Dupaco Credit Union Mortgage Rates – If you are a first-time home buyer, you may be eligible for a $15,000 grant from the Federal Reserve Bank’s $tart home financing program to help with a down payment or down payment. To be eligible, you must meet the scholarship requirements, including:

These grants are available on a first-come, first-served basis. A loan officer can help you find one during the application process.

Dupaco Credit Union Mortgage Rates

Do you have a question? Do you need help? Contact our mortgage brokers at mortgage@ or call us at 800-373-7600, ext. 204.

Dupaco’s Shine Online And Mobile Banking

Buying a home is exciting, expensive and tiring. This will be the most money you will ever spend in any business. Whether you’re planning to buy a home now or planning to buy one next year, here are some things you should know.

When you start the home buying process, don’t open a new line of credit without checking with your loan officer.

A down payment is a portion of the purchase price of your home that you pay up front when you close your home loan. Not only will this affect how much you will borrow, but it can also affect whether the lender will require you to pay mortgage insurance (PMI). This usually happens if you put down less than 20% of the home purchase price. Also, since your down payment represents your home equity, your lender will often offer you a lower amount if you can afford to pay more.

How much of a down payment you need depends on the purchase price of your home and your credit score. Different types of loans require different percentages, usually from 3% to 20%. Most people pay for most of their homes with home equity loans. Knowing how much you need to save can be difficult, but there can be many benefits to waiting until you have 20% or more down, including lower mortgage rates, lower interest rates, and no mortgage payments ( PMI). .

Dupaco Community Credit Union

Getting pre-approved for a home loan allows you to determine how much you can borrow based on your income and debt. It also lets the seller know that you are a serious buyer and can make it easier to know that you won’t need to rush to get the money.

About 80% of all home searches today begin on the Internet, but you also need to find a good real estate agent to represent you in the search and negotiation process.

Make sure your payment is covered before submitting an offer! Then check out the comparable products when making your offer. How are other homes in the community starting out (“the asking price”) and what are they selling for? Be sure to add how much you can expect to pay for closing costs.

A loan agreement means that the lender agrees to give you a loan that has certain conditions to be met.

Steps To Homeownership

Make sure that all the things you agree with will be there and the things you don’t agree with will be removed and the house is not damaged in the process.

Be prepared to sign many documents. When everything closes, the house is yours! Now you can start preparing to move into your home.

See how much the home loan decision is and how much property you can afford.

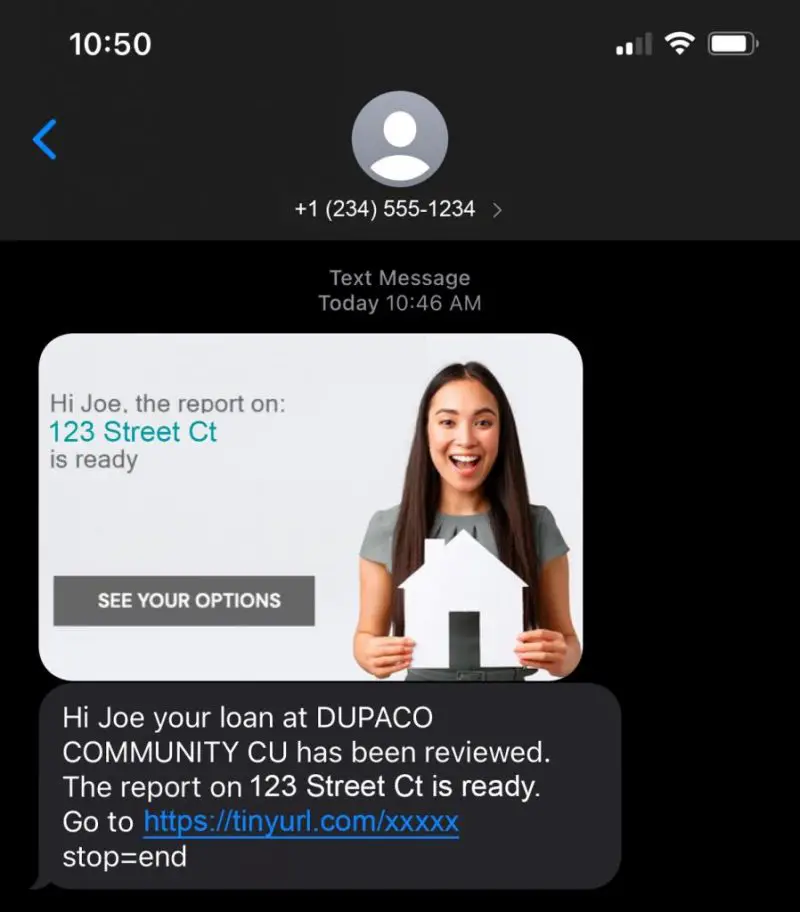

Scam alert! Do not click on unknown links in emails or texts. Fraudsters trick us (and other big companies) into trying to steal your identity. If anything sounds like you, trust your instincts and call us directly at 800-373-7600. Dubuque/Jackson County Habitat for Humanity and Dubuque Builders and Partners working on construction during National Construction Week Blitz 2016 hosted an all-worker lunch to recognize the progress they made in just one day . (M. Blondin / photo)

Will An Overdraft Balance Impact Your Stimulus Check?

How many bedrooms and rooms do you want to have? Where are you going to put them? What does your dream kitchen look like?

But unless you have limited savings, you may need a loan for the construction period. Financing a new home is not the same as taking out a traditional home loan for your existing home.

Of course, there are pros and cons to building your own home. So knowing more about the process – and how investment finance works – can help you decide if building a new home is right for you.

Home loans have many names depending on the lender you use. And each lender has its own criteria.

Bank Connections In Deskera

In , borrowers take out what is called a one-year ARM, also known as a 1/1 ARM. This is short for fixed rate mortgage, which means that the interest you pay on your loan will vary over the life of the loan.

In , the loan can be used to cover 80 percent of the costs involved in building your home, which may include labor, materials or more. personally, said Jean Digman, vice president, loans.

Consider a loan as a temporary financing option. Once your home is built, you can refinance the loan into a traditional home loan.

Keep in mind that each home improvement loan may work differently depending on the lender. Make sure you understand your lender’s policies before proceeding.

Acuma Pipeline Winter 2019 By Acuma

While the loan is there to help you get through the construction phase, you still need to have skin in the game. Most lenders require at least a 20% down payment, as is the case with .

You also need to carry a special insurance policy, called a builder’s risk insurance policy, while building a home, Digman said.

Once your home is finished, the insurance agent can convert the policy into a homeowner’s insurance policy.

Recent graduate Shawn Klinkhammer sands drywall at the Residential Education and Rehabilitation (HEART) housing complex in Dubuque, Iowa. (M. Blondin / photo)

Amber Thach On Linkedin: Today I Got To Hangout With My Friend Erika Demers @ Iowa Mortgage Assoc…

Most general contractors give you a payment schedule that you can expect to pay at different stages of the process.

Then you need to withdraw money from your loan. Be prepared to give these construction receipts to your lender to prove how you spent the money. You may also be required to sign a release form each time you make a withdrawal.

Remember that some financial institutions pay you every time you withdraw money from your loan (not in). Find out first what the lender’s policy is.

During construction, the lender will schedule several inspections to check the progress of your project.

Top 10 Best Banks & Credit Unions Near Shellsburg, Ia

“When we distribute these loans, we want them to go home,” Digman said. “We need to see progress in progress.”

Although it may be tempting to go with the lowest price, remember that you get what you pay for.

Members Tom and Rebecca Amech closed on their first home with Crystal Frederick (right) last April in the Asbury, Iowa branch. With the help of a credit union, the couple bought their house in Dubuque, Iowa, a few months before their wedding day. (M. Blondin / photo)

The equipment will increase. You can get a new light, more expensive. Something unexpected can happen during construction.

Acuma Pipeline Magazine Summer 2022 By Acuma

“We advise people to borrow more money than they think they need,” Digman said. “99 percent of the time their failure is worse than they think it will be.”

If the job is less than your loan, great! You don’t have to use the entire loan, Digman said. But at least you have money if you need it.

Keep your budget on track by always asking about costs. If the developer sees a new idea, ask how the price is changing. If you have the money and want to continue, fine. If not, think about whether it’s something you can do later.

It’s better for your calendar – and your expectations – to plan the construction process to take longer than you think.

What You Should Know About Financing New Home Construction

“They cannot predict the weather. And the information can be returned, “said Digman. “There is no guarantee that the building will be ready when they think it will be. Expect it to take a long time.”

You must visit the construction site to check the progress and make a decision. You should keep in touch with your provider until you apply. And you have to pay both the contractor and ultimately the lender.

“It can be frustrating to create, and some people have a hard time imagining what it’s going to look like unless they can see it,” Digman said. “But it can be useful.”

Scam alert! Do not click on unknown links in emails or texts. Fraudsters trick us (and other big companies) into trying to steal your identity. If something doesn’t feel right, trust your gut and call us directly at 800-373-7600. The two former home loan companies are now subsidiaries of Dupaco Credit Union. Dupaco bought HSB, which currently operates a branch at 7701 Mineral Point Road and another at 3762 E.

Those New

Mortgage rates dupaco, dupaco credit union cd rates, dupaco community credit union mortgage rates, lowest credit union mortgage rates, credit union mortgage rates, global credit union mortgage rates, ge credit union mortgage rates, california credit union mortgage rates, dupaco community credit union cd rates, navy credit union mortgage rates, cd rates at dupaco credit union, best credit union mortgage rates