Arkansas Federal Credit Union Refinance Rates – Home > Learn > Vehicles and Auto Finance > How do I know when I need to refinance my car?

Refinancing a car loan involves replacing the old loan with a new loan. There are many different reasons you might consider refinancing your loan. For example, if you struggle to make your monthly payments, refinancing your loan can help you break those payments down into manageable amounts.

Arkansas Federal Credit Union Refinance Rates

If your credit score has changed or interest rates have changed since you took out the loan, you may want to consider refinancing to get a different term or a better interest rate. Arkansas Federal Credit Union offers fast and easy refinancing with competitive rates, a wide variety of loans and no application fees. Our online application is simple; you can apply online in less than 20 minutes.

Home Equity Or Mortgage Loan

There are many reasons why you might want to consider refinancing your car loan. Each of these factors can change how your cashback benefits you.

If interest rates have dropped since you took out the original loan and the loan is at another financial institution, you may be able to refinance the loan at a lower rate.

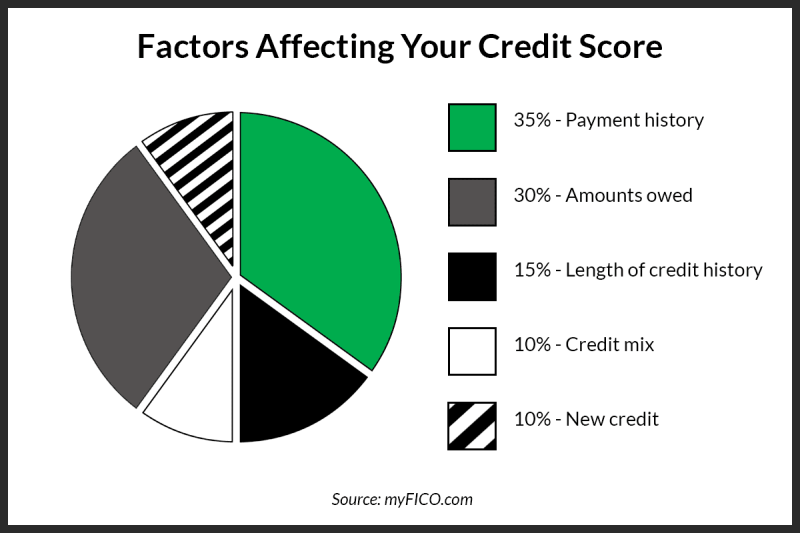

If your credit score has improved since you took out your first loan, there are several different ways you can apply for better credit. Depending on where you refinance your car loan, you may have lower monthly payments, interest rates, or better terms.

If you’re struggling with your monthly car payments, you may be able to refinance your loan to lower your monthly payments to higher payments.

Coastal1: Personal & Business Banking In Ma & Ri

Before you apply for a loan, there are a few steps you should take to make sure you understand your finances and know what to expect from your repayments.

The first step is to analyze your current car loan. By looking at your current loan, you can make sure you understand the current terms of the loan and how much you are paying. If your current loan has a prepayment penalty, it’s important to keep this in mind when considering a new loan. A prepayment penalty is a penalty for paying off a loan early. Paying back your loan will result in this penalty, so you need to understand how much this penalty is and how it will affect you financially.

After reviewing your current credit, you should check your credit score and determine the cost of the loan. A higher credit score can help you get a better term or rate on a new loan.

The value of your current loan plays an important role in calculating your loan amount. To estimate the value of your current loan, you need to compare the loan amount to the value of your vehicle. It’s also worth researching repayment rates. You should research current loan rates to find out what interest rates are available to you.

Ecfr :: 12 Cfr Part 701 Organization And Operation Of Federal Credit Unions

The last step is to calculate how much you can save. You can estimate how much interest rates and short financing terms can save you over the life of the loan. Here is the cost penalty before calculating your savings. If your current loan has a prepayment, you need to calculate this amount and subtract it from your savings.

Once you have learned about auto loan repayment, you can begin to use that knowledge to take appropriate steps towards repayment. To refinance your car loan, you will need to submit several different documents to your lender. To prove the ownership of your car, you need proof of car insurance and the registration number of your car. You will also need to provide your income and current loan information in order to correctly calculate the interest rate for the loan.

To refinance your car loan, you must meet certain requirements of the lender. Getting a car loan depends on your lender, but it usually depends on a few factors, including:

If you want to refinance your car loan, you need to know how these situations will affect your credit. Contact us to learn more about the auto loan refinancing options available.

Best Student Loan Refinance Companies Of March 2024

The time it takes to repay a car loan depends on the lender and may vary. With some lenders, your loan can be approved on the same day, but it may take up to two weeks for your loan to be approved. Refinancing a car loan is a quick process, especially if you have the necessary documents ready to submit to the lender.

If you’re considering refinancing your car, you should start by researching the best options for you and your unique situation. There are many different reasons why you can get better credit. You should also check the financing options, as other financial institutions offer other options for auto loans.

Arkansas Federal offers automatic loans with no application fees and competitive interest rates. Arkansas Federal refinancing can lower your monthly payments and take the burden of high monthly payments off your shoulders. You can apply quickly and easily online in 20 minutes or visit one of our branches today. Plus, once approved, you can enjoy a 90-day payment break!* Rates up to 4.00% APY APY is an annual percentage of profits. A Cash Check is a fixed income product with variable interest rates. Offer valid 05/31/2023. To qualify for 4.00% APY, member must be in good standing and make 10 monthly transactions of at least $1 each, defined as ACH, direct debit, bill pay, credit card (used as credit , or credit), and checks. Currently, Zelle® transfers are not considered token transfers. Inactive accounts are eligible for offers if they meet the same criteria. 4.00% APY applies to deposits between $0 and $10,000. Deposits of $10,000.01 or more earn 0.05% APY. The costs are lower than the profits. It costs $15 a month if your daily balance drops below $2,500. Offers and prices are subject to change. Cancellation can be requested. For full details, see the price list. Arkansas Federal Credit Union membership required.

Wondering which account is right for you? Take our quiz and we’ll help point you in the right direction.

Locations & Atms

Spend, earn and enjoy great results with our checking account. Earn up to 4.00% APY APY annual percentage return. A Cash Check is a fixed income product with variable interest rates. Offer valid 05/31/2023. To qualify for 4.00% APY, member must be in good standing and make 10 monthly transactions of at least $1 each, defined as ACH, direct debit, bill pay, credit card (used as credit , or credit), and checks. Currently, Zelle® transfers are not considered token transfers. Inactive accounts are eligible for offers if they meet the same criteria. 4.00% APY applies to deposits between $0 and $10,000. Deposits of $10,000.01 or more earn 0.05% APY. The costs are lower than the profits. It costs $15 a month if your daily balance drops below $2,500. Offers and prices are subject to change. Cancellation can be requested. For full details, see the price list. Arkansas Federal Credit Union membership required. to your monthly balance as you shop, pay bills, and more. That’s a higher rate than most checking and savings accounts — and all at no extra cost.

Put a little more Cha-Ching in your pocket with up to 4.00% APY APY annual percentage return. A Cash Check is a fixed income product with variable interest rates. Offer valid 05/31/2023. To qualify for 4.00% APY, member must be in good standing and make 10 monthly transactions of at least $1 each, defined as ACH, direct debit, bill pay, credit card (used as credit , or credit), and checks. Currently, Zelle® transfers are not considered token transfers. Inactive accounts are eligible for offers if they meet the same criteria. 4.00% APY applies to deposits between $0 and $10,000. Deposits of $10,000.01 or more earn 0.05% APY. Costs can reduce profits. It costs $15 a month if your daily balance drops below $2,500. Offers and prices are subject to change. Cancellation can be requested. See the price list for full details. Arkansas Federal Credit Union membership required. for things you do every day, like using your credit card. Open your Premium checking account today!

Use your checking account as a checking account. Make at least 10 trades per month and you can earn up to 4.00% APY APY annual percentage of profit. A Cash Check is a fixed income product with variable interest rates. Offer valid 05/31/2023. To qualify for the 4.00% APY, members must be in good standing and complete 10 monthly transactions of at least $1 per month, defined as ACH, direct debit, bill pay, or credit card (used as a debit or credit card), must be verified. Currently, Zelle® transfers are not considered token transfers. Existing inactive accounts are eligible for submissions if they meet the same criteria. 4.00% APY applies to deposits between $0 and $10,000. Deposits of $10,000.01 or more earn 0.05% APY. Costs can reduce profits. If the daily balance falls below that, a monthly fee of $15 will be charged

Langley federal credit union refinance rates, bethpage federal credit union refinance rates, teachers federal credit union refinance rates, arkansas federal credit union refinance, credit union refinance rates, navy federal credit union auto refinance rates, arkansas federal credit union mortgage rates, arkansas federal credit union auto refinance, arkansas federal credit union, federal credit union refinance rates, navy federal credit union refinance rates, navy federal credit union home refinance rates