Best Credit Union Home Equity Loan Rates – Home equity can be the most powerful financial tool you have. Whether it’s financing a home improvement or debt consolidation, your equity can provide the money needed for all kinds of projects and payments.

Basically, equity is just an equation that shows the value of your home compared to your debt. To calculate your total equity, determine the value of your property and subtract any loans you have taken out.

Best Credit Union Home Equity Loan Rates

You’ll often see stocks expressed in terms of LTV, which stands for “loan-to-value” and is a debt-to-value ratio. In our previous example, you have a total loan of $300,000 on a home that is worth $400,000. Dividing $300,000 by $400,000 gives us an LTV of 0.75 or 75%.

Heloc Do’s And Don’ts: A Step By Step Guide To Home Equity Lines Of Credit

Now that we know what equity is and can determine how much we have, how do we get there?

This is where a home equity loan or home equity line of credit (HELOC) comes in. This is a loan that you get in addition to or instead of a mortgage that uses your home as collateral. You may have heard this loan called a second mortgage.

A home equity loan is usually a term loan where you get the entire loan upfront. It can be a fixed rate, meaning the rate stays the same for the entire loan, or a variable rate, meaning the rate can change as you pay it off. Often, equity loans are used for one-time projects, such as bathroom renovations or in other cases where you need all the money at once, such as for debt consolidation.

A HELOC works like a credit card. Once you’re approved for a HELOC, you get a limit based on your available equity and you can advance up to that limit. You can advance the limit all at once or little by little according to the needs of Mr. When you pay off your HELOC, the amount you paid for the principal becomes available for you to borrow again. A HELOC usually has a period in which you can make advances, called the drawing period, and a later period in which you only make payments, called the repayment period.

Heloc Requirements And Guidelines

During the draw period, you pay a percentage of your balance each month. This amount may change depending on how much you owe at the end of the month. When your HELOC moves into a repayment period, your monthly payments will be the same amount each month, so your balance will be paid off in full at the end of the repayment period.

Your equity can be a powerful tool in your financial portfolio. If you are considering opening a home equity loan or HELOC or just want to To request, check out our stock offer or contact a mortgage specialist at we They will sit down with you, talk about your goals and work to find the best loan for you. Call us today at 206.398.5888 to get started. By clicking “Accept all cookies”, you agree to store cookies on your device to improve website navigation, analyze website usage and assist in our marketing efforts.

Mortgage loans and home equity loans are both large loans that use the home as collateral or security for the debt. This means that the lender can foreclose on the home if you default on your payments. However, home equity loans and mortgages are used for different purposes and at different stages in the home buying and ownership process.

A conventional mortgage is when a financial institution, such as a bank or credit union, lends you money to purchase a property.

How A Line Of Credit Works

With a more traditional mortgage, the bank lends up to 80% of the home’s appraised value or purchase price, whichever is lower. For example, if the home is worth $200,000, the borrower will qualify for a mortgage of up to $160,000. The borrower must pay the remaining 20%, or $40,000, as a down payment.

In other cases, such as government-backed loan programs that provide down payment assistance, you can get a loan for more than 80% of the appraised value.

Non-conventional mortgage options include the Federal Housing Administration (FHA) mortgage, which allows you to put down as little as 3.5% as long as you pay mortgage insurance. Department of Veterans Affairs (VA) loans. and the United States Department of Agriculture. (USDA) requires a 0% down payment.

Mortgage interest rates can be fixed (the same for the entire period of the mortgage) or variable (change every year for example). You repay the loan amount plus interest within the specified period. The most common terms for mortgages are 15, 20, or 30 years, although other terms exist.

Home Equity Line Of Credit

Before you get a mortgage, it is important to research the best mortgage lenders to determine which one will offer you the best rate and loan terms. The mortgage calculator is also very useful for showing how different interest rates and loan terms affect your monthly payment.

If you fall behind on your payments, the lender can seize your home through foreclosure. The lender then sells the home, often at auction, to recoup the money. If so, this mortgage (called a “first” mortgage) takes precedence over subsequent loans made against the property, such as a home equity loan (sometimes called a “second mortgage”) or a home equity line of credit (HELOC). . The original lender must be repaid in full before the subsequent lender receives the proceeds from the foreclosure sale.

Home equity loans are also a type of mortgage. However, you take out a home equity loan once you own the property and have built up equity. Lenders typically limit the amount of your home loan to no more than 80% of your total value.

As the name suggests, home equity loans are secured, that is, secured by the home owner’s equity in the property, which is the difference between the value of the property and the existing mortgage balance. For example, if you owe $150,000 on a home worth $250,000, you have $100,000 in equity. Assuming your credit is good and you qualify, you may be able to get an additional loan using a portion of the $100,000 in equity as collateral.

What Can Your Heloc (home Equity Line Of Credit) Do For You?

Like traditional mortgages, home equity loans are installment loans that are repaid over a set period of time. Different lenders have different standards for the percentage of home equity they are willing to lend. Your credit score helps inform this decision.

Lenders use the loan-to-value (LTV) ratio to determine how much you can borrow. The LTV ratio is calculated by dividing the loan amount by the appraised value of the home. If you have paid off most of their mortgage or the value of the home has increased significantly, your loan-to-value ratio will be higher and you may be able to get a larger loan.

Home equity loans are often offered at fixed rates, while traditional mortgages can have fixed or variable interest rates.

In many cases, home equity loans are considered second mortgages. If you have an existing mortgage on housing. If your home is in foreclosure, the lender holding the home equity loan will not be paid until the first mortgage lender is paid.

Home Equity Loan Vs. Mortgage: What’s The Difference?

Therefore, the risk of home equity lenders is greater, which is why these loans often have higher interest rates than traditional mortgages.

However, not all home loans are second mortgages. If you own your property right away, you can decide to take out a home equity loan. In this case, the lender who makes the home loan is considered the loan holder. First. The appraisal may be the only requirement to complete the transaction if you own the home.

Home loans and mortgages are eligible for tax deductions similar to their interest payments under the Tax Cuts and Jobs Act of 2017. Before the Tax Cuts and Jobs Act, you could only deduct up to $100,000 in home equity debt. Loan participation.

Currently, mortgage interest is tax-deductible for mortgages up to $1 million (if you took out the loan before December 15, 2017) or $750,000 (if you took it out after that date). The new limit also applies to certain home equity loans if they are used to buy, build or improve a home.

Home Equity Loans And Lines

Homeowners can use a home equity loan for any purpose. But if you use the loan for a purpose other than buying, building or improving a home (such as restructuring debt or paying for your child’s college education), you can’t deduct the interest.

A home equity loan is a type of second mortgage that allows you to borrow money against the equity in your home. You get this money in one lump sum. It is also called a second mortgage because you have another payment to make on your primary mortgage.

There are many keys

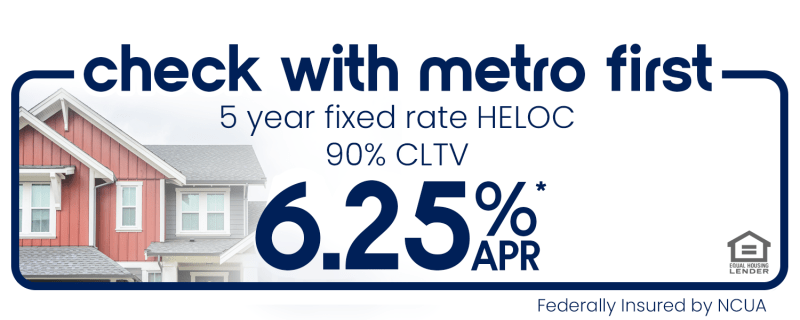

Credit union home equity loan rates, pawtucket credit union home equity loan rates, landmark credit union home equity loan rates, eastman credit union home equity loan rates, corning credit union home equity loan rates, capital credit union home equity loan rates, credit union home equity rates, best credit union loan rates, suncoast credit union home equity loan rates, credit union equity loan rates, scott credit union home equity loan rates, metro credit union home equity loan rates