Community Choice Credit Union Car Loan Rates – When it comes to a new car, low-cost financing from your credit union and best cash value from the dealer are usually the way to go. But new or used car, you may find that the best price you can get is here at TCU. Your prime interest rate is determined by the term of your loan and your creditworthiness. If your loan is pre-approved by us at no cost, you essentially become a cash buyer, which is helpful when you negotiate price. Whatever you do, be sure to contact us before you accept additional funding. There’s a big chance we’ll beat him!

You can get low cost TCU financing at most dealers! All you have to do is ask for it. The dealer can arrange your credit union loan when you buy the car. Enjoy the convenience of 1-stop shopping! Many car dealers in our area participate in this program. Visit the AutoSMART website to find a specific dealer.

Community Choice Credit Union Car Loan Rates

On the AutoSMART site you can search for vehicles, get Carfax reports, view Kelly Blue Book and NADA prices, get car buying tips and information, and use a payment calculator. This is a smart way to start your selection and buying process!

Members Choice Wv Fcu

For even more convenience, ask the experts at Auto Solutions to find the vehicle you specify and offer it to you at a very competitive price. There are no obligations, and there is no pressure or pressure. Instead of spending time shopping at the dealer yourself, you can skip all the searching and haggling! Call 503-238-2429 or 1-800-207-2429. Or visit the AutoResolution website.

Instead of expensive dealer-sold extended warranties, consider Mechanical Breakdown Protection (MBP) for your vehicle, which we provide through United Solutions. Click here to get an instant quote and learn more about the benefits of maintaining protection against mechanical damage.

As your financial partner, we also want to protect your investment in credit union loans. We offer optional credit disability and credit life insurance that pays off your loan if you become disabled, or if you die early. Coverage is available for a nominal fee that can be included in your monthly payments. It reduces the financial burden on your family if the worst happens. We also offer Guaranteed Auto Protection (GAP), which covers the difference between what you owe on your car and what it would be worth if it were totaled.

Each year our members with consumer debt have the opportunity to defer loan payments during the holiday season. Our “Skip Pay” program provides participants with extra cash throughout the year when they need it.

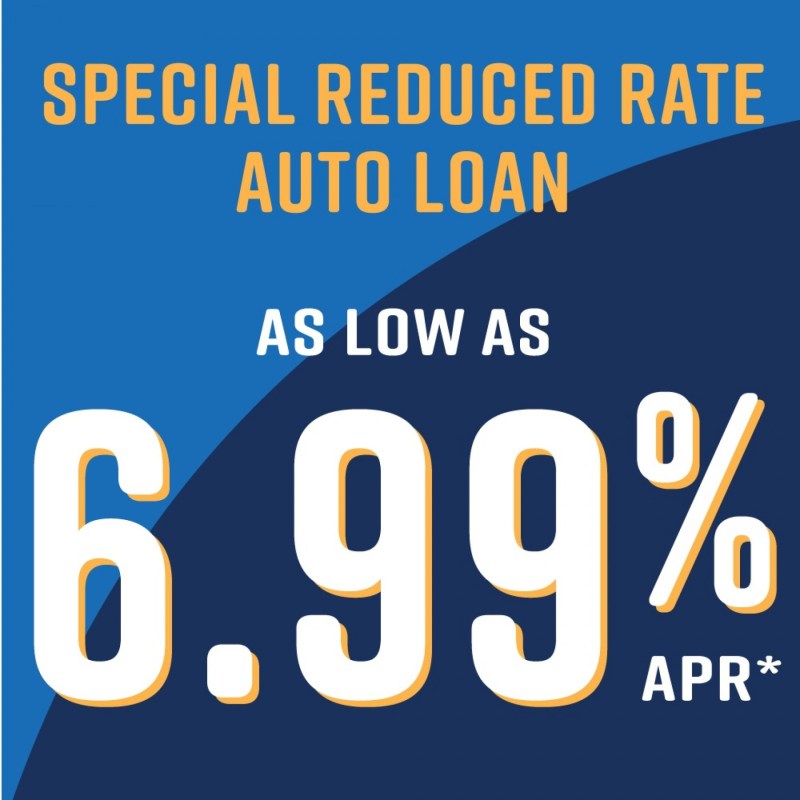

Low Rate Auto Loan

Contact your credit union for assistance in the event of a Teamsters strike or lockout. We have the most generous loan extension policy in the country, up to six months for all real estate loans (and we’ll change it if possible).

Discover a range of car buying tools to make your next car purchase easy and hassle-free.

Let us find your perfect car! We do everything for you to make your car buying experience better!

Please note that you are accessing a website other than Teamster Credit Union. Please see our Privacy Policy for terms and conditions. People’s Choice Credit Union wants to be fully digital by 2020, starting the journey by enlisting Salesforce to help it move to multi-cloud.

Best Credit Unions For Car Loans

Digital Transformation: The CXO’s Guide You can download all articles in this special report in one PDF (free registration required). Read it now

But as customer expectations change rapidly, People’s Choice says it will also drive demand for technology expertise and innovation, and many others say customers want the same level of banking personalization and convenience they get from consumer apps.

People’s Choice will replace its 10-year-old legacy technology system with Salesforce, unifying the experience for members and employees to meet those expectations.

“Our members are at the heart of everything we do, so it’s important that we have a clear understanding of how best to meet their needs.” People’s Choice CEO Steve Laidlaw said.

Best Car Loan Rates

“Working with [Salesforce] will allow People’s Choice to better manage our members’ data while leveraging Salesforce’s experience in the US interactive market.

People’s Choice will implement Salesforce Financial Services Cloud, Einstein Analytics for Financial Services, Community Cloud, MuleSoft and Marketing Cloud.

People’s Choice Credit Union will also roll out MyTrailhead — a Salesforce learning experience it uses to empower organizations to “create a culture of learning” — in South Australia, the Northern Territory, Victoria, the Australian Capital Territory. Disciplines. and Western Australia.

Related: What to expect from MWC 2024: Transparent laptops, AI phones, smart rings and more Easy as 1. + 2 = $12/month. Choose eligible products and services that fit your lifestyle, and you’ll earn $144 in annual rewards.

Savings & Loan Companies Vs. Commercial Banks: What’s The Difference?

During the virtual e-banking tour you discover fun and rewarding surprises, including a chance to win a $1,000 grand prize.

Earn $50 for every friend or family member who opens a checking account and maintains their Community Choice Credit Union membership for 30 days. There is no limit to how many referrals you can make, so get out there and spread the word.

GetBigReward$ Road Rally is a virtual e-banking adventure exclusively available to GetBigReward$ members. Explore all that Michigan has to offer as you answer questions, win challenges, earn badges and more as you go on a backpacking trip!

We know that when our members live well and enjoy healthy finances, our community is better off. That’s why we offer smart solutions and great banking benefits.

Recourse Vs. Non Recourse Loan: What’s The Difference?

* At the end of the month “One Choice” options include: Open Select checking account in good standing, or remaining loan balance (excluding credit cards and express cash), or total available funds of $3,500 (total (including contributions and related goals). With account this membership).

** Maintain 20 monthly Community Choice MasterCard transactions (collects all plastic and digital debit and credit card transactions, but does not include ATM transactions). A minimum total monthly direct deposit of $300 must also be maintained.

Must be a member in good standing. The terms of GetBigRewards$ are subject to change at the discretion of the Board of Directors.

*** Loan interest deductions are determined annually by the Board of Directors. In 2013-2023, a 10% discount is given on loan interest paid on eligible loans. We provide links to third party websites, independent of Member Choice WV FCU. These links are provided for convenience only. We do not control the content of these sites. The privacy and security policies of external websites will differ from those of Member Choice WV FCU. Click the “X” to stay or continue on this site.

Community Choice Credit Union

Car Loans Boat Loans Motorcycle Loans ATV Loans Mortgage Loans Home Equity Home Improvement Members Business Loans Loans Interest Rates Pay Your Loan Online

MCWV Application Online Banking Bill Payment Credit Score Monitoring Order Form Checking Account Application Loan Application Mortgage Application Debit Card Limit Setting Member Business

At MCWV, you’re not just a number in line. We are a full-service, member-focused financial institution designed to meet all your financial needs with a personal touch. We embrace the uniqueness of a credit union as a not-for-profit organization by providing quality financial products and services with excellent, low interest rates and loan terms. As a member, you also own the credit union and always have the right to vote, receive dividends, and be a part of the support provided to your community.

An additional layer of identity verification before authorization. 3-D Secure (3DS) enables the exchange of information between merchants, card issuers and, when necessary, consumers to verify that a transaction was initiated by an authorized account holder.

Auto Loan Rates For New & Used Cars From Macu

Delta community credit union home loan rates, community choice credit union loan, community choice credit union auto loan rates, community choice credit union loan rates, community choice credit union rates, community america credit union auto loan rates, community choice credit union cd rates, community first credit union home loan rates, delta community credit union loan rates, community choice credit union interest rates, community choice credit union mortgage rates, delta community credit union auto loan rates