For example, states such as Ohio and Pennsylvania require lawyers to carry malpractice insurance with policy limits of $100,000 and $300,000 per year, or to notify clients in writing if they do not have such coverage.

Professional Liability Insurance Cost: 2024 Customer Prices

Texas requires $100,000 of coverage per claim, or set that amount aside as a self-insured emergency fund. Oregon requires attorneys to obtain this coverage through a state fund.

Even if you did nothing wrong, a lawsuit can be expensive. Professional indemnity insurance covers the costs of legal proceedings, such as attorneys’ fees, court costs and settlements.

Take out professional insurance to protect yourself from missed claims or costly mistakes.

Some customers require that you follow this policy. It can protect you from costly lawsuits up to $60 per month.

States With The Highest Average Malpractice Insurance Premiums

Denial of coverage can result in significant liability for your business as professional indemnity policies are issued on a claims basis. This means that your policy will only provide benefits as long as it is active.

You will not be covered if you are sued for an incident that happened before your policy was in effect.

If you opt out of coverage and are later sued for something that happened while your policy was active, you’re not covered because the opt-out eliminates the insurer’s liability to you.

These insurance policies provide liability coverage for various situations. Depending on the type of risk you face, you may need one or two policies.

Lynda Mitchell, Are, Cplp, Execplp, Rplu On Linkedin: Did You Know That Isba Mutual Provides Lawyers’ Malpractice Insurance To…

General liability insurance is often the first type of insurance that small business owners purchase. It covers everyday business risks such as consumer bodily injury, consumer property damage and advertising injury.

If a customer has an accident at your business or you damage the customer’s property, your general liability policy covers all legal costs.

Your professional indemnity insurance covers claims for professional errors and omissions such as unsatisfactory performance, professional negligence and missed deadlines.

“Many insurance carriers have E&O requirements when writing general liability policies for transactions such as insurance and real estate,” explains the professional liability expert. “These carriers require insurance agents and realtors to provide proof of insurance before committing to a general liability policy.

The Basics Of Medical Malpractice Insurance

General liability insurance and professional liability insurance cannot protect against every risk of running a business. Depending on the specifics of your business, you may need other policies, some of which may be required by law.

Complete a simple online application today and compare professional insurance quotes from America’s top providers. A licensed insurance agent can help you find affordable insurance that meets the unique needs of your business. Once you’ve found the right policy, you can start implementing coverage in less than 24 hours.

Professional Insurance Certificate of Insurance (CO) Professional Insurance Insurance Frequently Asked Questions When do you need Professional Insurance Insurance? Professional liability insurance for independent contractors Requirements and examples of professional liability insurance. defending lawyers and law firms against claims of professional negligence or malpractice.

Insurance serves as a safety net that protects the insured against a wide range of possible risks. There are many insurance policies available based on the specific expectations and requirements of the customers. One such coverage that we will discuss in this article is malpractice insurance. After reviewing it, you will understand what malpractice insurance is and why

True Cost Of Legal Malpractice Insurance

Legal malpractice insurance solo practitioners, how much legal malpractice insurance do i need, best legal malpractice insurance, california legal malpractice insurance requirements, medical malpractice insurance requirements by state, legal malpractice insurance cost, legal malpractice insurance, california legal malpractice insurance, legal malpractice insurance quotes, malpractice insurance requirements by state, cheap legal malpractice insurance, florida legal malpractice insurance